AllenBoswell-2

@t_AllenBoswell-2

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

AllenBoswell-2

📰 Impact of news:1. PCE and Consumer Index📈 Market analysis:The current price of 3280 has a higher profit and loss ratio advantage. Technical indicators show that the hourly chart is severely oversold. Combined with the top and bottom conversion of 3300 above, there is a 20-point rebound space in the short term. If the PCE data is in line with the trend, gold prices are expected to quickly regain the 3,300 mark. Note that negative data beyond expectations may cause a brief decline.🏅 Trading strategies:BUY 3295-3280-3275TP 3298-3300-3310SELL 3300-3310TP 3290-3280-3260-3250If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices. GOLD XAUUSD XAUUSD XAUUSD XAUUSD

AllenBoswell-2

📰 Impact of news:1. PCE and Consumer Index📈 Market analysis:Judging from the 4H chart, the Bollinger Bands are closing and the MACD is showing a trend of forming a death cross, indicating that the short-selling momentum is still relatively strong in the short term. However, as the overall upward structure has not been destroyed, there is still a possibility of a rebound and repair in the future. During the day, we need to pay special attention to the support strength of the MA5 and MA10 moving averages. It is recommended to adopt the idea of shorting at high levels and going long at low levels. The key support below is the 3305-3295 area, and the upper resistance is the 3340-3350 range. However, judging from the chart, in the short term, there may be a rebound near 3313. At present, it has indeed rebounded to around 3319 as expected. If it falls weakly to this week's low of 3295, you can buy if it does not break. On the whole, if it rebounds to 3335-3345, you can consider shorting, and if the support below 3305-3295 is not broken, go long. Today is Friday, and as it is near the end of the month, market liquidity is strong. Please be cautious in your operations today and be sure to set stop losses strictly.🏅 Trading strategies:SELL 3335-3345-3350TP 3320-3315-3300BUY 3305-3295TP 3310-3320-3330If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.Gold rebounded as expected and then fell again. It has reached the 3295 line of support. I have already executed long orders according to the trading strategy.

AllenBoswell-2

📰 Impact of news:1. Initial unemployment claims data📈 Market analysis:Gold is in a sideways consolidation near 3320 in the short term. The market has no clear direction for the time being, and the long and short positions are in a tug-of-war. The hourly line rebounded to 3328 and then fell back again, suggesting that there is still room for short-term retracement. The current operation needs to focus on key points: if it rebounds to the 3320-3330 resistance area, you can consider entering short positions again. If the market continues to decline, focus on the 3300-3290 support range. If it stabilizes, long orders can be arranged. The overall idea is to maintain a volatile market. Before effectively breaking through 3350 or falling below 3290, high-altitude and low-multiple is still the main strategy.🏅 Trading strategies:SELL 3320-3330TP 3310-3300-3290BUY 3310-3300TP 3320-3330-3340If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices. XAUUSD XAUUSD XAUUSD XAUUSD GOLDBefore effectively breaking through 3350 or 3290, maintain high-altitude and low-multiple operations. If the bulls regain 3335 again, the operation will be to oscillate in the 3350-3310 range. If 3335 is regained on Friday, it is recommended to place a short order in the 3345-3350 area for the second time during the day. There are only two scenarios on Friday: either it remains weak and continues to break the previous low, or it recovers 3335 and continues to fluctuate around the range.Short orders are profitable again, shorting 3330, and 3335 increases positions at the same time, I have made a profit, keeping up with the trading pace and bros who are following my 🌐 have made profits.

AllenBoswell-2

📰 Impact of news:1. Initial unemployment claims data📈 Market analysis:Gold has begun to show signs of bottoming out in the short term in the past two days. Since the daily line bottomed out and pulled up, the daily line closed positive yesterday, and the bulls began to counterattack, and the 1H low was rising. If it doesn't fall further in the short term, it will most likely bottom out and rebound. The upper pressure is at the Bollinger middle track of 3355, which is also the high point of Tuesday's decline. If gold breaks and stabilizes at this price, it will have a larger upward space, and the upper side will look at 3385. In the 4H chart, MACD temporarily forms a golden cross, which is a bullish signal; but the BOLL track pressure is still there, and gold bears still have momentum in the short term. Therefore, on the whole, in the short term, gold should pay attention to the 3350-3360 resistance above. If it encounters resistance under pressure here, it can consider shorting. Pay attention to the 3330-3320 support area below.🏅 Trading strategies:SELL 3350-3360TP 3340-3330-3320BUY 3330-3320TP 3340-3350If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices. GOLD XAUUSD XAUUSD XAUUSD XAUUSDAt present, our short-selling has generated good trading profits. The current support is at 3330-3320. Considering that gold may usher in another wave of rebound in the short term before completing the downward trend, I manually closed the position near 3340. At present, we will patiently wait for the key point to enter the market again.Although gold broke through 3311 and reached the lowest point around 3309, it did not stabilize below, so it did not effectively touch our SL. At the same time, the short-term gold rebound highs are lower and lower. In the short term, it consolidated around 3320 for a long time, so I chose to manually close the position to lock in profits.

AllenBoswell-2

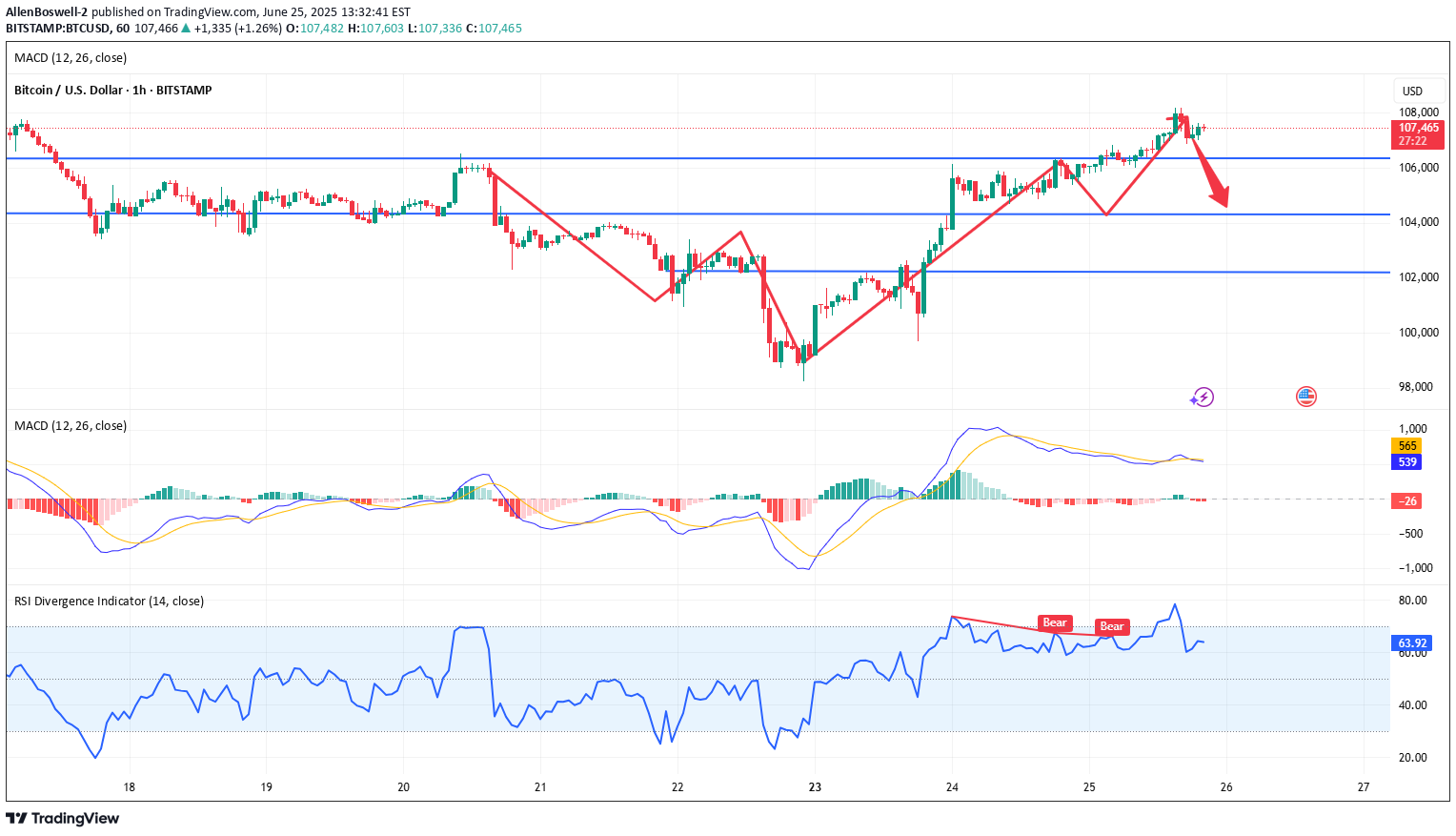

📰 Impact of news:1. Geopolitical impact📈 Market analysis:BTC has reached an intraday high of 108,125, just one step away from the all-time high of 112,000. With the increase in trading volume and institutional sentiment turning bullish, the momentum seems to be in the bulls' favor. In addition to institutional buying, the ceasefire agreement in the Iran-Israel war is also an important factor in Bitcoin's sharp rebound. Trump's announcement of the end of the war almost immediately triggered a surge in the cryptocurrency market. However, the overall pattern has not changed, and the range resistance has not been broken, so we still keep the idea of shorting at high levels.🏅 Trading strategies:SELL 108000-107500TP 104500-103500If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

AllenBoswell-2

📰 Impact of news:1. Powell's testimony2. Geopolitical impact📈 Market analysis:I have completed the long trade according to the previous trading strategy, and the long order has generated profit. In the short term, the overall trend of gold is still bearish. Only if it breaks through and stabilizes above 3350 can the bulls continue. If it rebounds to the 3330-3335 line and encounters resistance under pressure, you can consider shorting. If it rebounds to 3340-3350 but fails to stabilize, you can increase your short position. Pay attention to the support of 3320-3300 below. If it falls below 3300, it is expected to reach 3280🏅 Trading strategies:SELL 3330-3335-3340-3350TP 3320-3310-3300-3280If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices. XAUUSD XAUUSD XAUUSD XAUUSD GOLD

AllenBoswell-2

📰 Impact of news:1. Powell's testimony2. Geopolitical impact📈 Market analysis:The short-term rebound of gold is the release of energy for the accumulated bulls. From the current market trend, 3340 above is the key point of the short-term watershed between bulls and bears. The short-term resistance above is around 3342-3348, and the short-term support below is around 33220-3315. If it falls below this, it will continue to look towards yesterday's low of 3290-3280. The daily level is under pressure and continues to see a decline and adjustment. If it touches 3340-3350 above, you can try to short. After it retreats to 3320-3315 and obtains effective support, you can consider going long.🏅 Trading strategies:SELL 3340-3350TP 3330-3320-3315BUY 3320-3315TP 3330-3340-3350If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices. XAUUSD XAUUSD XAUUSD XAUUSD GOLDAt present, gold is trading sideways at 3330. 3332 is the 61.8% position of yesterday's decline from 3357 to 3294. If there is no rapid retracement here, the possibility of gold volatility in the short term is high. Currently, we are focusing on 3335. If it breaks through, it will move towards our target of 3340-3350 to see the pressure effect. Aggressive bros can consider going long above 3330 and look at 3340-3350.I have already exited the long trade with a profit. In the short term, I will focus on the short trading opportunities in the upper resistance area. Bros, if you missed the opportunity to go long, you must seize the short trading opportunity this time.

AllenBoswell-2

📰 Impact of news:1. The ceasefire agreement reached earlier did not take effect, and Trump believed that both sides violated the agreement2. Federal Reserve Chairman Powell delivered a speech 3 hours later📈 Market analysis:At the 4H level: the Bollinger Band opening is enlarged, the MACD indicator double-line death cross is downward, the short-selling force is strengthened, but the RSI indicator rebounds after being oversold. Overall, there are obvious signs of a rebound in gold prices. At the hourly level: the gold price is in a downward channel, the Bollinger Bands are expanding, the MACD indicator is dead cross and the red bars are converging, and the short momentum has weakened. The RSI indicator rebounds from oversold, and the demand for spot gold rebounds is obvious. Therefore, we still hold long orders near 3320 in the short term. Short-term operation suggestion: go long when it stabilizes at 3325-3315, pay attention to the resistance range of 3370-3380 on the upside, and consider shorting when encountering resistance and pressure.🏅 Trading strategies:BUY 3325-3315TP 3335-3345-3365SELL 3370-3380TP 3340-3330If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices. XAUUSD XAUUSD XAUUSD XAUUSD GOLD

AllenBoswell-2

Bowman's dovish comments in the afternoon eased the market, by which time risk aversion was deepening as sudden geopolitical conflicts continued to deepen. Will the USA make a corresponding response to this matter? This series of events has once again put gold into a complicated situation. Can gold hit the 3,400 mark today?Free trading strategies are updated daily🌐. All trading strategies released since this month have been verified and can serve as a good reference📈.👇 I sincerely hope that these strategies can be helpful to you👇. XAUUSD XAUUSD XAUUSD XAUUSD GOLD

AllenBoswell-2

📰 Impact of news:1. Bowman hinted at a July rate cut2. Fed Governor Kugler and FOMC permanent voting member and New York Fed President Williams hosted the "Fed Listening" event.📈 Market analysis:Gold will maintain a short-term volatile trend. Although the United States intervenes in the conflict between Iran and Israel, the geopolitical situation will affect the market trend to a certain extent. However, the remarks of Federal Reserve Board member Bowman hinting at a rate cut in July have eased market volatility to a certain extent. Gold maintains a narrow range of fluctuations at the 4H level, and the technical pattern is gradually adjusted. The K-line stands firmly on the short-term moving average. The short-term trend shows that it is necessary to observe the second opportunity for pull-up after the confirmation of the retracement. At the hourly level, the short-term moving average diverges upward, and the short-term volatile and strong pattern is maintained. In the evening, pay attention to the upper resistance area of 3395-3405, focus on the suppression of the 3405 line, pay attention to 3375-3365 below, and further pay attention to the 3345 support line if it breaks through.🏅 Trading strategies:SELL 3385-3395-3405TP 3370-3365-3345BUY 3375-3365-3355TP 3390-3400-3405If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices. GOLD XAUUSD XAUUSD XAUUSD XAUUSDOur trading strategy has been confirmed once again. The long and short trading points are very consistent with our trading strategy. The bros who kept up with the pace have already made considerable profits.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.