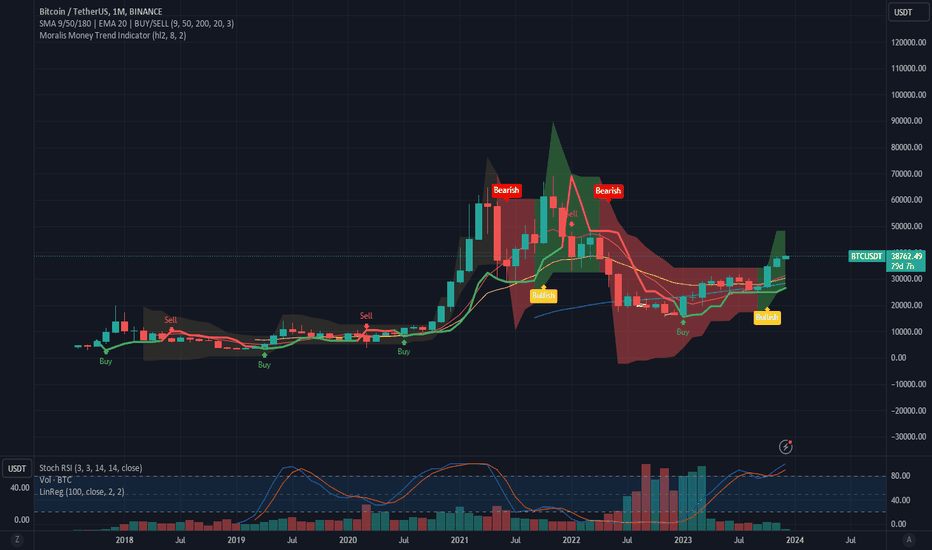

Technical analysis by theotzusound about Symbol BTC: Buy recommendation (12/2/2023)

theotzusound

Upon examining the monthly BTC/USDT chart, it's evident that Bitcoin is exhibiting a bullish posture. The Moralis Money Line, which serves as a dynamic support and resistance indicator, has been decisively broken to the upside. This break is characterized by a candle closing above the line with increased volume, indicating a strong buyer presence. Supporting this bullish outlook, we see the convergence of multiple indicators: The 9-period SMA has crossed above the longer-term 50 and 180 SMAs, a classic bullish signal. The price is positioned above the 20-period EMA, reinforcing the strength of the upward trend. The Ichimoku Cloud is transitioning from red to green, suggesting a shift in market sentiment from bearish to bullish. The Stochastic RSI has reset from the overbought territory and is now ascending, indicating that there is room for upward momentum. Taking into account these factors, the bullish scenario is further bolstered by a higher low pattern forming over the past months, building a solid base for potential upward movement. Trade Idea: Entry Point: A retest of the Moralis Money Line as new support, which aligns with the 20-period EMA. Profit Targets: The first target is set at the recent swing high. Subsequent targets should align with key psychological levels and Fibonacci extensions. Stop Loss: A conservative stop loss is placed just below the recent swing low, allowing for market volatility while safeguarding the capital. Risks: While the bullish scenario is strong, it's important to consider potential risks such as regulatory news or macroeconomic shifts that could impact market sentiment. Always manage risk according to your trading plan and adjust positions accordingly. Remember, while historical data can inform predictions, the cryptocurrency market's volatility requires constant vigilance and flexibility in strategy. Not financial advice.