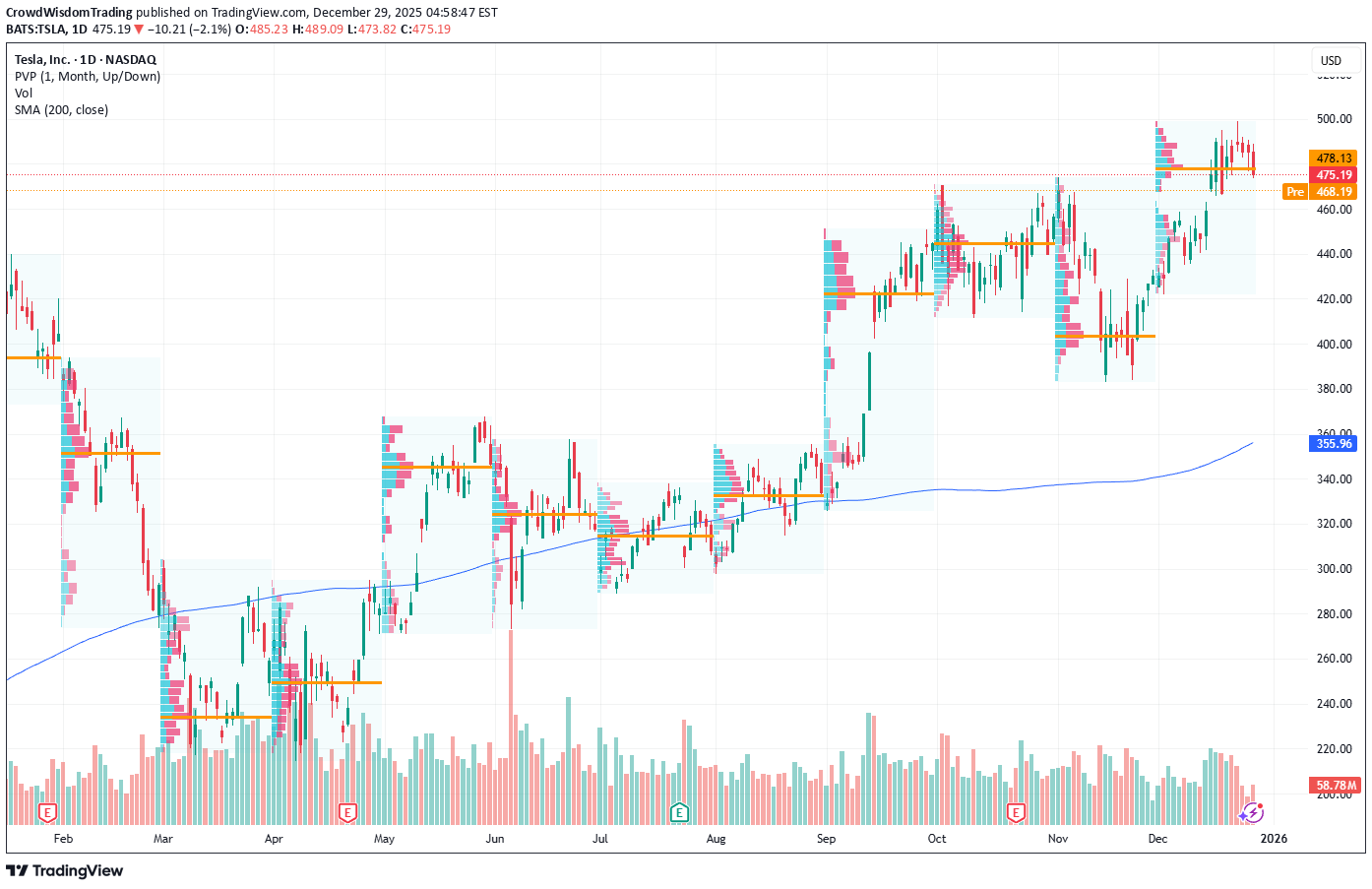

Technical analysis by CrowdWisdomTrading about Symbol TSLAX: Sell recommendation (12/29/2025)

Tesla near key support as traders warn of further downside this

Current Price: $475.19 Direction: SHORT Confidence Level: 58% (Several professional traders are aligned on short-term weakness with repeated downside levels mentioned, while X sentiment is mixed but not strong enough to offset the bearish technical tone.) Targets: - T1 = $466 - T2 = $458 Stop Levels: - S1 = $481 - S2 = $488 **Wisdom of Professional Traders:** This analysis pulls together the collective thinking of several professional traders and market experts who are actively trading Tesla. I’m leaning heavily on crowd wisdom here because many different traders are pointing to the same downside risk levels. When multiple independent traders highlight identical support and breakdown zones, that consensus usually matters more than any single opinion. **Key Insights:** Here’s what’s driving this setup. Across the professional trader analysis, Tesla is repeatedly described as being in a multi‑day pullback below former resistance. Several traders emphasized that as long as price stays below the 481–488 zone, downside pressure remains the dominant force. Levels like 470, 466, and even the high‑450s came up again and again as potential downside magnets. What really stands out to me is how often traders warned that a daily close below the 470–466 area opens the door to acceleration lower. Even traders who are constructive on Tesla longer term are openly hedging or staying cautious this week. That tells me short‑term control is still with sellers, not buyers. **Recent Performance:** Tesla just pulled back from the 498 area and has struggled to hold momentum since. Over the last week, price has slipped under short‑term moving averages and failed multiple rebound attempts near 480. Volume picked up on down days, which lines up with traders flagging distribution rather than healthy consolidation. **Expert Analysis:** When I look at the collective trader commentary, the message is consistent. Several traders described Tesla as making lower highs, with momentum indicators rolling over and MACD pressure building. Many pointed out 472 and 470 as critical near‑term supports, saying a failure there could quickly lead into the mid‑460s. At the same time, upside levels were also clearly defined. Multiple traders said Tesla must reclaim 481 first, and ideally 488, to invalidate the short‑term bearish structure. Until that happens, rallies are being treated as selling opportunities by the trading community. **News Impact:** Recent news isn’t helping the short‑term case. Ongoing attention around quality investigations and cautious delivery expectations has added a layer of headline risk. On top of that, broader market hesitation has made high‑beta names like Tesla more vulnerable to pullbacks. Traders clearly see these headlines as reasons to stay defensive in the near term. **Trading Recommendation:** Putting it all together, I’m favoring a SHORT position on Tesla for this week. As long as price stays below 481, I expect pressure toward 466 first, with a stretch target near 458 if support fails. I’d cut this idea if Tesla reclaims 481 and fully invalidate it above 488. This is a tactical, short‑term trade based on trader consensus around weakening structure, not a long‑term call on Tesla’s business.