AriasWave

@t_AriasWave

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

AriasWave

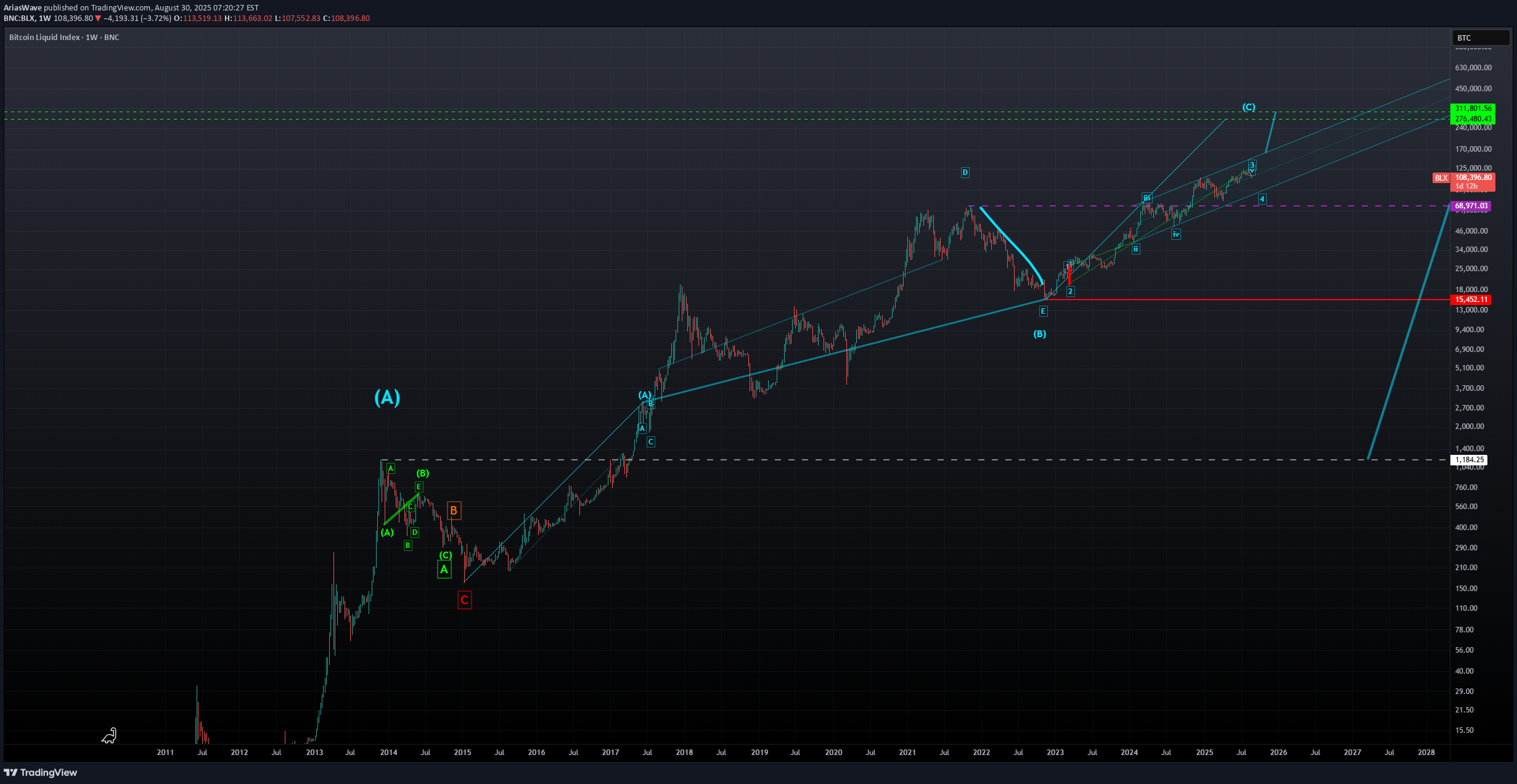

BITCOIN - Just Some Talk Before I Get Serious...

I’m not here to sugarcoat your reasons for investing in crypto. My role is simply to share the insights I see in this market, whether you like them or not. Honestly, part of me hopes people lose money—not because I think about it every day, but because maybe then they’ll finally wake up to what they’re really doing with their money. From a bigger-picture perspective, I believe we’re on the edge of a major economic reset. The system can’t keep repeating the same cycles without breaking down. Eventually, reality catches up—and when it does, the economy will collapse in on itself, at least for a time. Do I care about that collapse personally? Not really. What I do care about is AriasWave analysis—the methodology I developed over many years. And through that lens, the current market looks just like Tulip Mania or the dot-com bubble: frothy, unsustainable, and honestly, kind of hilarious. I can already see how it ends. Whether or not I “hope” for it, the patterns themselves point to an inevitable outcome. If you can’t see this based on the analysis I’m showing you, then you’re willfully blind. Blind as a bat. And in markets, blindness costs money—you will lose. Here’s the bottom line: based on AriasWave, I expect Bitcoin to peak somewhere between $276,000 and $311,000 before topping out. If you want to understand what comes next, you’d better follow along. Because if you don’t, you’ll stay blind to what’s really happening in the broader market—and in that case, survival is not on your side. And by the way, there is more to come.

AriasWave

XLM Breakout Watch | How Global Markets Are Setting the Stage

In this update, I break down XLM’s mid-term outlook and why the $0.65 level is a key breakout zone to confirm further upside. Based on current patterns, I’m targeting a potential move into the $100–$138 range over the mid-term. While Bitcoin still influences XLM, the backdrop of massive money printing since 2018 has created conditions for meaningful accumulation, setting the stage for higher prices. Add to that an environment of rising interest rates, Fed interventions, and volatility cycles, and it’s clear we’re only at the beginning of what could be a period of outsized returns. Stellar’s role in a shifting economic system also can’t be ignored. As fiat currencies face structural limits, crypto offers a framework that breaks those shackles, with altcoins like XLM poised to outperform Bitcoin in the next cycle. Markets will continue to follow their familiar pump-and-dump patterns, but each cycle brings diminishing returns for central bank interventions—leaving room for crypto markets to step in and restore balance. Stay tuned for the charts and insights that put these patterns into perspective.

AriasWave

XLM - Stellar Lumens - Zero to Hero Chart... $138...

After a long silence, I return—not with the same voice you once knew, but with a vision sharpened by time and transformation. Welcome back to AriasWave, where charts are more than technicals—they are echoes of cycles, whispers of the unseen rhythm guiding both markets and empires. For those gripped by bearish doubt, prepare to enter paralysis… because what I now see is far greater than just XLM’s price action. My eyes have opened beyond M2 money supply, beyond the surface stories of economics, into a deeper current—an unfolding pattern etched into the very fabric of the global system. AriasWave has revealed to me the coming sequence of peaks and troughs, not only in crypto but across the arc of history itself, stretching 20… 30… even 40 years ahead (much more actually). But first, we must face the shadows. The near term carries darkness, volatility, uncertainty—but hidden within is the seed of renewal. This chart, though only a fragment of a vast fractal structure, is where I begin to share these revelations. It is simple, yes, yet profoundly niche, and it carries the pulse of what is to come. Step into this journey with me. What lies ahead is not merely analysis—it is prophecy written in waves. I will explain this target in a video shortly... stay tuned...

AriasWave

BITCOIN - Short Trade - Take 2 - Downside Target Is 74,517...

We're watching for a break below 87,000 to confirm the start of Wave (C), with a target of 74,517. If price drops below 87,000 without making a new high, it confirms 88,894 as key resistance and an ideal stop level. For a full breakdown, check out the video linked below in Related Ideas.

AriasWave

BITCOIN - Price Action Update - Have We Seen The End of Wave E..

Bitcoin appears to be encountering resistance on several fronts: recent highs, the 200-day moving average, and the extended length now required for Wave (C) to complete the larger Wave B Zig-Zag pattern. A break below the 87,000 level would likely signal the completion of Wave E. Price action remains choppy at the highs due to ongoing uncertainty, but I expect this to resolve soon. The downside target sits at a minimum of 74,517 to complete the broader Wave B Zig-Zag.

AriasWave

BTCUSD - Short Trade - Back To The Lows To Complete Wave B...

Price has been rejected at the 200-period moving average on the daily time frame. This presents an opportunity to short back toward the recent lows, completing the complex Zig-Zag structure I mentioned earlier. A strong resistance level remains above at 88,486, with a downside target set at 74,517.I’ll be posting a video update shortly.

AriasWave

BTCUSD - Wave B Needs One More Low - Lets Talk About It...

So far, there's been no actual gain or loss from my current idea that we could reach 90K. However, I’d like to propose a new perspective — that we may have been navigating a complex, expanded Wave B Zig-Zag this entire time.With a deeper understanding of AriasWave, I can now make certain assumptions more confidently. I had considered this scenario before but dismissed it due to how far-fetched it seemed. Now, I’m revisiting that idea with a fresh outlook.The key point is: nothing has been gained or lost yet — which means this is your opportunity to reassess and position your trade in the right direction using this analysis.Let’s make it count. Let’s do this!Check out the chart version linked below.Short Entry: 83,000Target: 74,517

AriasWave

BTCUSD - Another Dip Is Possible With This Count...

Recent rejections at the highs have prompted a deeper analysis, and the findings are quite intriguing. Based on a detailed wave review, there's a possibility we're currently trading within an expanded Wave B zig-zag pattern that has yet to find a bottom. If this scenario holds and we see a break below the 83,000 support level, price could potentially decline toward the 74,517 area. On the upside, resistance is observed at 86,506 and 85,493.

AriasWave

BTCUSD - Short Term Long Trade - Evidence of 90K Incoming...

In this video, not only do I walk you through the small degree long trade (based on the chart linked below), but I also break down the entire pattern, explain the corrective process, and share what I expect to happen next.As long as 83,015 holds, all signs point toward a potential 6%+ move up to 90K. This is a solid opportunity—price tends to move slowly during corrections, and then all at once.Let’s navigate this setup together, so you can take advantage of it with solid risk management and smart leverage.

AriasWave

BTCUSD - Looking For A Push To 90K...

We appear to be in the midst of an expanded zig-zag correction. A small push toward 90K—without breaking the support at 83,015—would confirm the pattern. So far, the break above the recent high, along with the expanded correction, supports this outlook. As long as the 83,015 level holds, price may reject any prolonged move below the 1000-period moving average.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.