BigLava

@t_BigLava

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BigLava

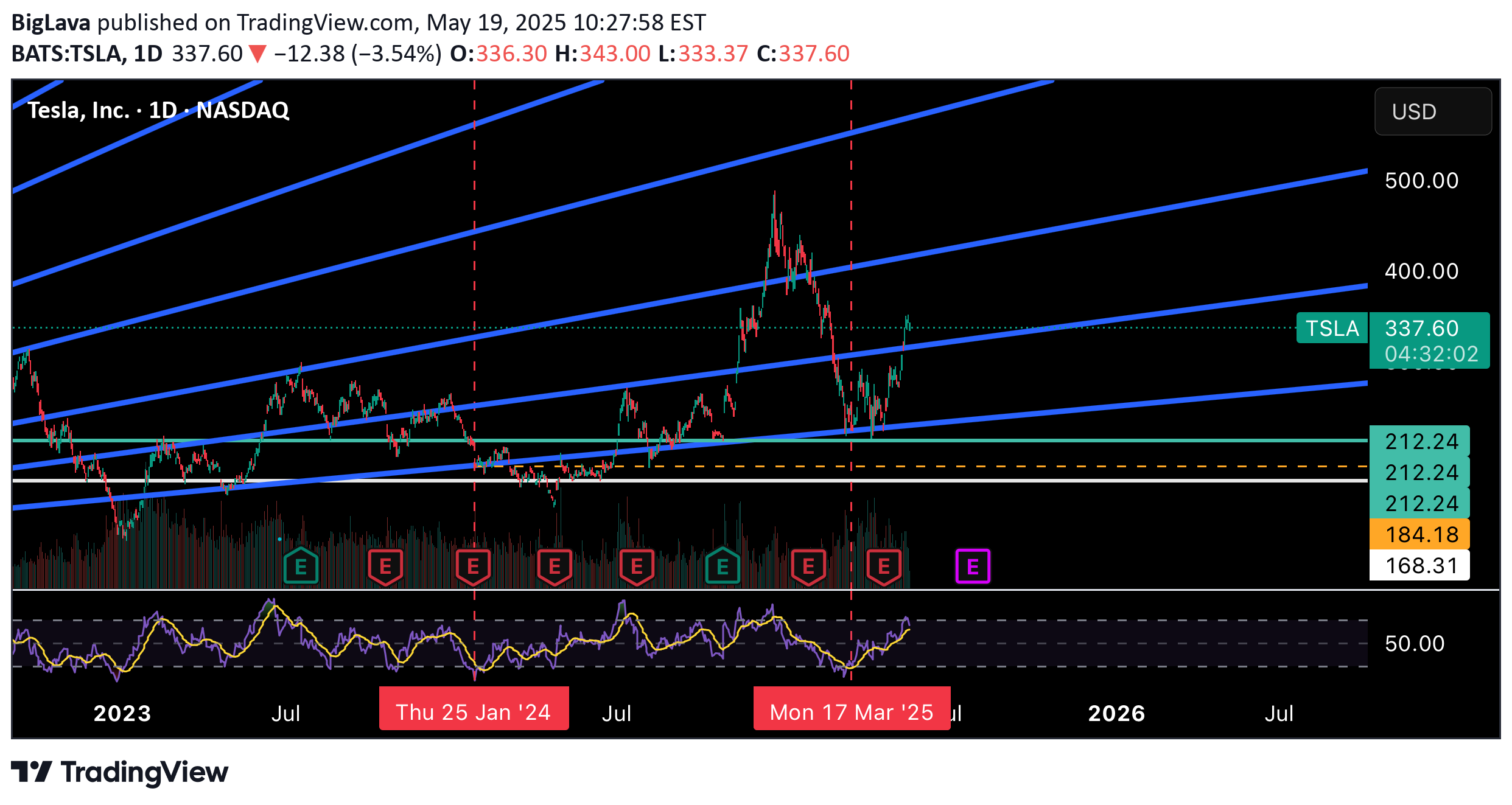

Tesla reclaimed spider trends

Made a sizable entry last year when daily RSI was bottomed. Double downed and picked up more around $256. Price bounced off Spider support trend lines and broke through resistance trend lines. Elon posted this in march 2025: x.com/elonmusk/status/1895997740385255784?s=46&t=4U3HhlyvAM21z9GQgbz48A Expecting to see 2,000$ within 3-5yrs. NFA.

BigLava

Clean confirmed bottom

15,000 TPS.Market makers are getting incentives.Weekly RSI bullish crossing.

BigLava

BigLava

Scalability and L3s?

Major reset on Celestia. If your bullish on scalability, projects launching own chains (L3).Good conviction trade.NFAThis should be studied a bit more.

BigLava

Study 2020 Halving

speculation of an instant pump after halving 4/20/2024 leads to leverage wipe out.Give it some time, let it shake people out, let conviction and confidence boil down.

BigLava

Astar looking to move?

The price has been in a distribution phase since its launch during the bull market. A textbook U-shaped pattern, with the price currently testing and remaining above resistance levels from two years ago. The trend has transitioned into an accumulation phase for some time now.

BigLava

YGG scalp play

YGG rejected at trend line.Expecting to see price trend to support level before potentially bouncing back for up trend. Using 3x leverage.Scale into position don’t market sell at once.

BigLava

ETH CME GAP

Price is currently volatile due to Vitalik depositing eth to exchanges. Cme gap the 1530 range. Expecting to see a bounce

BigLava

PEPE range

PEPE has made a massive move possibly a short squeeze. Price is now back in range. RSI bearish divergence

BigLava

CHZ Scalp opportunity

CHZ is currently trending around a key liquidation cluster level. Waiting for double top confirmation from Sept 16th.Looking to open a short with a tight stop loss.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.