BiggyBalls

@t_BiggyBalls

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BiggyBalls

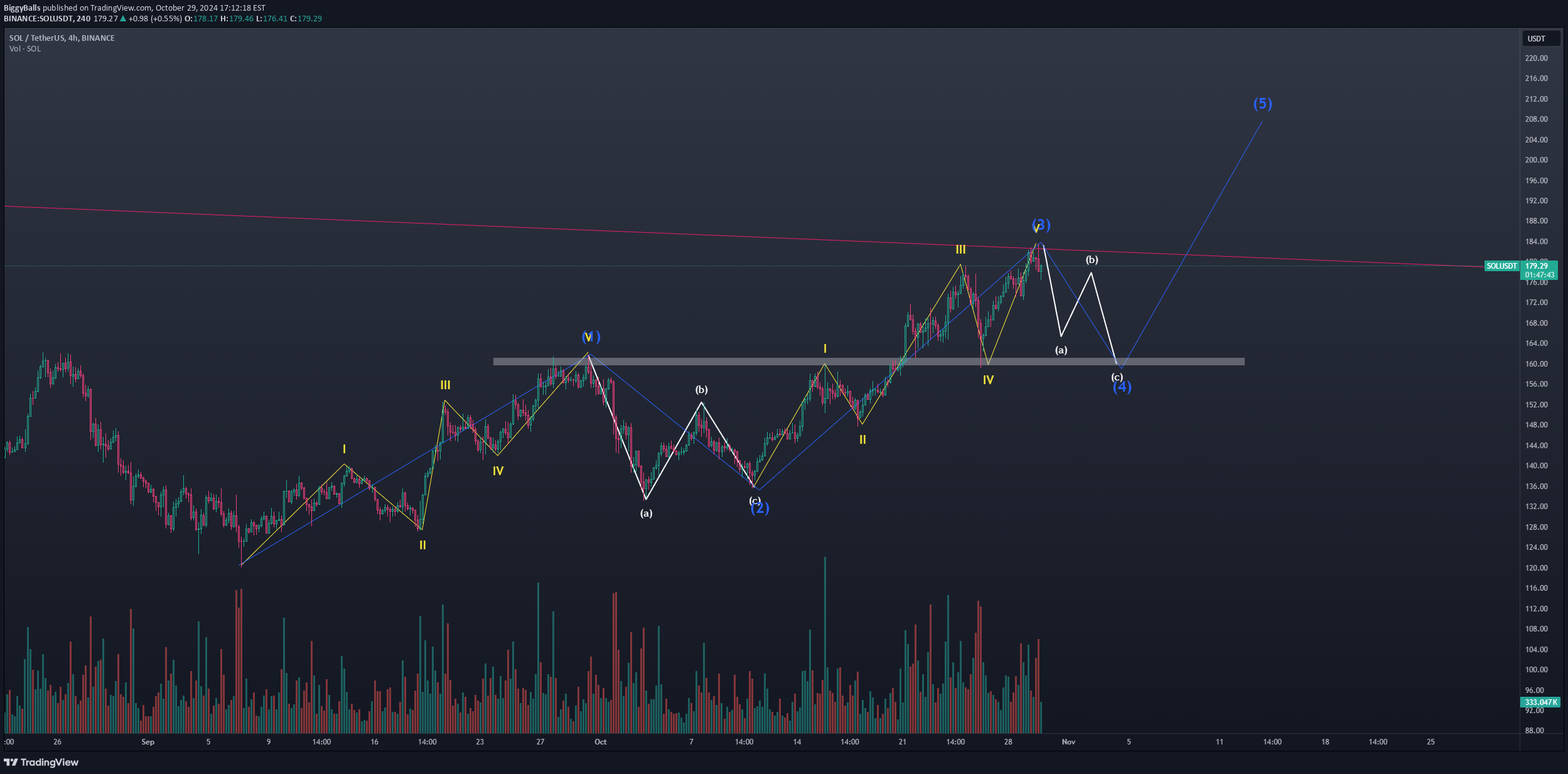

Solana - Wave 4

Can see a wave count here with anticipated abc/abcde correction leg into the larger wave 4 count. This would line up with post-election rally with a possible fakeout of Head n Shoulders pattern depending on the structure of the correction leg. May be lagging BTC fractal pattern by few days as it does its consolidation retest from ATH rejection. Markets very volatile, a lot of uncertainty with election nearing and mid-east tensions ect. Could see a higher Wave 3 here, but can already count a smaller 5-wave cycle within the larger Wave 3 as it heads into Macro trendline Resistance.

BiggyBalls

$ATLAS - Wave 5 Rally

Can see a clear 4 wave count & breakout of abcde correction. Log scale 1hr tf. 265% move with the trend-based fib extension to the 1.618. 55m mcap gem, huge community and product game already listed on epic game store in beta. Recent update looks good, and they hired new marketing manager.

BiggyBalls

$JUP - Breakout target $1.35

Pretty simply play this -- breakout of prior resistance as announcement comes for launchpad voting. Not alot of data to use, so have done a basic 1.618 extension mark for $1.35 target

BiggyBalls

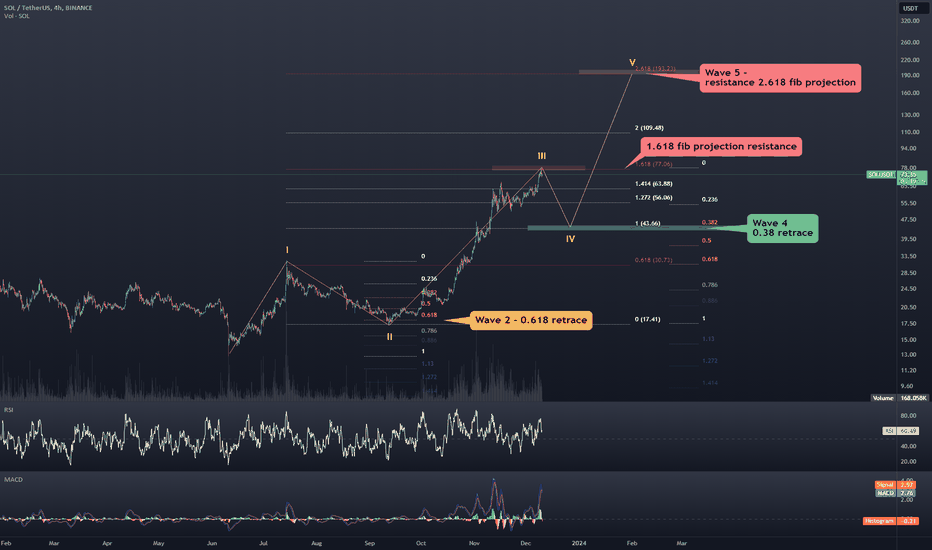

$SOL Ewave

Possible top of Wave 3 here at the 1.618 Fib Projection (log scale). Typical pattern here is to see an alternated depth of wave 4 to wave 2 -- this being 0.38 correction relative to the 0.618 correction here on wave 2. Timeline of this would line up end of wave 4 for boxing day specials, with a new years peak. Complete speculation with some basic ewave and fib analysis.

BiggyBalls

$GALA breakout

Log scale - overlapping Fib retrace from ATH/ATL and 2023 wave @ 0.06 to ATL - confluence resistance levels appear at; R1: $0.034 (0.618 + 0.236 retrace levels + alternated support at $0.033 from March 23) R2: $0.062 (1 + 0.38 retrace levels + price resistance at 0.062 from Jan 2023) R3: $0.166 (1.618 + 0.618 retrace levels + alternated support from Jan 2022) Massive Triangle formation that has broken since November.galachain.com/ New L1 Chain - Galachain, has infinite TPS ability. Read that again -- Infinite TPS scalability.

BiggyBalls

$SOL correction possibility

On smaller TF can see a 5-wave count blowing off into bearish divergence on RSI. Typical of corrections/pivots. Look for supports around $40 & $30 levels to scale in. This is probably needed to sweep fomo longs and attract dip shorters to fuel the wider wave 3 structure. Recommendation is take some profit and reload dip levels, risky to short against the trend.

BiggyBalls

$RNDR to $60

Fundamentals: #RENDER has announced building on #SOLANA as breakpoint. On of the leading AI-projects that will impact Film and Animation industry. Expect to see projects on SOL pump as Firedancer validator moves through test net and comes online. Technical: From ATH to ATL, RNDR has formed a Wave 1 & 2 with 0.38 fib correction, now breaking through the 0.618 fib retrace and using it as support. Larger formation is the Wave 3 back to ATH, with speculated Wave 5 around $60. Confluence with both 1.618 levels for Fib extension and Fib projections. If you don't know the difference -- one is placing the target from the ATH and ATL, while the other is projecting the target from Wave 1 and Wave 2 with a three-point measure.

BiggyBalls

$SOL to $4,380

Fundamentals: Firedancer validator node upgrade expected around Q2 of 2024, pushing TPS over 1.2m+ for a single cpu core. Technical: Parallel channel on Log Scale showing strong support line. With similar timeline of 21 bull run, we get a target of 4380, slightly above the 1.618 Fib Extension with a blow off top.Might see corrective dip here from $65 to 30/40 levels. A dip, not a reversal of wider trend.

BiggyBalls

Ethereum Targets/Zones

Now we've started to see the early breakout from previous call back in early november. What ive done here is simply overlap fib retrace levels from the previous bull and bear cycle with extension levels. Also bull cycle top with the 1.618 extension level. 2.618 is above 11xxx.

BiggyBalls

BTC - Second Super Cycle: Wave 3

With this wave count, 1.618 fib projected a target around $180,000/BTC for Wave 3. note: 2015 bear market fractal appears to be following at this stage, with volatile reversal expected very soon.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.