Anele_888

@t_Anele_888

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Anele_888

Ethereum

Ethereum took out a large liquidity pool at 2 360.00 and has since been struggling to trade lower. Daily Order Block at 2 495.00 is also acting as a strong support. We have a bullish break in structure on the H4 which is the confirmation we were waiting for. More updates to follow.Trades were closed at breakeven, a bearish railroad has formed and the break in structure was a fake out.

Anele_888

XAUUSD

We have dollar strength which puts Gold under pressure. We have a reclaimed order block at 2310 and a propulsion block at 2327 We also have the lower highs indicating further weakness. More updates to follow.Target 1 coming in at 2,295 has been reached. Target 2 upcoming.Trades got stopped out at breakeven with target 1 reached.

Anele_888

XAUUSD H4

We are anticipating higher pricing following the recent dollar weakness. Our entry long will come in at 2345.00 which is also a Reclaimed Order Block on H4 and Order block on the Weekly TF coinciding with the enrty level.Target 1 will be coming in at 2377 and target 2 will be 2417. More updates to follow.Target 1 has been reached at 2377Target 2 has been reached at 2417. All positions have been filled

Anele_888

XAUUSD H4

After sweeping 2015.28 we saw price react from that level abruptly and breaking our descending wedge. We have a Reclaimed Order Block coming in at 2033.00 which is our entry long. We have a reentry opportunity coming in at 2045.11 which would be the safer entry point for confirmation purposes. More updates to follow.Move SL to breakeven and TP1 has been reached. Holding the reminder to 2070.86We have added more positions on this trade on our reentry level coming in at 2045.11We have exited our positions at breakeven coming in at 2045.11 We believe that this level is not willing to hold price, and se we are looking to reverse our positions.

Anele_888

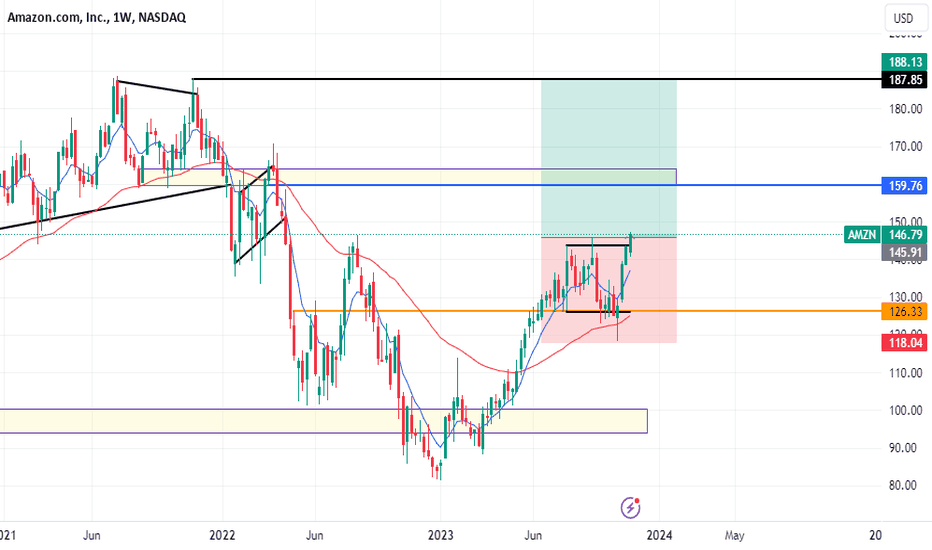

Amazon

Amazon was trading Bearish for the whole of 2022 into January this year and now we finally turned Bullish on May 15 with a Break in Structure at $113. Our main focus was the Propulsion Block resting at $126 and at the same level we had a Search and Destroy Profile sweeping 143.98 (High) and 126.33 (Low) Our first target is $159 and we looking to make a re entry around the same level. More updates to followOur first target has been reached ($159) and we are looking to make a reentry at the same level when price retraces into it.$187 target has been hit

Anele_888

Dash/USD

After a sweep for liquidity below the $30 level on the monthly timeframe, we are starting to see a bullish sentiment. We broke structure at $28.72 and now we are waiting for price to retrace into our Recliamed daily Order Block at $32.70 More updates to followOur Reclaimed Order Block was triggered, our entries are in.

Anele_888

LTC/USD

We have a search and destroy profile on the Weekly TF, sweeping $105 and $65 showing unwillingness to continue lower. We have a higher low at $59 on the Daily and a Break in structure supporting our search and destroy profile on the Weekly. We anticipate seeing $72.94 being broken soon which is our low hanging fruit (target 1) More updates on entry points soon$72.94 was hit, I'm anticipating a pull back to occur soon which will give us a re entryWe have a Bullish Order Block coming in at $72.54 this will be our re entry level

Anele_888

SOLUSD

After the recent surge, price was looking to fill in the liquidity void it had created from the drop from $39.98 Price is showing unwillingness to fill the entire void and is showing weakness, supported by the fact that it entered into a significant Premium Array. Target 1 $17.14 Target 2 $15.39 Target 3 $13.94We secured target 1, price is still consolidating between $26 and $20, not a good time for re entries

Anele_888

BTCUSD Buying Pressure Increase

BTC sold off to clear the $28673.26 liquidity pool, Daily turned bullish. Our 50 & 8 MA's crossed over and are under the current price. We are about to break out an Asymmetrical triangle on H4 trading into or Resistance turned Support and Imbalance area coming in at $29519.66 Strong support coming in at $28789.89 Strong resistance coming in at $30423.04 $31535.32Buy limit order triggered

Anele_888

XAUUSD FOMC MANIPULATION

Note: we have a Interest rate report being released in the next 2 hours+/- Daily bias is bearish and both 50 & 8 MA's are bearish. I anticipate a raid of buy stop orders resting above 1872.11 and potentially 1877.96 A sniper entry short would be the 1883.38 level and we have a strong resistance coming in at at 1874.66 Our target will be 1847.80

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.