A3MInvestments

@t_A3MInvestments

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

A3MInvestments

The Fed Funds Rate and Inflation: Understanding the Fed's Stance

The Fed Funds Rate and Inflation: Understanding the Fed's Stance and Investment Implications The Federal Reserve's key interest rate and the official inflation rate are two critical benchmarks for financial markets. Their interplay determines whether monetary policy is accommodative or restrictive and provides clues about its future direction. To assess true financial conditions, analysts focus not on nominal figures but on the difference between them: the real interest rate. Current Key Figures: Nominal Fed Funds Rate: Following the December 2025 cut, the target range is 3.50–3.75%. Official Inflation (PCE): The Fed's primary gauge, the Personal Consumption Expenditures index, is rising at approximately 2.8% year-on-year. The more commonly cited Consumer Price Index (CPI) is slightly higher, at around 3.0%. Calculating the Real Interest Rate: The formula is: Real Interest Rate = Nominal Fed Funds Rate – Inflation. Using the upper bound of the Fed's rate and the PCE index: 3.75% – 2.8% = 0.95%. A positive real rate indicates that the cost of borrowing exceeds the pace of inflation. This acts as a brake on the economy, intended to cool demand and steer inflation back toward the Fed's 2% target. Where is the "Neutral" Rate? The neutral rate (often denoted as r* or "r-star") is the theoretical level of the real interest rate at which monetary policy is neither stimulating nor restricting the economy, allowing for stable growth at full capacity. The Fed's consensus estimates the long-term neutral real rate at approximately 1%. This implies that to achieve a neutral stance, the nominal policy rate should be about 1% above the inflation target (2%), or roughly 3%. Analysis of the Current Stance: The current real rate of ~0.95% is very close to the estimated neutral rate of ~1%. This proximity explains why the Fed recently communicated that its policy stance is nearing neutral. This assessment is reflected in the regulator's projections, which, as of early 2026, signal a more cautious approach, potentially involving only a single rate cut throughout the year. The real interest rate directly influences borrowing costs for businesses and households, thereby shaping the pace of economic growth and asset valuations. Investment Considerations: Policy Shifts: While the current Fed leadership has signaled a pause, a future shift in leadership or a deterioration in economic data could renew a rate-cutting cycle. This would be a tailwind for interest-rate-sensitive sectors like real estate and utilities. Global Divergence: In recent years, while the US maintained relatively high rates, other major central banks were more aggressive in cutting. Since most "Magnificent Seven" companies (excluding Amazon and Microsoft) derive over half their revenue from international markets, this global liquidity provided a significant boost to their earnings, contributing to their historical outperformance. Domestic vs. International Exposure: Small-cap stocks (e.g., Russell 2000 index) are typically focused on the domestic US market. Their performance is therefore more directly tied to US financial conditions. As the real rate moves from restrictive levels toward neutral or accommodative territory, it alleviates pressure on these smaller, often more indebted companies, making it easier for them to service debt and invest. Conclusion: Monitoring the gap between the real Fed Funds rate and the estimated neutral rate provides a powerful framework for gauging monetary policy. For investors, a move toward the "neutral zone" suggests a more favorable environment for domestic-focused companies and small-caps, as lower real rates reduce the burden of net debt and support domestic expansion.

A3MInvestments

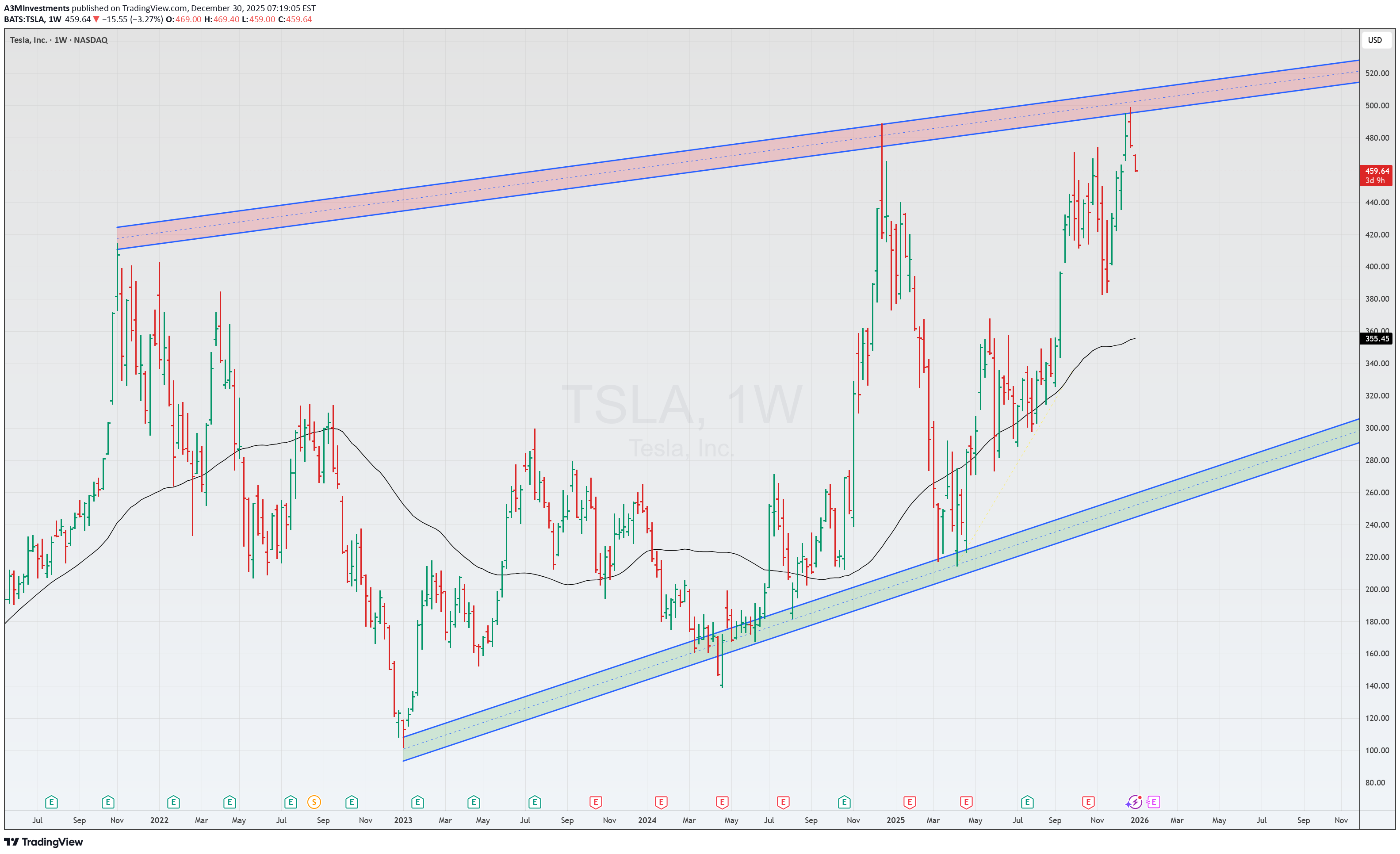

تسلا فقط یک خودروساز نیست؛ راز ارزش نجومی سهام TSLA در هوش مصنوعی و ربوتاکسیهاست!

Tesla: A Bet on AI, Not Just Cars TSLA is no longer just a car manufacturer — it’s a massive bet on AI and Robotaxis. This vision is precisely what keeps the stock at its current valuation. Why is the stock so expensive? The market is pricing in future dominance in two key areas: Robotaxis & AI Wall Street expects 2026 to be the breakout year. Key catalysts: Robotaxi service launch in 30+ US cities. Mass production of Cybercabs starting Spring 2026. Analyst price targets of $600+ are built on these prospects. 🔋 Energy Storage (Megapack) 🔎

A3MInvestments

AAPL

Apple's recent record-breaking stock price may create an illusion of invulnerability. However, serious structural problems are simmering beneath the surface 1. Soaring Memory Prices: A Direct Hit on Margins DRAM and NAND (memory chip) prices have soared 50-300% since the beginning of 2025 due to surging demand from AI servers. 74% of Apple's revenue comes from hardware (iPhone, Mac, iPad), where memory is a critical component of the cost. Analysis indicates that if Apple is forced to purchase memory at market prices, this could impact its gross margin by approximately 4.9%. Long-term contracts with Samsung, SK Hynix, and Micron are currently shielding Apple. Crucially, current preferential DRAM supply agreements expire in December 2025. Samsung and SK Hynix are reportedly planning to significantly raise chip prices for AAPL starting in January 2026. 2. Weak Position in the AI Race and Key Talent Attrition 🔎

A3MInvestments

NVDA

🌎NVIDIA: At the Peak or the Brink? Nvidia's record highs are accompanied by warning signs. A market cap of $4.37 trillion and a P/E ratio of 51 indicate inflated expectations. Risks: Speculative demand: The $23.7 billion investment looks like an artificial market pump. Macro threats: The AI boom will face energy shortages. Historical parallel: The scenario mirrors Cisco's pre-dot-com bubble. Fierce competition: AMD, Intel, and cloud giants are creating their own chips. Growth drivers: Leadership in AI, a closed CUDA ecosystem, and 66% data center revenue growth. Nvidia is a leader, but its shares have become a high-risk asset. Any slowdown in business performance will lead to a collapse in the stock price. The baseline scenario is a broad sideways trend.we'd like to add a little information to post. Everyone is talking about Nvidia's expensive chips for training AI. But the real battle for money and influence has already shifted to another area—inference, or the use of ready-made models. Google and Amazon aren't chasing after more powerful chips than Nvidia. Their goal is to create cheaper and more efficient specialized chips (TPUs, Inference) specifically for running pre-trained models. Why is this important? Scale: The number of AI requests (inference) will far exceed the volume of AI training. Economics: Why pay for a Ferrari (Nvidia chip) when a Toyota (optimized chip for a specific task) will suffice for the daily commute? Nvidia's weak point is price. Hyperscalers are forced to buy Nvidia GPUs for training, but they are doing everything they can to reduce their dependence on them for mass inference. The reason is margins and control. Having their own vertical stack (from their hardware to their cloud) allows Amazon and Google to offer inference at a lower cost. In the long run, their investments in their chips pay off. Nvidia will likely remain the king in training the most complex models. But the gigantic and growing inference market will be fragmented among those who control the infrastructure: cloud platforms with their specialized chips. This threatens Nvidia with the loss of the most valuable part of the market and makes its future revenue less predictable.

A3MInvestments

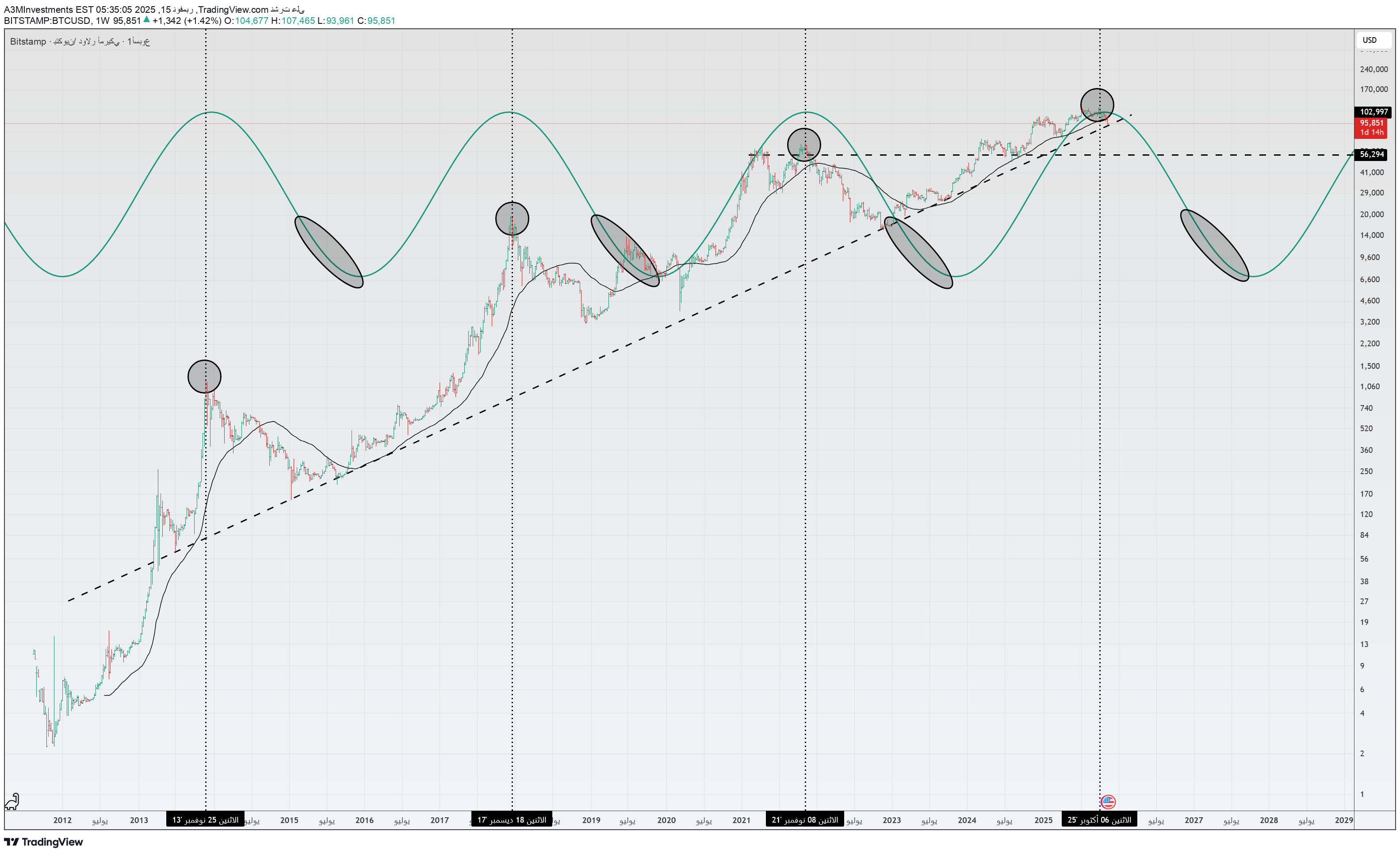

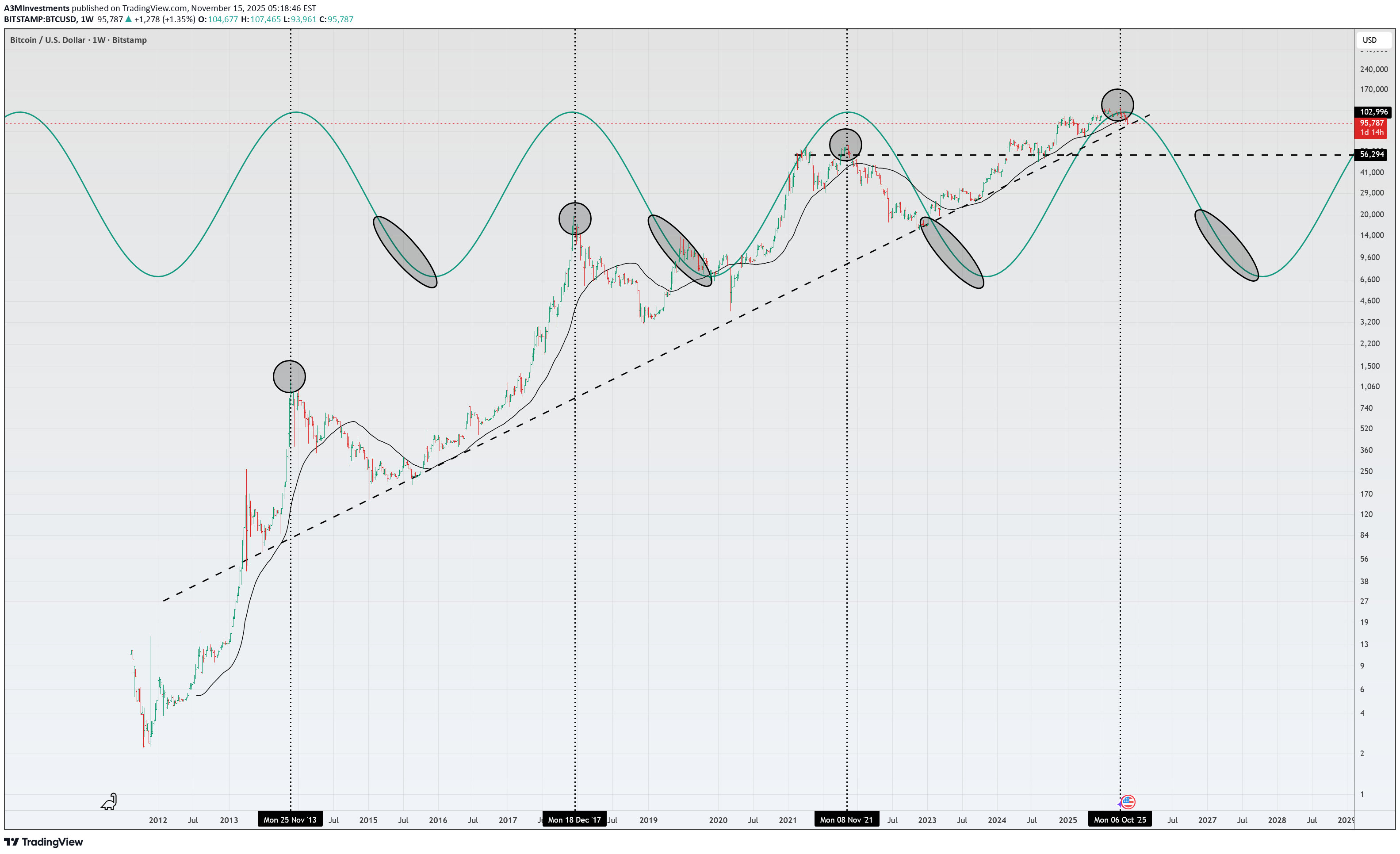

سقوط 75 درصدی بیت کوین در راه است؟ پیشبینی تکاندهنده از آینده BTC/USD

🌎حافظت عملة البیتکوین على أدائها الجید خلال دوراتها لأکثر من عشر سنوات. فی حالات سابقة، عندما بلغت ذروتها فی موجة جیبیة، فقدت أکثر من 75% من قیمتها. من المتوقع حدوث ارتداد قصیر المدى من خط اتجاهها طویل المدى، وهو ما یتوافق أیضًا مع الارتفاع العام المتوقع فی دیسمبر. تُظهر هذه الدورات أن التصحیحات تنتهی قبل أدنى مستویات الموجة الجیبیة، ودائمًا تقریبًا خلال نفس الإطار الزمنی، مما یُشیر إلى أن العام المقبل سیکون صعبًا للغایة على المضاربین على الارتفاع.

A3MInvestments

چرخه ۱۰ ساله بیت کوین: آیا سقوط ۷۵ درصدی در راه است؟

🌎Bitcoin has been holding up very well in cycles for over 10 years. In previous instances, when it peaked in a sine wave, it lost more than 75% of its value from its peak. A short-term rebound from its long-term trendline is expected, and it also fits into the overall Santa Claus rally expected in December. These cycles show that corrections end before the sine wave lows, and almost always within the same timeframe, suggesting that next year will be a very difficult time for bulls.

A3MInvestments

پیشبینی هیجانانگیز بازار SPX آمریکا: موج سوم در راه است؟

🌎The first wave of the current impulse has ended, and we are now in the second. The second wave's target has been met—the gap has been closed. A breakout of 6870 will confirm that we are entering the third wave. This marking fits well with the New Year's rally. Also, the expectation of a Fed rate cut, as well as the end of the shutdown, will support the bullish momentum.

A3MInvestments

مایکرواستراتژی (MSTR): غول بیت کوین با استراتژی مالی جسورانه و ارزش پنهان!

🌎MicroStrategy pioneered the use of Bitcoin as a corporate reserve asset. This strategy transformed MSTR from a traditional technology company into a unique hybrid: a provider of analytics solutions and a publicly traded instrument for indirect exposure to Bitcoin. As of September 2025, the company's reserves totaled 636,505 BTC, equivalent to approximately $70 billion and representing approximately 2.6% of the total Bitcoin supply globally. This makes it the largest corporate holder of Bitcoin. To accumulate this amount, the company employed an aggressive financial strategy, including issuing convertible debt and, more recently, issuing preferred shares. mNAV Premium. One of the most important metrics for MSTR's valuation is mNAV (Multiple on Net Asset Value). It is calculated as the ratio of a company's market capitalization to the dollar value of Bitcoin on its balance sheet. A high mNAV means the market values the company significantly above the value of its Bitcoin reserves, allowing it to attract cheap capital for further acquisitions. Operating revenue remains relatively stable at approximately $463 million. Gross margin over the past 12 months has remained at approximately 70%. Net income is highly volatile due to adjustments for Bitcoin price fluctuations. In 2023, the company reported a net income of $429.1 million, but for 2024, it recorded a loss of -$1.17 billion. OCF -$53.7 million Debt 8.16 B cash 0.05 B Debt can be repaid by selling a portion of the Bitcoin held on the balance sheet.

A3MInvestments

پیشبینی انفجاری DEEPUSDT: راز نقدینگی فوقسریع در شبکه Sui چیست؟

🌎بروتوکول DeepBook هو سجل أوامر لامرکزی (CLOB) یعمل على منصة Sui blockchain. وهو بمثابة طبقة السیولة الأساسیة لنظام التمویل اللامرکزی (DeFi) بأکمله على منصة Sui، حیث یوفر تداولًا عالی السرعة برسوم منخفضة. بفضل Sui وتنفیذها المتوازی للمعاملات، یوفر DeepBook سرعة عالیة (متوسط وقت التسویة حوالی 390 مللی ثانیة) ورسومًا منخفضة جدًا (أقل من 0.01 دولار أمریکی). یُستخدم: 1. لدفع رسوم التداول ورسوم إنشاء المجمعات. 2. لتحفیز السیولة (یحصل مزودو السیولة على مکافآت وخصومات على شکل رموز DEEP). 3. یمکن لحاملی الرموز المشارکة فی حوکمة البروتوکول، مثل التصویت على تغییرات معلمات المجمع. یبلغ الحد الأقصى لعرض الرموز 10 ملیارات DEEP. اعتبارًا من أکتوبر 2025، بلغ عدد الرموز المتداولة حوالی 4.23 ملیار رمز. سیتم إصدار الرموز المتبقیة تدریجیًا على مدى سبع سنوات، بهدف الحفاظ على الاستقرار على المدى الطویل. فی نهایة أبریل 2025، أُدرج رمز DEEP فی عدة منصات تداول. قبل إدراجه بفترة وجیزة، أصدر الفریق تحدیث DeepBook v3.1، والذی تضمن تحسینات مثل إمکانیة إنشاء تجمعات تداول بدون أذونات ورسوم مخفضة. یُعد DeepBook مشروعًا رئیسیًا فی منظومة Sui، التی تشهد نموًا سریعًا. اعتبارًا من أکتوبر 2025، تجاوز حجم التداول الشهری على DeepBook 1.4 ملیار دولار، مما یُظهر الاستخدام الفعلی للبروتوکول. یتم حرق جزء من رسوم التداول (تم حرق أکثر من 80 ملیون رمز حتى الآن)، مما یُقلل تدریجیًا من عرض DEEP المتداول، وقد یدعم السعر.

A3MInvestments

Litecoin (LTC): Dijital Gümüşün Hızlı ve Ucuz Sırları ve Geleceği!

🌎Litecoin (LTC), 2011 yılında Bitcoin'e alternatif olarak oluşturulan merkezi olmayan, eşler arası bir kripto para birimidir. Daha hızlı ve daha ucuz işlemler sağlamak üzere tasarlanmış ve Bitcoin'in "dijital altını"na karşılık "dijital gümüş" olarak konumlanmıştır. Litecoin'in oluşturulmasının temel amacı, Bitcoin'den daha verimli bir anında ödeme ve transfer aracı haline gelmekti. Litecoin, Bitcoin gibi İş Kanıtı (Proof-of-Work) prensibiyle çalışır, ancak Scrypt algoritmasını kullanır. Scrypt algoritması, başlangıçta madenciliği daha merkeziyetsiz hale getirerek özel madencilik donanımlarına (ASIC'ler) karşı koymak için seçilmişti. Scrypt için ASIC'ler zamanla geliştirilmiş olsa da, bu algoritma Bitcoin'de kullanılan SHA-256'dan daha fazla bellek gerektirir. Litecoin ağı, verimi artıran ve anında mikro işlemlere olanak tanıyan Ayrılmış Tanık (SegWit) ve Lightning Ağı gibi önemli yükseltmeleri başarıyla uygulamıştır. Litecoin'in belirtilen maksimum arzı 84 milyon LTC'dir ve bu Bitcoin'den dört kat daha fazladır. Litecoin blok süreleri ve işlemleri Bitcoin'den önemli ölçüde daha hızlı onaylanır. Bu, daha az yoğun bir ağ ile birlikte çok düşük ücretlerle sonuçlanır. LTC kabul eden ve ödeme sistemleriyle entegrasyon sağlayan artan sayıda satıcı (Spend ile ortaklık gibi) Litecoin'in Spend platformuyla (Flexa tarafından SPEDN olarak da bilinir) ortaklığı, Litecoin ve diğer kripto para birimlerinin günlük hayatta kolayca ve anında harcanmasını amaçlayan daha geniş kapsamlı bir entegrasyonun parçasıydı. Bu ortaklık, Litecoin Vakfı, Nexus Cüzdan ve SPEDN uygulamasını işleten Flexa ödeme ağı gibi çeşitli tarafların ortak çalışmasıydı. Ortaklığın zirvesinde, Flexa ağı, çoğunlukla SPEDN ödemelerinin kabul edildiği Kuzey Amerika'da olmak üzere 41.000'den fazla satıcıyı içeriyordu. Bu sistem üzerinden ödeme kabul eden bazı tanınmış şirketler şunlardır: Lowe's, Petco, GameStop, Bed Bath & Beyond, Nordstrom Bu ortaklığın önemi: Dijital para birimini doğrudan gerçek mal ve hizmetlere bağladı. Ayrıca Litecoin'in avantajlarını da açıkça ortaya koydu: hız (blok başına 2,5 dakika) ve düşük ücretler. Bugün SPEDN uygulaması artık mevcut değil, ancak Flexa ödeme ağı çalışmaya ve diğer çözümler geliştirmeye devam ediyor. Litecoin, BitPay (kripto banka kartları ve hediye kartları) gibi diğer hizmetler aracılığıyla veya giderek artan sayıda çevrimiçi ve çevrimdışı satıcıda doğrudan harcama için mevcut olmaya devam ediyor. Yatırım ve ticarette, kripto para birimlerini risk alma/riskten kaçınma rejimine bağlı bir varlık sınıfı olarak ele alıyoruz; ancak tabiri caizse steroid almış gibi ek değişkenliklerle. Şu anda piyasalar risk alma modunda ve birçok faktör altcoin sezonunun başlangıcına işaret ediyor.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.