BardiniCapital

@t_BardiniCapital

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BardiniCapital

Final Post: The Collapse Is Brewing

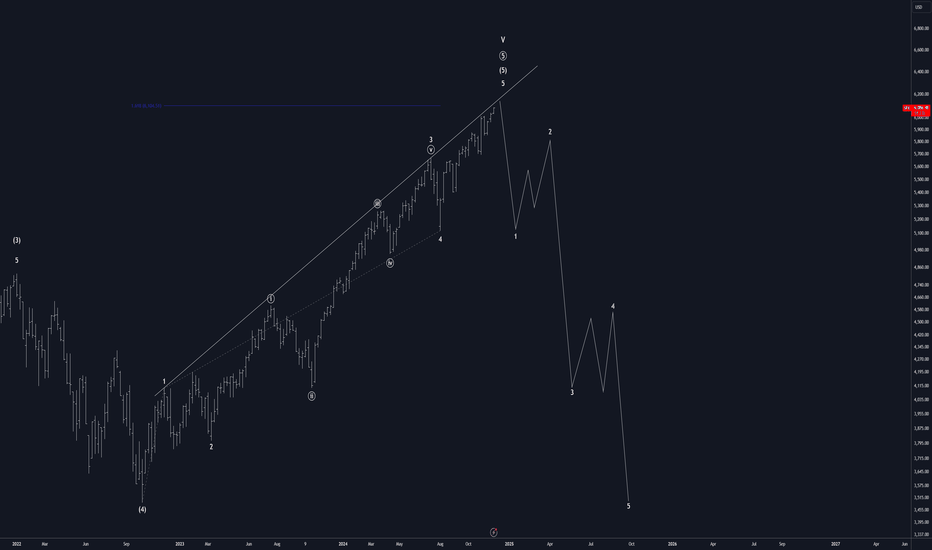

🚨 Final Warning: The Collapse is Brewing 🚨 The market is flashing unmistakable warning signals. If you’re still clinging to the idea of endless upside, it’s time to confront the data. Here are the key reasons why the market is on the brink of a major crash: 1. Record Dumb Money Investment, Consumer Debt, and Reckless Behavior Small traders, often referred to as “dumb money,” are more heavily invested in equities than ever in recorded financial history. Historically, these traders are most bullish at market tops, while smart money—like institutional investors—are quietly exiting. A prime example is Warren Buffett and Berkshire Hathaway. Buffett, widely regarded as one of the greatest investors of all time, has been signaling caution through his actions. Berkshire Hathaway is on track to finish its second straight year as a net seller of stocks, unloading a record $133.2 billion in equities through the first three quarters of 2024. The majority of these sales came from its largest holding, Apple (AAPL), generating over $125 billion in proceeds. Buffett's reluctance to reinvest that capital is a significant red flag. Even more telling, Berkshire has not repurchased any of its own stock this year for the first time in six years, signaling that Buffett believes even Berkshire itself is overvalued. This aligns with his famous adage: “Be fearful when others are greedy, and greedy when others are fearful.” At the same time, households are drowning in record levels of debt. Credit card balances have surged to all-time highs, and auto loan delinquencies are near record levels, signaling that consumers are stretched to the brink. Meanwhile, households have allocated more of their portfolios to equities than ever before, reaching record levels of stock investments as a percentage of total household equity. This dangerous combination of overleveraged consumer spending and peak exposure to equities creates the perfect storm. When the market begins to fall, liquidity issues and forced selling could accelerate the crash dramatically. 2. Elliott Wave Analysis: A Probable Turning Point When Wave 3 is extended, Wave 5 is typically shorter and often mirrors the length of Wave 1. In the chart above, I highlight a potential key target at 6,104.51 on the SPX, where Minor Wave 5 will equal 161.8% of Minor Wave 1. This level represents a probable turning point, as Wave 5 is unlikely to extend much further given the size of Wave 3 and the guideline concerning Wave 3 extensions. Additionally, the Minor Wave 1-3 trendline, shown on the chart, is a critical resistance level and a reliable predictor for pinpointing the end of Wave 5. This trendline suggests that Wave 5 is ending very soon, most likely by the end of the year. 3. Uninverted Yield Curve (After a Record Inversion) Buffetts favorite recession indicator! The yield curve has recently uninverted, a historically flawless predictor of recessions. But this time, it spent a record amount of time inverted, signaling extreme stress in the financial system. There is a strong historical correlation between the length of the inversion and the severity and length of the subsequent recession. With this inversion lasting longer than any in recorded history, the implications for the economy could be catastrophic. Final Thoughts The writing is on the wall. With record dumb money investment, Elliott Wave pattern nearing completion, a recently uninverted yield curve after a record inversion, and record consumer debt, the market is primed for a crash. Banks are sitting on over $500 billion in unrealized losses—and that’s just what we know of. The cracks in the financial system are growing, and in 2025, we should prepare for a 40-50% correction in US equities and banking failures across the globe. Greed and recklessness have reached unsustainable levels. History shows that these excesses are always punished, and this time will be no different. Stay cautious—this is your final warning. There will be no other post.

BardiniCapital

The Bitcoin Mania is Likely Over

I believe the recent surge in BTC has reached its conclusion. The term 'Mania' aptly characterizes the current state of BTC. In essence, BTC doesn't address tangible real-world issues, and the majority of those buying and selling it are driven by profit motives rather than a commitment to libertarian principles. Similar to the stock market, individuals are acquiring BTC driven by greed and selling out of fear, leading to the formation of tradable fractals. It appears that BTC has just completed a substantial ABC correction that commenced in November 2022. I anticipate BTC will ultimately decline below 15k and further. It's crucial not to buy into the mainstream narrative of BTC reaching 1 million; such projections lack rationality. I urge everyone to examine a weekly chart of BTC with the S&P overlaid to observe their correlation. Notably, all the rallies and downturns align perfectly. The crypto rally is essentially being facilitated by stock market movements; crypto is unlikely to rally unless the stock market does, and the likelihood of a stock market rally is uncertain.Good Luck, Abardini

BardiniCapital

DONT MISS OUT BTC TO A MILLION EASY BUY

DONT MISS OUT BTC TO A MILLION EASY BUY Are you intrigued by my attention-grabbing headline? It succinctly captures the current state of the BTC market—a clickbait rally. BTC has been riding the waves of the stock market, which reached its peak in January 2022. Around the same time, BTC experienced its own top (within weeks of the market). This demonstrates that while BTC may not be directly correlated with the stock market, its fluctuations of optimism and pessimism are interconnected with the broader market's highs and lows. Consequently, BTC's rally from its low at 3k to an eventual 69k was not driven by a desire for secure wealth storage or a libertarian ideology, but rather by speculation akin to gambling in a casino. Unfortunately, this short-lived rally is indicative of Wave B/2 wave personality. However, rest assured, everyone anticipates that BTC will skyrocket again, and believe me, NOBODY wants to miss out this time! The fear of missing the next rally compelled people to invest initially. Their intention was not to hold BTC or exercise liberty but rather to avoid missing out on the next possible surge in price.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.