Audacity618

@t_Audacity618

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Audacity618

تقویت اتریوم در برابر بیت کوین: آیا پیش از جلسه FOMC منتظر صعود ETH/USD باشیم؟

When ETHBTC breaks out of the trendline it's been a good indicator for further ETHUSD upside. Let's see a strong confirmation signal out of this downward trendline from October this year going into the last FOMC meeting of 2025 this week.

Audacity618

تشکیل سقف دو قلو و شمعهای رد شده: آیا بازار خرسی جدید در راه است؟

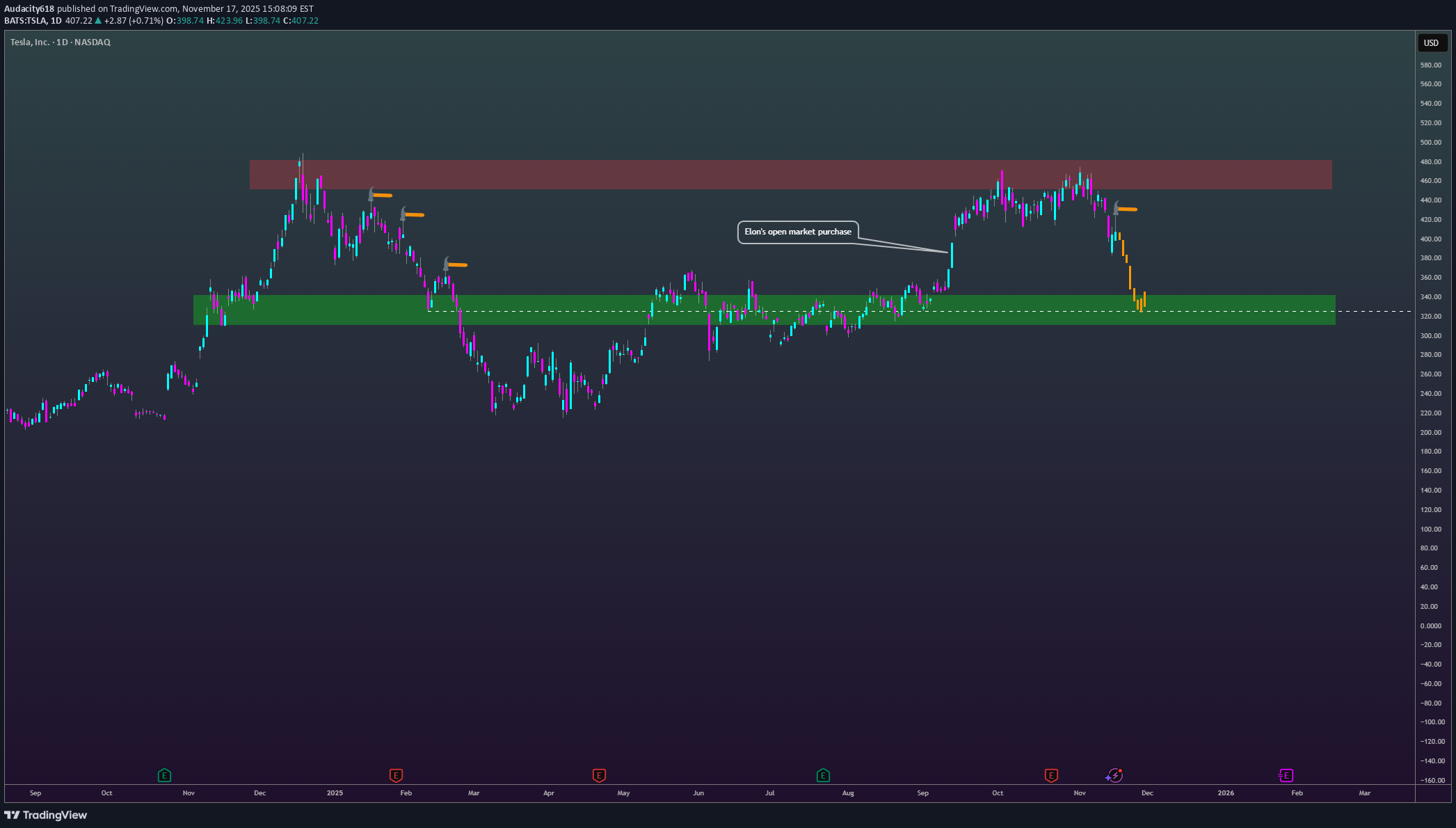

I do believe we are in the beginning innings of a mild "bear" market for the rest of the year. Too many folks wanting to sell high beta/valuation names. Add the Mag 7 collapse risk and TSLA is particularly vulnerable and may get unwound back to mid 300s. We do have NVDIA earnings this Wednesday and jobs report on Thursday. I don't expect these events to change the thesis. Add insult to injury, you have Peter Theil also lightening his TSLA position. And I don't think Elon's open market purchase on Sep 12 will support the stock price from falling back down to previous mid 300 level support Look for long wick rejection candles like the ones highlighted with the hammers, these will confirm we are still in the downward phase.

Audacity618

هشدار معکوس: چرا تقاطع مرگ در سهام متا (META) فرصت خرید طلایی است؟

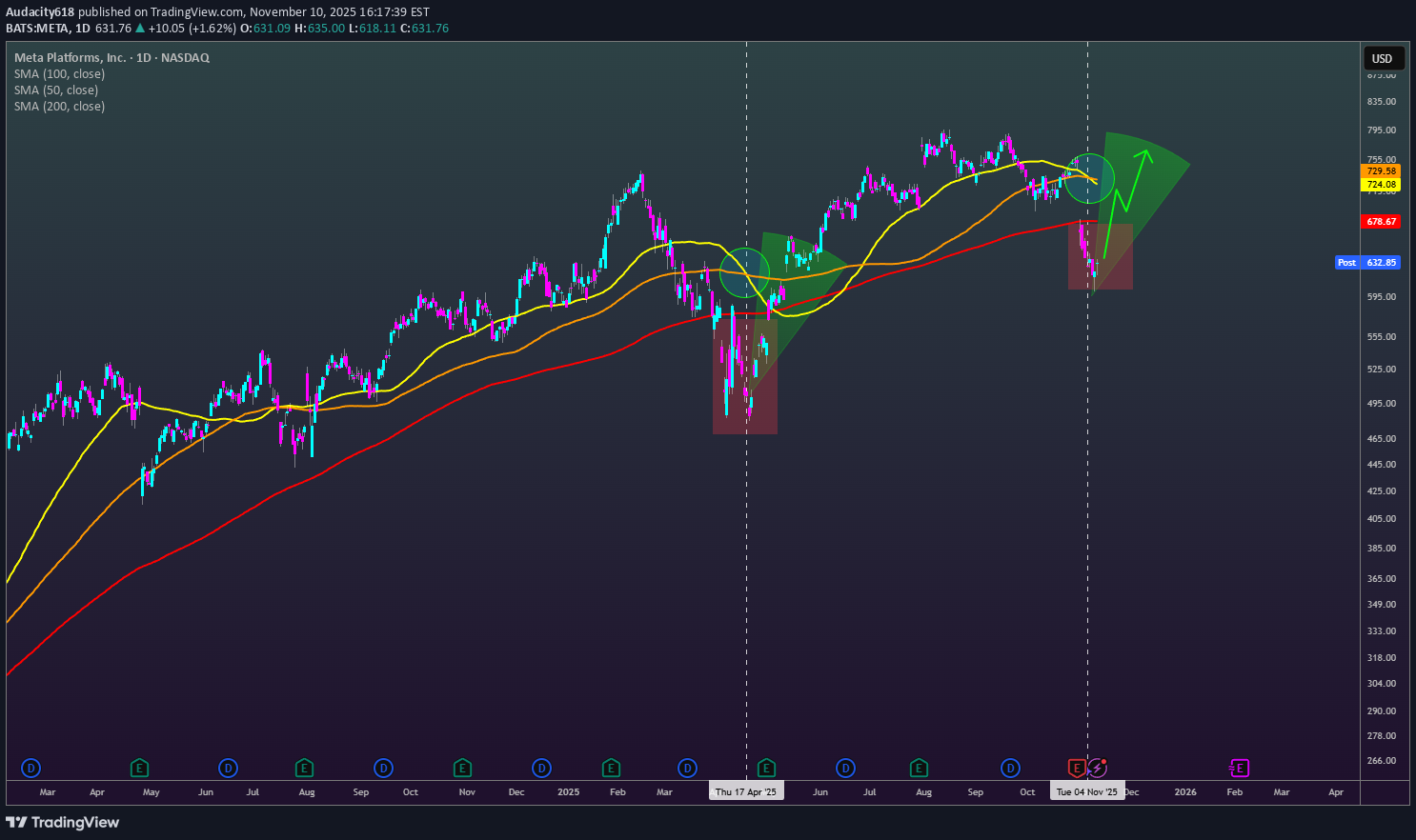

Rarely does the death cross actually provide a meaningful sell signal given its lagging components and, in some cases, can end up being a better buy signal. I think this is one of those times where META death cross is providing another meaningful buy signal as the price is well below the 200-day moving average. A similar setup was provided in April of this year after the tariff tantrum; this time it's on concerns post Q3 earnings on AI spending return model. I see price safely returning above the 200-day moving average, then slow grind higher back above the 50- and 100-day moving average would have to be assessed but possible as it was climbing back from April lows. I give this setup a $700 price target which would be respectful under this framework to exit the trade.Weekly view I see trend line support.Getting wacked with the beta movement down. but still holding here, seeing a double bottom setup (wish I waited for this, but not getting to get shaken out now).Linear Parallel Channels... Interesting...Adding the daily log view again. after it swept 600 on Friday it looks like it hit the support line around 595.too much downwward beta movement. got to sit this one out until daily Parabolic Sar confirms bullish reversal.

Audacity618

رالی باورنکردنی اتریوم: آیا فاندامنتالها بر ترس غلبه میکنند؟

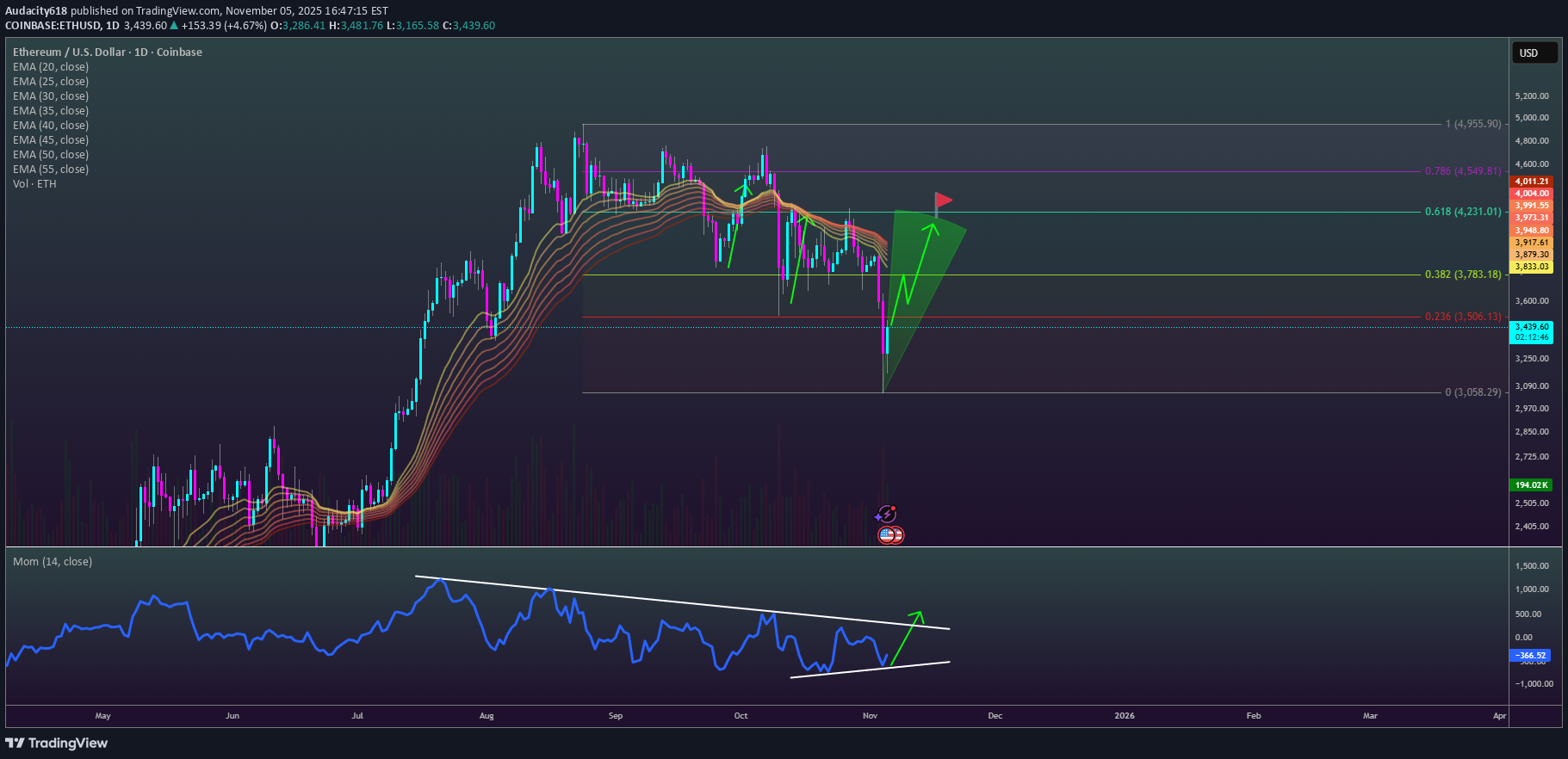

A lot of extreme bearish exuberance, but fundamentals continue to go up on the Ethereum network: lower gas fees, record transactions, record stable coin and real-world asset volume (digital treasuries, digital gold, etc). Recipe for a disbelief rally given extreme low sentiment. Bullish catalysts: - Fusaka upgrade go-live - Tariff SCOTUS reversal odds - Government reopening - Clarity act progress - New record network stats - New dovish economic reportsDown day but still keeping this trade on.Not enough momentum right now. closing out until better entry.

Audacity618

سقوط قریبالوقوع گوگل (GOOGL): آیا همه اعداد در قیمتگذاری لحاظ شدهاند؟

Fundamentals all baked in with price to sales ratio at previous 2021 post-covid highs will push to profit locking and selling pressure. GOOGL price target in the ~$230 range. RSI weekly divergence and upper log line hit confluence with top fundamental ratios.

Audacity618

بیتکوین به ۱۰۰ هزار دلار سقوط میکند؟ تحلیل تکنیکال هشداردهنده برای خریداران!

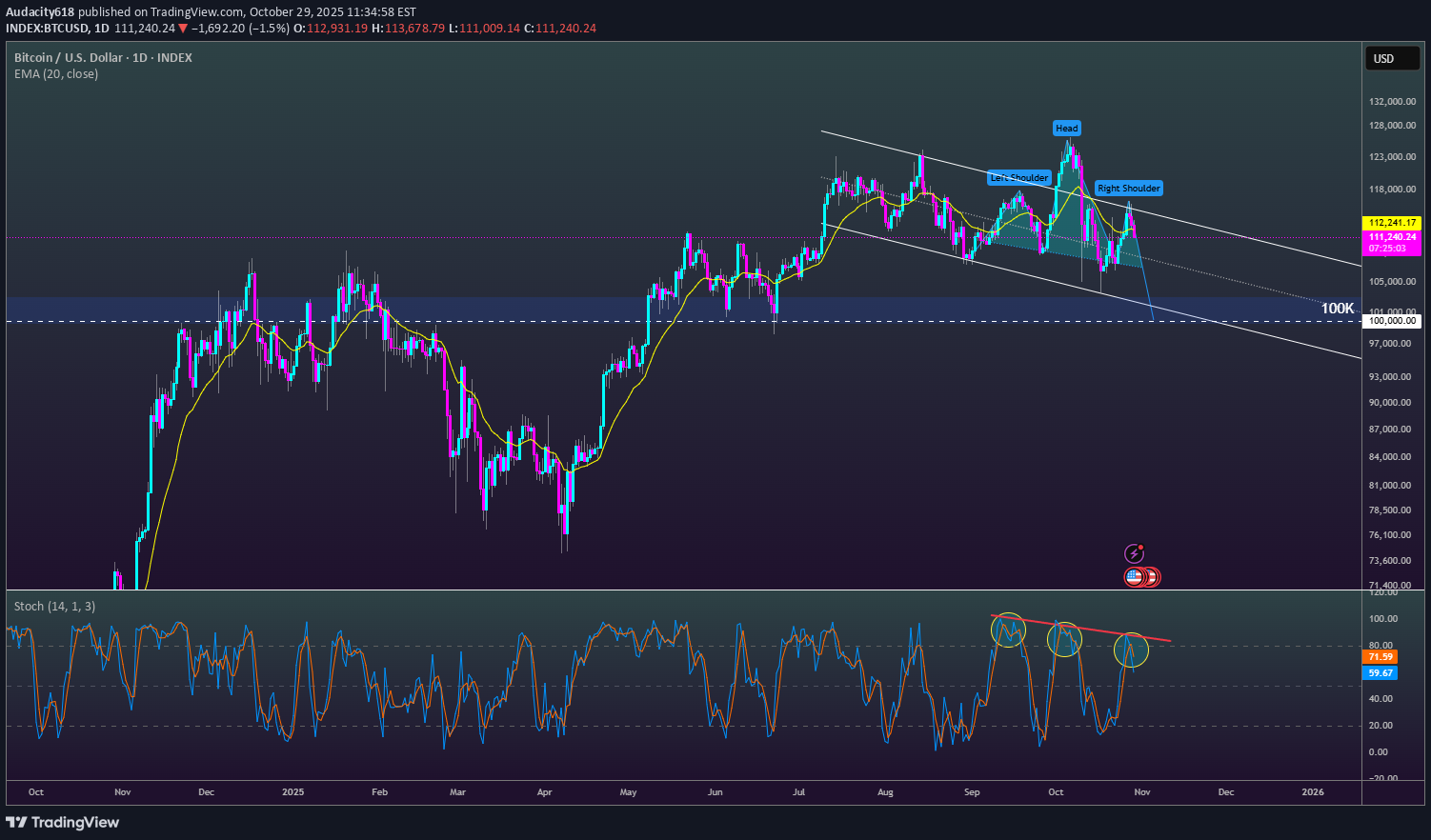

I want to be bullish on Bitcoin. We have a rate cutting environment, skyrocketing sovereign US debt, potential rotation from gold into bitcoin. But the technicals right now are ugly and bearish: 1. Right shoulder formation 2. Stochastic reversion 3. Unbroken downward channel Recipes for another flash crash or sell off back to the unbearable 100K level IMO. Sellers are still in control regardless of the fundamental backdrop.

Audacity618

کفسازی اتریوم زیر 4000 دلار: سیگنال صعود قدرتمند تا 5000 دلار!

Accumulation of Ethereum under $4000 by DATs will keep the trend line intact. I see a low-risk entry to climb back to ATH and test $5K while under $4K. This is a 6hr chart showing a nice hesitant but steady bottoming seen in similar local bottoms in 2025. Fundamentally we have the fed rate cut in late October along with the Fusaka upgrade as near-term catalysts for bullish momentum.

Audacity618

Great Entry for Ethereum

Retesting the previous Log Channel. RSI hitting prior low support.Short Term View, Look for a race back to the original down trend line and prior support. Just north of 4300.

Audacity618

Long Swing Entry Opportunity

Solana still performing as a strong beta play to Ethereum. This pull back is steep but hitting all the right zones for a long entry (log trend line and EMA bands). The Steepness of the recent pullback I attribute to fairly large liquidation of over levered longs exploited in a bear attack to force a long squeeze, uncorrelated to a change in the fundamental market sentiment for Solana.

Audacity618

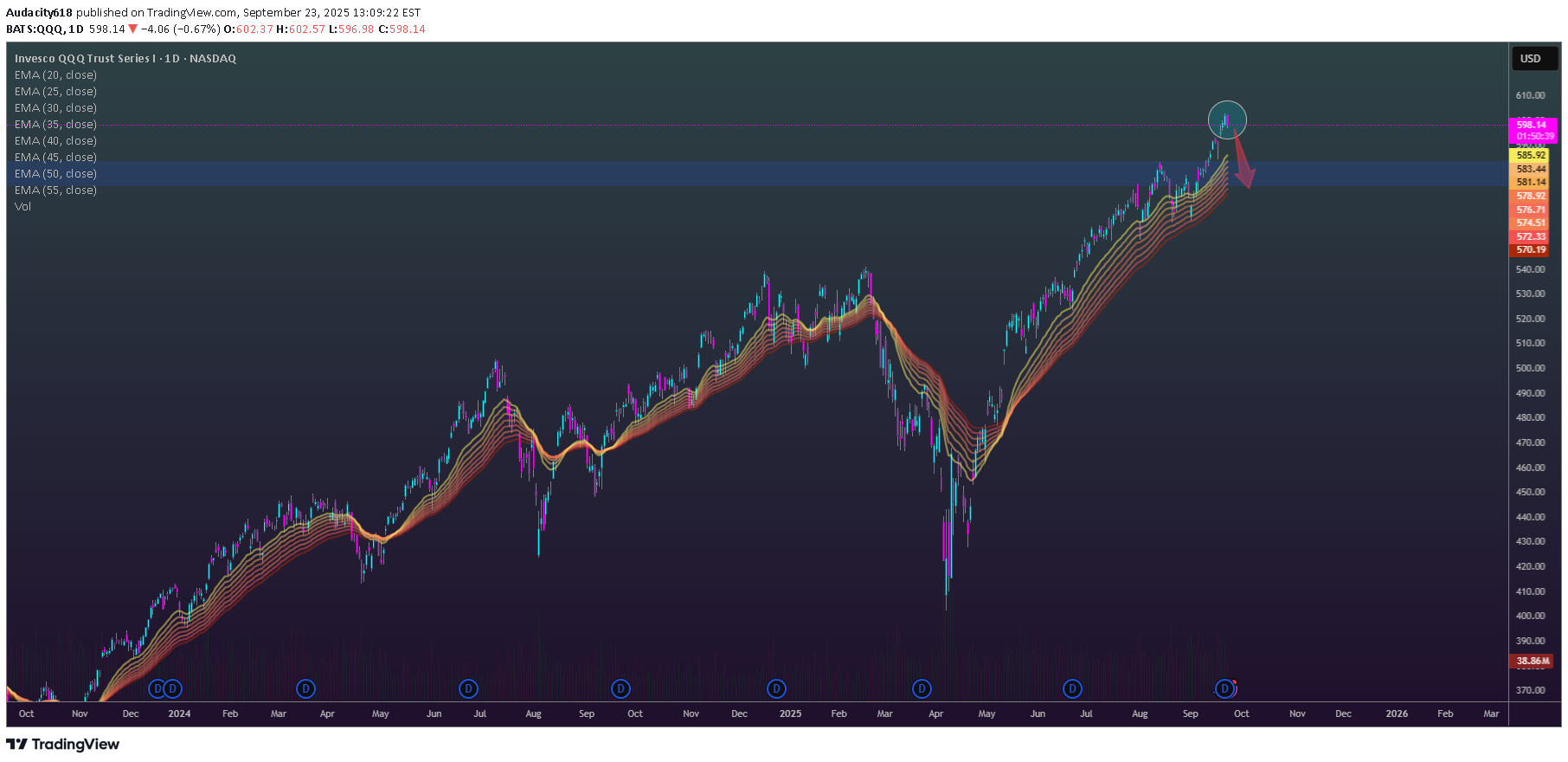

Powell: Stock Prices appear "Fairly Highly Valued"

“We do look at overall financial conditions, and we ask ourselves whether our policies are affecting financial conditions in a way that is what we’re trying to achieve,” Powell said. “But you’re right, by many measures, for example, equity prices are fairly highly valued.” “Markets listen to us and follow and they make an estimation of where they think rates are going. And so they’ll price things in,” Powell said in part of the conversation dealing with mortgage rates. Though Powell noted the lofty equity values, he said this is “not a time of elevated financial stability risks.” Not really something you want your central banker saying to keep positive momentum in the stock market. Particularly when the Nasdaq is fairly stretched. A downside scenario could see us pulling back into the EMA bands to 575s for the $QQQ.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.