Aibullz

@t_Aibullz

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Aibullz

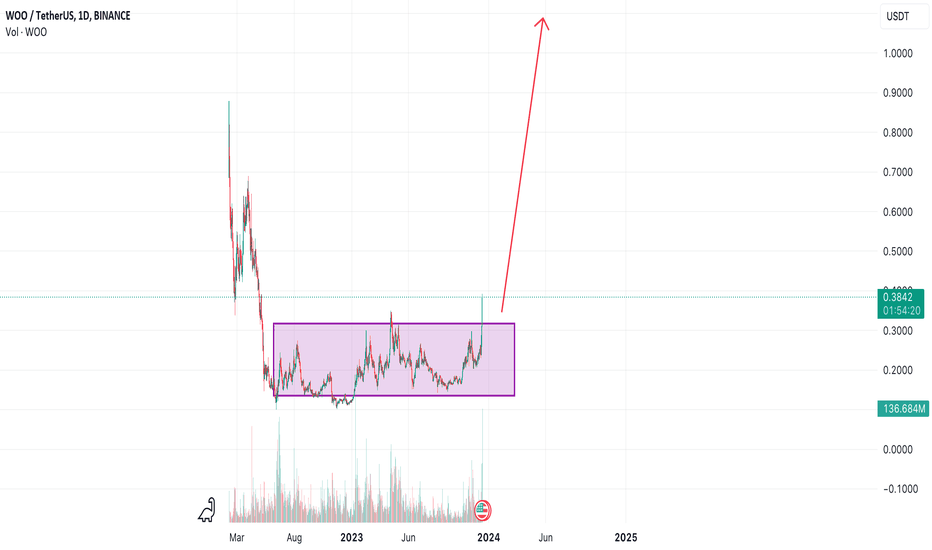

This is my long term alt coin investment, It has a long way to go and we are early in . My take profit is December 2024 , 1000% from here at least!

Aibullz

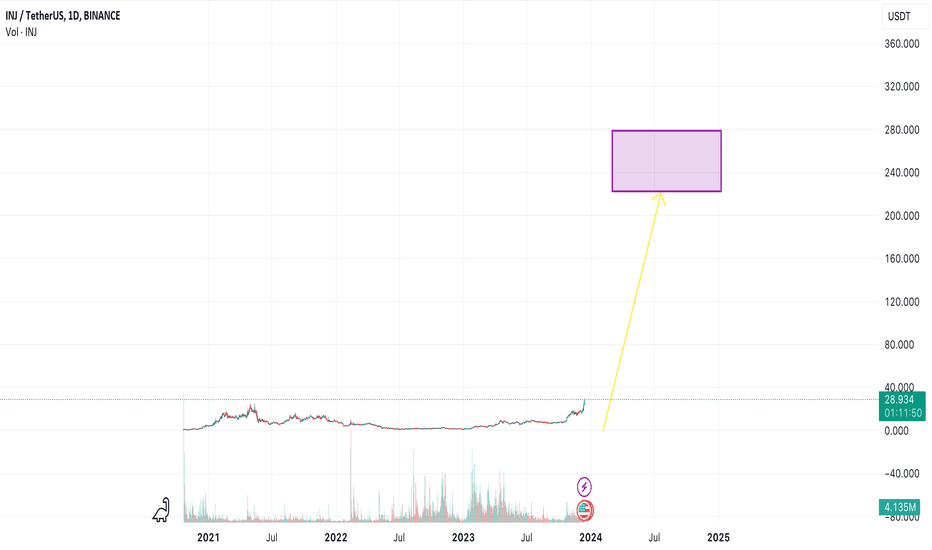

INJ is on of the most hyped AI coin and has gained a lot of attention recently due to the spike in price. This is one of my longterm AI coin I will hold until December 2024. I am expecting 10X profit on this one

Aibullz

Injective (INJ) is a blockchain protocol focused on decentralized finance (DeFi) applications. Developed by Injective Labs, it was launched in 2018 with key features designed to enhance the DeFi ecosystem. Key Features of Injective: - Interoperability: Built using the Cosmos SDK, Injective is highly interoperable. It supports the Cosmos Inter-Blockchain Communication (IBC) protocol, allowing seamless asset transfer across different blockchain networks. Injective is compatible with multiple blockchains like Ethereum, Solana, and Cosmos. - Decentralized Finance Tools: Injective provides developers with software modules to build DeFi solutions, including decentralized exchanges (DEXs). These tools ensure interoperability and liquidity aggregation within its ecosystem. - Decentralized Autonomous Organization (DAO): Governance of the Injective protocol is overseen by a DAO, allowing community-driven network and protocol updates. - Resistance to Front-Running: Injective employs a frequent batch auction model to prevent front-running, a common issue in decentralized exchanges. - Deflationary Tokenomics: INJ, the native token of Injective, has a deflationary mechanism. 60% of all protocol fees are burned weekly, reducing the token's supply over time. - Use Cases of INJ Token: INJ is used for transaction fee discounts, staking rewards, governance, providing passive income, and incentivizing market makers. Development and Ecosystem: - Development Team: The Injective protocol was developed by Injective Labs, comprising engineers, traders, and operators. The team maintains a relayer interface and offers backend support for the protocol. - Ecosystem Growth: Injective has a rapidly growing ecosystem with projects like Helix, Astroport, and Frontrunner. It also announced a $150M ecosystem initiative to support DeFi developers building on Injective. - Technological Upgrades: Injective has undergone significant upgrades, such as the Injective CosmWasm Mainnet upgrade, which supports smart contracts and automated execution. The upcoming Volan upgrade will introduce sub-second block times and full IBC integration. Injective Chain and Tokenomics: - Chain Details. Injective Chain is a permissionless public blockchain network that operates on a Delegated Proof-of-Stake (DPoS) consensus. - Token Supply: INJ has a maximum supply of 100 million tokens, with various allocations for ecosystem development, community growth, and initial sales. In essence, Injective aims to create a more democratized and efficient financial system through its DeFi-focused blockchain infrastructure and native token INJ.

Aibullz

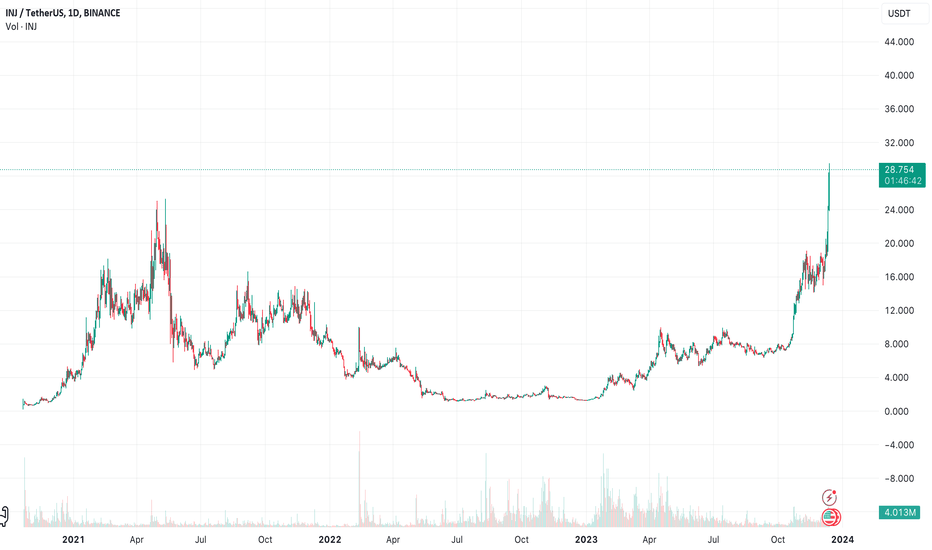

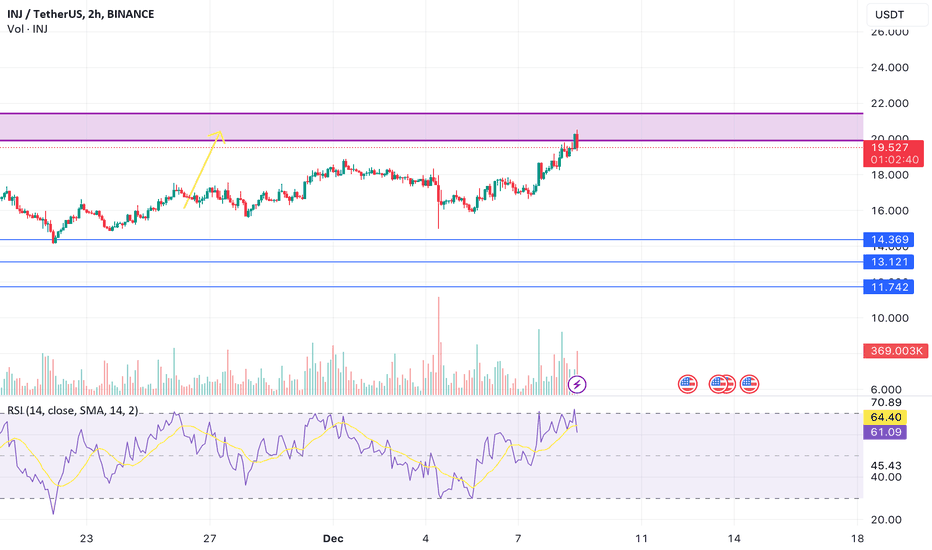

INJUSDT has reached the big resistance level as we predicted short time ago. From here it will retrace and consolidate before a next leg up!

Aibullz

1. Current Trend : Bitcoin is currently experiencing a minor bullish trend, which means its price is gradually increasing. 2. Short-term Price Movement : There is an anticipation of a temporary pullback in Bitcoin's price. This pullback refers to a short-term decline in the price, which is normal in financial markets even during an overall upward trend. 3. Institutional Investment Strategy: The expected pullback is seen as a strategic opportunity for larger investors or institutions. These entities are predicted to buy Bitcoin during this dip in price, with the intention of investing at a lower cost. 4. Impact of SEC's ETF Approval: A key factor in this prediction is the potential approval of a Bitcoin ETF by the Securities and Exchange Commission (SEC). The approval of a Bitcoin ETF would likely lead to increased demand and higher prices, as it would make Bitcoin more accessible and legitimate to a wider range of investors, including those who prefer traditional investment vehicles. 5. Post-ETF Approval Scenario : Assuming the SEC approves the Bitcoin ETF, the prediction is that Bitcoin's price will see a significant increase. This rise would be fueled by the influx of new investors and increased mainstream acceptance. 6. Long-term Outlook: The long-term outlook for Bitcoin, post-ETF approval, is positive. As more institutions and individual investors gain confidence and invest in Bitcoin, its price is expected to stabilize at a higher level than its pre-ETF approval price. In conclusion, this prediction sees a short-term pullback in Bitcoin's price as a strategic buying opportunity for institutions, leading up to a significant rise in value following the potential SEC approval of a Bitcoin ETF. This scenario is contingent on several factors, particularly regulatory developments, and thus carries inherent uncertainty typical of financial market predictions.

Aibullz

This is the bullish scenario for ETH before a crash. Take profit on the purple area, that is big resistance area!!Big resistance here, take profit in this area is a smart choice

Aibullz

INJUSDT will move towards the purple area before a correction. Take profit is within that area! Buy later on the blue lines.

Aibullz

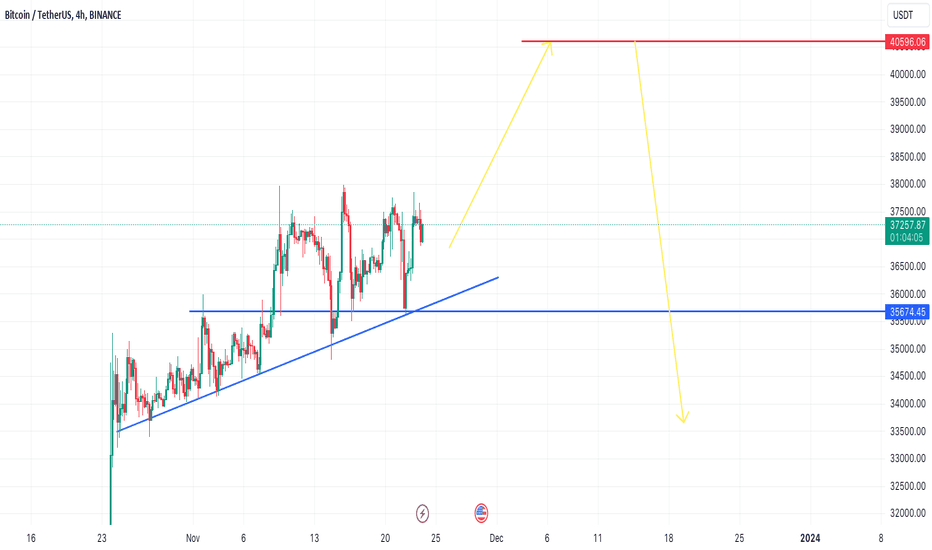

I believe BTCUSDT will touch 40k before new year and the retrace hard below 35k. When BTCUSDT is retracing to 30k-33k , you should start investing for the bull run 2024! Blue lines: Support levels , aka Buy Red line : Resistance level

Aibullz

The price has surges a lot during short time, in these kind of cases, the price will need to retrace. The blue lines are the support levels where you can buy. Take profit between 5%-10%

Aibullz

Buy on blue line, support levels and sell att green line, resistance level. Take profit 1 : 3.3% Take profit 2 : 5.7 %

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.