AllAboutMoney

@t_AllAboutMoney

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

AllAboutMoney

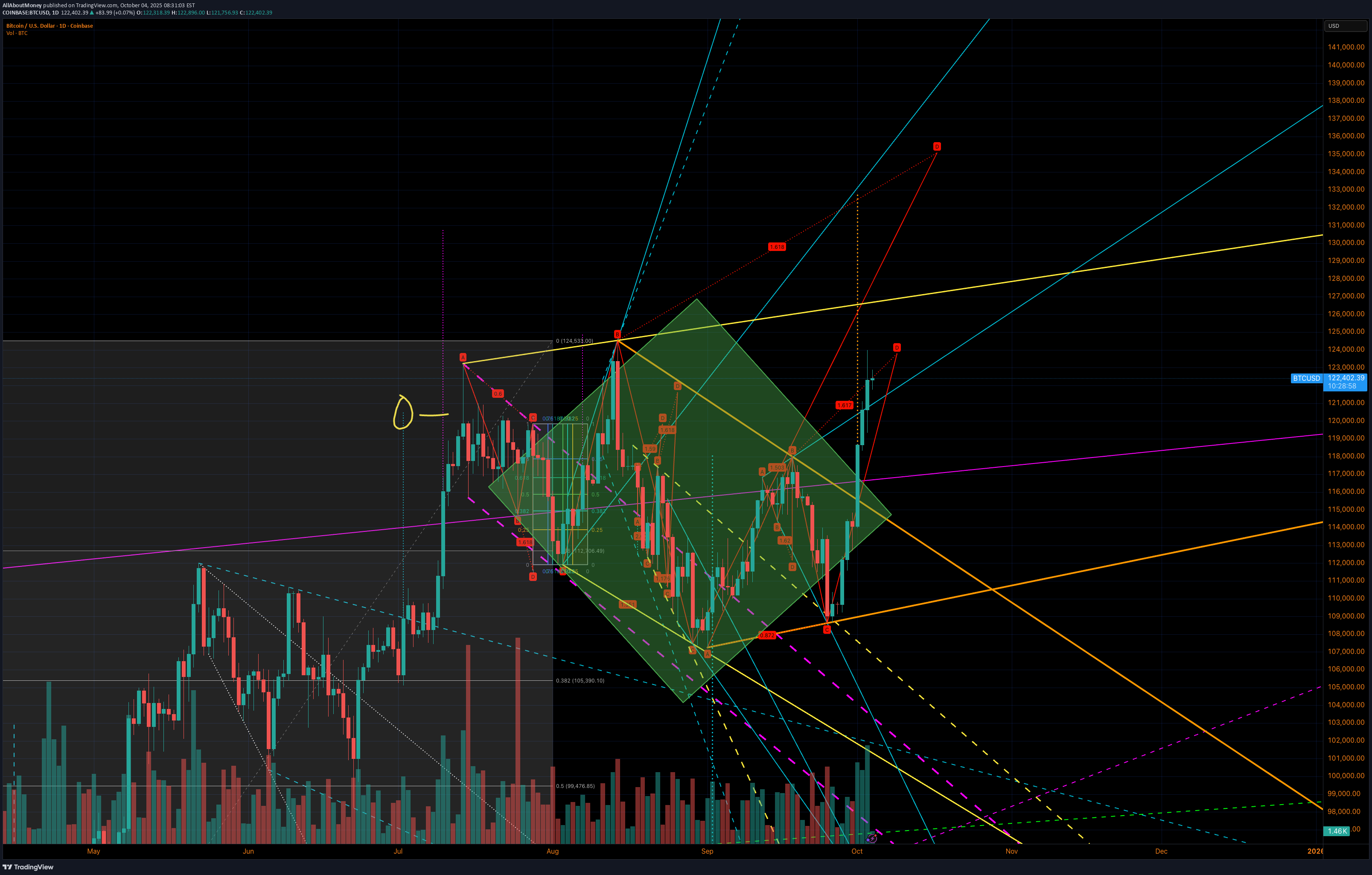

بیت کوین منفجر میشود: مسیر صعودی جدید تا مرز ۱۴۵,۰۰۰ دلار آغاز شد!

After almost two months of back and forth, Bitcoin has finally reached the price that the algorithms had programmed, opening the way for the continuation of the rise that targets 129,900 and later 145,000. The elements involved: two megaphones and two flags. This should be very explosive.

AllAboutMoney

الماس صعودی: الگوی 100% گاوی که شما را به بالای 130 هزار میرساند!

When a megaphone and a symmetrical triangle intersect, a diamond is formed — a 100% bullish pattern that completes the previous setup and should take us above 130K.

AllAboutMoney

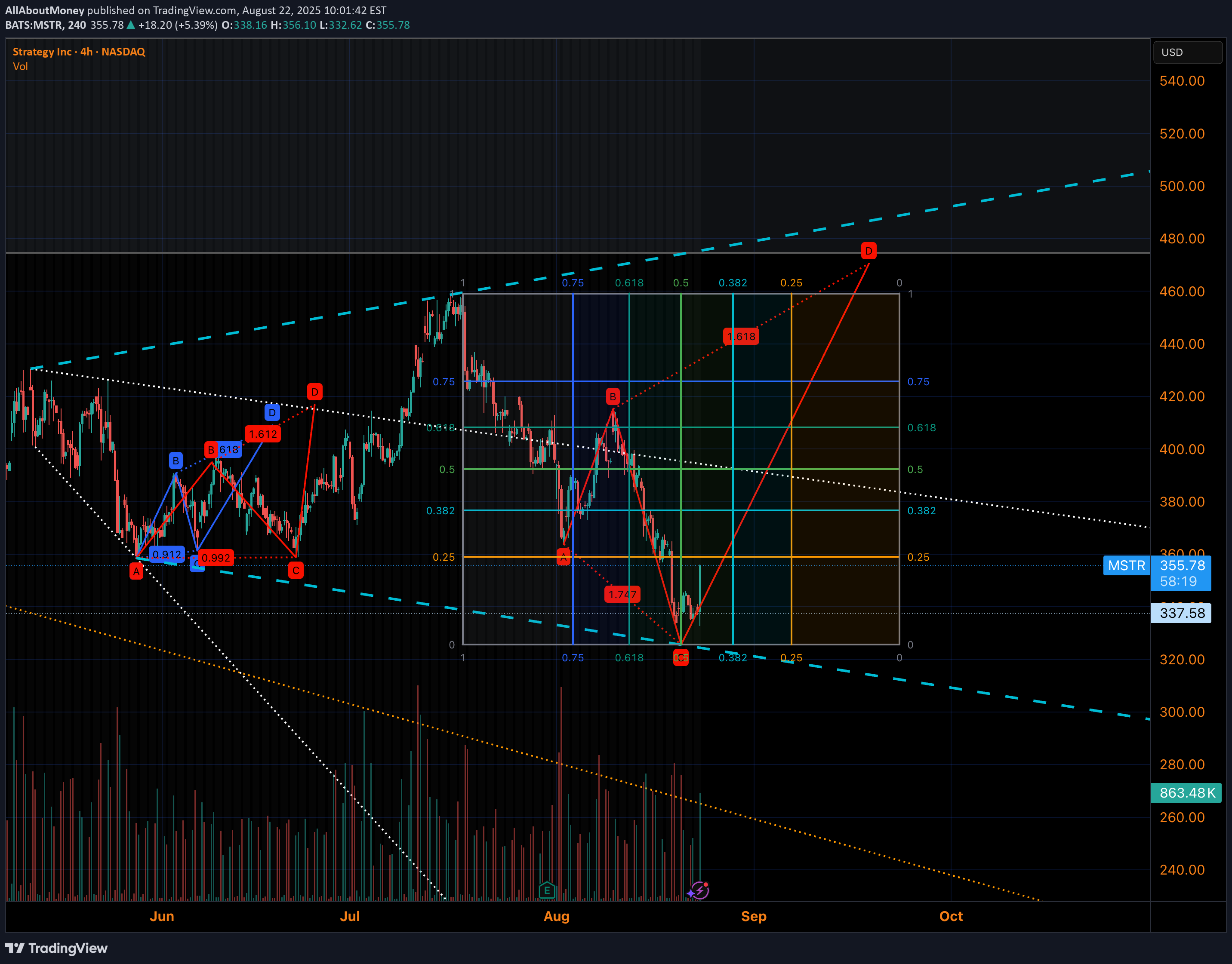

a megaphone over 500

A good signal right on time was Powell saying he would change his monetary policy (he said he would adjust it). Then Bitcoin and all the equities hurt by the recent drops resumed the solid uptrend we’ve been seeing. They came back to consolidate technical levels and give us new highs. In the case of MSTR, we can see the formation of a megaphone pattern that could take us above 500 USD.Still there, don't desperate

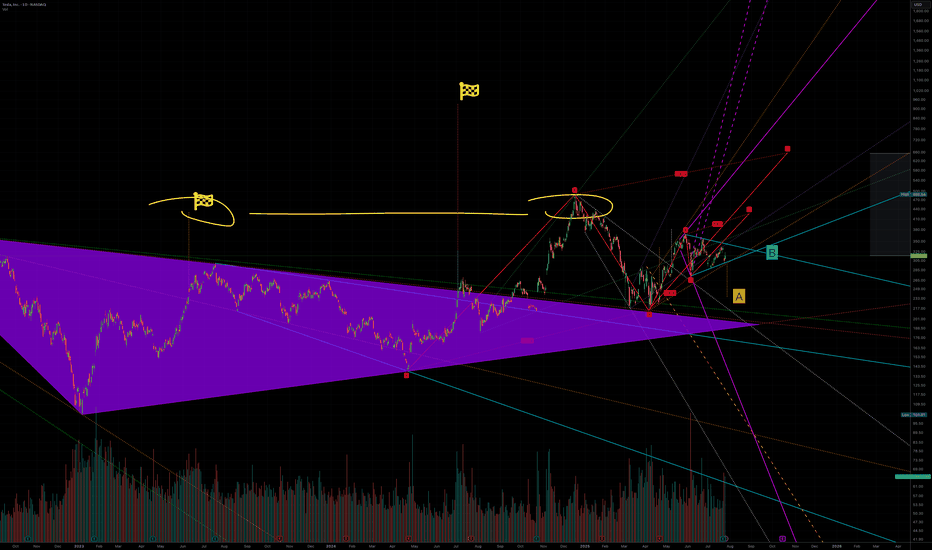

AllAboutMoney

A to 236 or B killing A to 420

Tesla is one of those stocks that is heavily manipulated algorithmically. When we were in an uptrend and needed a little push, a large fractal was created that could break a previously formed structure which should have taken us to $236(A). Interestingly, a very strong symmetrical triangle has emerged, influencing this upward movement, and the final price—due to some mystical reason—seems to be $420(B). It’s also worth noting that this whole move is being influenced by another similar structure whose target is above $600. So, if we analyze everything that’s happening, a 12% drop in sales means nothing compared to what Tesla will gain from robots, restaurants, and robotaxis, which I call RRR

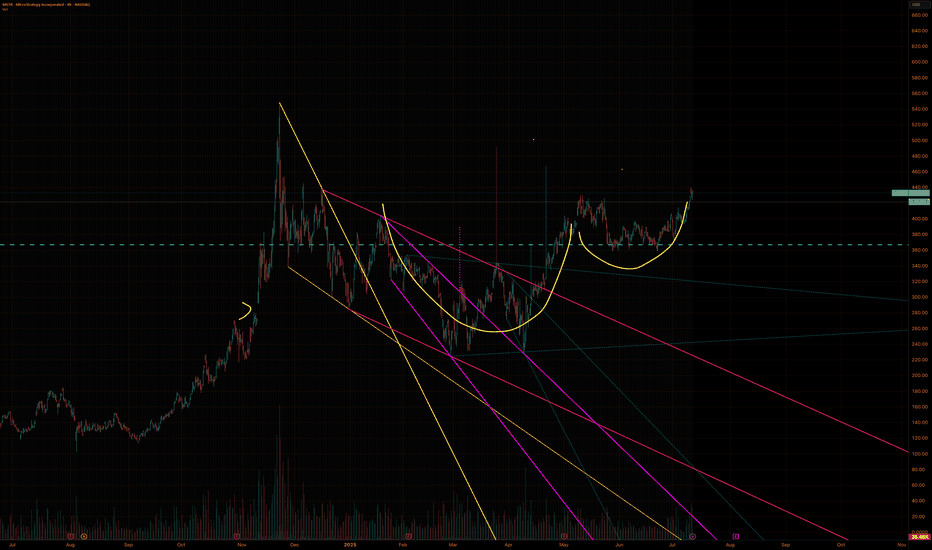

AllAboutMoney

Cup and handle

After many months, we now have a cup and handle formation. Regardless of Michael Saylor's constant buying, we have a bull flag in play that takes us to $491 USD.

AllAboutMoney

symmetrical triangle in progress

Bitcoin has been consolidating at this level for several weeks, easing some of the pressure in order to push above 120K. As of today, we have a clear formation—a large symmetrical triangle—which confirms the continuation of the upward trend and rules out any possibility of returning to lower levels.At first, I was expecting a symmetrical triangle, but the pattern didn’t fully form. Now, we’re seeing two bull flags targeting the 120K levelHappy ending

AllAboutMoney

Hello Symmetrical triangle

The appearance of this symmetrical triangle marks the end of the decline in this cycle, in which the price is stabilizing in order to continue its upward movement. 109 is the next level.

AllAboutMoney

Up or Down

As we can see in the chart, on December 24th, Bitcoin's price reached its climax, moving cleanly without further structures to follow. Since then, the price has formed micro-structures and is now attempting to create a much larger one that would allow it to advance—a megaphone pattern (D). If this megaphone were completed with an upward move today, it could catapult the price above $149K. With each passing day, the potential price target increases. However, to form the full megaphone, a base had to be established, which is what we are seeing now. On December 24th, a structure was formed that facilitates a return to the $107K level and also helps determine the price range where the megaphone's base (C) could be finalized, between $86K and $77.6K. Today, a bull flag (B) has formed within a falling wedge (A), and the price movements align with this pattern, which aims to return to the apex before continuing the upward move. However, even if the price surges due to the bull flag breakout, I believe it might retrace again to continue building the base of the megaphone, which is quite broad.X pattern invalidated, which is good because we can see the completion of the megaphone floor, now and not wait for another month. I assume that a catalyst will make the price rebound because MSTR and others already have very strong structures

AllAboutMoney

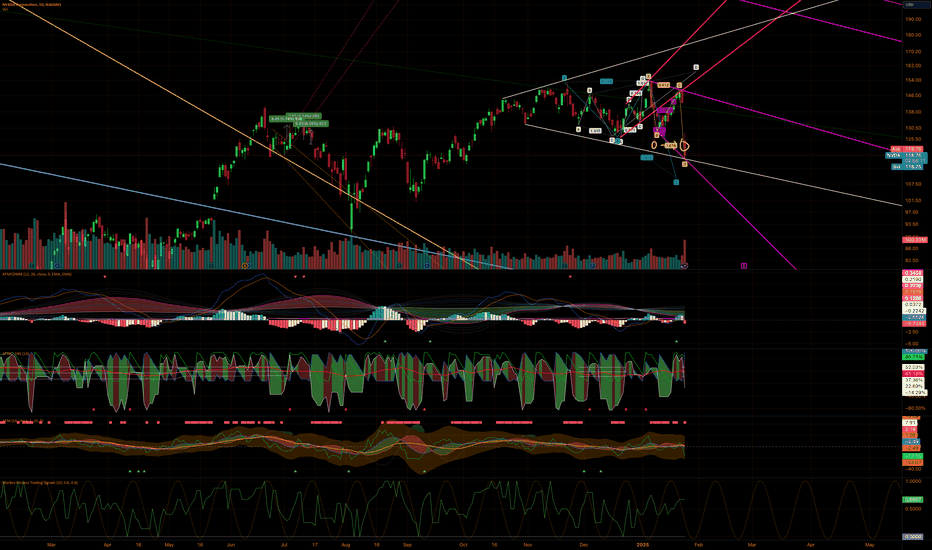

i dont know guys!

I don’t know, guys, but I think this stock is getting interesting. Just last Friday, the first fractal of the drop formed, and now we’ll see the continuation. All this activity is happening within a megaphone pattern, which makes me think NVDA’s price will surpass its all-time high. The optimization of LLM models doesn’t affect anything negatively—it only helps them become more popular and drives more chip sales. We’re on the brink of launching the Stargate project, and let’s not overlook the fact that both the hardware and software used for AI are evolving. Nothing is set in stone, which is why sales will continue to be monumental. A clear example is that if these models become optimized enough, we could see the massive use of new, more compact chips for household and personal appliances, robots, etc. So don’t be afraid—join the revolution!

AllAboutMoney

Destination known 111K

Confirmed: As I mentioned in another post, we have now crossed the resistance of the symmetrical triangle, indicating a potential move towards 111K and breaking the possible downtrend. At the end doesn't make any sense wait for a downtrend when everybody is moving to bitcoin(not now).

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.