رضا غنی پور

@g_1180175648

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

رضا غنی پور

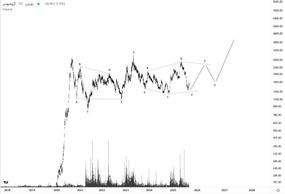

🔍 #Silver 11/10/2025 The previous analysis has grown by 70 % (dollar) and much like the gold chart before the $ 2000 ceiling failure (comparison link). The following is waiting for this scenario for the long run. Make sure that silver sales in Iran are a bit hard and below the price. I also add one point: Silver in its historical root is "hard money", but with a few important differences with gold. Hard money means an asset that has limited supply and hard production, high physical stability and division, and has been accepted for centuries. Throughout history (especially before the 5th century), the world practically worked with a bimetallic state. Gold for international and silver storage and trade for everyday transactions and smaller transactions. The ratio of the historical value of gold to silver was about 1 to 2 (ie ounce of gold ounces of silver). But today this ratio is about 1 to 2, that is, silver is much cheaper than gold. The new annual supply is silver (0.5-5 %) but gold is about (2.5 %). Industrial consumption of gold (1 %) but silver (1 %+). Simple silver is also a hard money, but the "harder industrial money" has a commodity at the same time. If you are looking for classic hard money to save long -term value, gold is the main choice. But if you are looking for an inflationary lever on gold, silver is more attractive; Because when Fiat money is weakened, silver usually grows faster. For example, in the crisis, gold rose from $ 1 to $ 2 ($ 1.2), but silver from $ 1 to $ 2 ($ 1.2). Silver means more profits and profits in inflationary cycles, but it experiences more in recession. In terms of monetary philosophy, it is next to gold, but it is more like a commodity in terms of price behavior. ========================= @Reza_ghanipur

رضا غنی پور

# #And Trade 9-2 September 4-4-4-11 ========================= ☑@Reza_Ghanipur

رضا غنی پور

#2 and 2-2 September 4-4-4-11 ========================= ☑@Reza_Ghanipur

رضا غنی پور

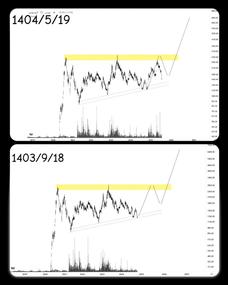

# #Khabah 4-2 September 4-4-4-11 Give a further explanation about it. The previous analysis that I was raised in December last year came to the target (ie 80 % growth and 40 % later). But it changed a bit. I would probably be a bit more complicated to break the previous ceiling (top scenario). Of course, there was no change in the new entry price, which was 130. ========================= ☑@Reza_Ghanipur

رضا غنی پور

🔍 #Ahabar 20 September 1404 I was reporting to the last analysis that was three years ago. The low level of risk has not changed and has shown a positive reaction three times. I think the scenario is likely. ========================= ☑@Reza_Ghanipur

رضا غنی پور

🔍 #Topko 18 September 1404 ========================= ☑@Reza_Ghanipur

رضا غنی پور

# #Khabaman 0-2 August 4-0-4-4-11 ========================= ☑@Reza_Ghanipur

رضا غنی پور

# #Thawad 16 August 1404 ========================= ☑@Reza_Ghanipur

رضا غنی پور

# #14 August 1404 ========================= ☑@Reza_Ghanipur

رضا غنی پور

Gold has the best performance in the current century among the main assets, and even modified with inflation is on its roof. The inflation calculation formula never shows you real inflation. I think the best criterion is gold and guarantees your purchasing power. I have always suggested to friends to try to buy gold stairs for 30 to 70 percent of their capital (depending on risk taking). ========================= ☑@Reza_Ghanipur

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.