Asif_Brain_Waves

@t_Asif_Brain_Waves

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Asif_Brain_Waves

Xauusd Sell setup 16 Dec 2025

Xauusd Sell setup 16 Dec 2025 i am looking for sell setup. i dont know what is going on.

Asif_Brain_Waves

سیگنال خرید بیت کوین (BTC): فرصت طلایی در حمایت قوی - منتظر واکنش قیمتی باشید!

BTC Buy Setup Market is pulling back from the recent swing high and heading toward a bullish support zone. If price dips into that demand area and shows a stable reaction, it can form a new dealing range. From there, a clean shift in structure on the lower timeframe can open a long opportunity. The idea is to let price tap the demand zone, hold it, and then catch the move as it expands back toward the upper boundary of the ascending channel. The overall bias stays bullish as long as the trendline and support zone remain protected.

Asif_Brain_Waves

سیگنال خرید S&P 500: آماده جهش پس از تغییر ساختار بازار!

price market structure has been shifted from bearish to bullish. nasdac 100 already swept PWL sp500 showing strentgh, rencet fvg will push price higher once candle close above black candle series buy trade become high probality.

Asif_Brain_Waves

سیگنال فروش طلا: تله صعودی زیر ناحیه قیمت شکست!

good giving reaction after tab on bearish say fvg type 1. we have just sitting below bullish fvg type 1 that will push price little higher, but i am antispate thi swill fail to push higher atleat below target hit, potancial target is sellside liqdudity. best of luch.

Asif_Brain_Waves

تحلیل طلا (XAU/USD): استراتژی فروش با اهداف مشخص (تایم فریم 2 ساعته)

**Sell Plan (XAU/USD | 2H)** Price has swept the previous day’s high and sharply rejected from the marked zone, showing a shift in short-term momentum. The most recent candle remains active, confirming bearish intent. Wait for price to retrace into the highlighted supply area and show rejection or bearish confirmation. Once validated, follow the trade plan to execute. Downside targets lie near the recent liquidity zone. Trade strictly by plan — avoid adjusting SL, BE, or TP once the position is live.

Asif_Brain_Waves

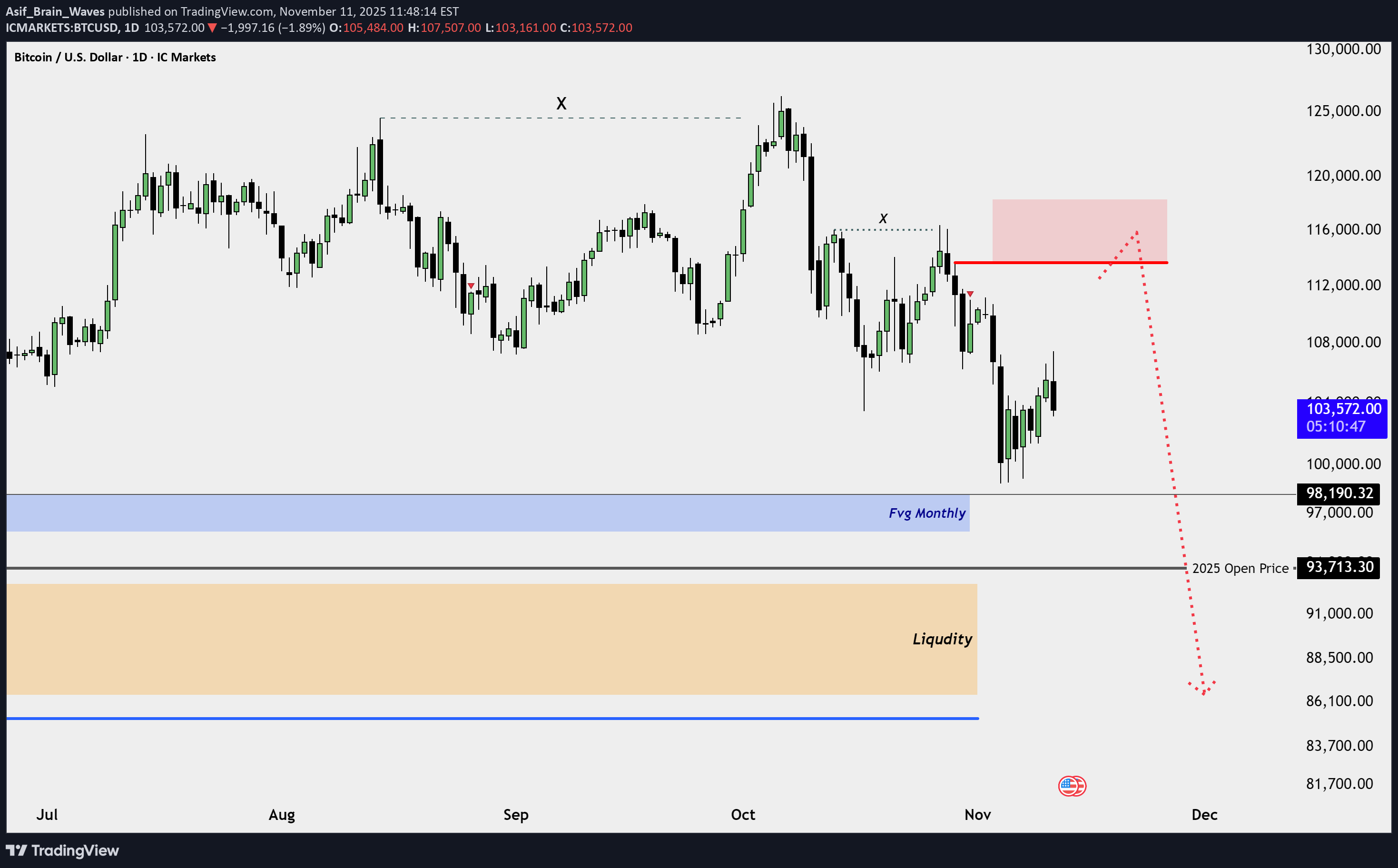

پیشبینی ریزش بیت کوین (BTC/USD): آمادهسازی برای حرکت نزولی بزرگ پس از نوسان کوتاهمدت

Sell Setup – BTC/USD (1D) Price is currently retracing upward after forming a lower high. The plan anticipates a potential sweep of short-term liquidity resting above the recent high (marked X) before a continuation lower. Premium Zone (Red Area): Expected area where price could deliver into before bearish continuation. Monthly FVG (Blue Zone): Acts as an intermediate draw on liquidity and potential first target area. 2025 Open Price: Serves as a key magnet level, aligning with the draw on liquidity below. Liquidity Pool (Orange Zone): Final downside objective, where price may rebalance and collect long-term liquidity. Narrative: After the short-term retracement into the premium zone, watch for signs of rejection (e.g., bearish FVG formation or a break of structure). Once confirmed, anticipate a continuation toward the monthly imbalance and below the yearly open price.

Asif_Brain_Waves

طلا در حال جمعآوری نقدینگی: راز حفظ سرمایه در منطقه سکون (کنسالیدیشن) XAUUSD

Gold Always Love to Break ALL time High. iski fitrat hai. As trader Sab se mukhkil hota hai Consolidate main Portfolio Bacha k Rakhna. so wait for Took Any side Liqudity then Excution is become High Probality. Gold Recantly Farming liqudity. i belive it will not Trade at All time High untill Visit Recent Low, (3886). Let See Market is ALways right.

Asif_Brain_Waves

صعود قدرتمند S&P 500: اهداف جدید و نقاط ورود طلایی!

Price has completed a clean sweep of sell-side liquidity and is now showing strong displacement toward the upside. The recent break in structure confirms short-term bullish intent. If price returns to the fair value gap or discount zone, I’ll look for confirmation to enter in alignment with the intraday bullish flow. My first target remains the internal liquidity zone, and the potential extended target is the previous day’s high where buy-side liquidity rests.

Asif_Brain_Waves

برنامه معاملاتی طلا (XAUUSD): منتظر کدام سناریو برای ورود به بازار باشیم؟

Gold (XAUUSD) Trade Plan At the moment, this is the observation phase — I want to see which direction the market moves first. The ideal scenario would be a gap-down open, followed by a liquidity grab below the previous week’s low, and then a move to the upside. There’s a daily bearish Fair Value Gap (FVG) above that remains unmitigated, so if the market takes out the weekly low first and then starts showing strength, I’ll be looking for long setups targeting that upper imbalance. However, if price fails to hold above the CISD level and breaks lower structure instead, I’ll shift my bias to bearish continuation toward the weekly T2 and DOL zones. For now, patience is key — waiting for the first move to reveal direction before making any trade decisions.

Asif_Brain_Waves

پیشبینی فروش بیت کوین (BTC): آیا قیمت تا ۹۳ هزار سقوط میکند؟ (استراتژی ۳۱ اکتبر ۲۰۲۵)

Sell Plan Price failed to hold above the short-term high and is showing weakness near the resistance zone. My focus is on continuation toward the monthly FVG and liquidity zone below. As long as price stays under 111,284, the bearish structure remains valid. I’ll look for lower timeframe confirmation before entering, targeting the 98,190–93,700 range. Patience remains key — no need to rush the entry.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.