Technical analysis by SMC-Trading-Point about Symbol PAXG: Buy recommendation (12/28/2025)

SMC-Trading-Point

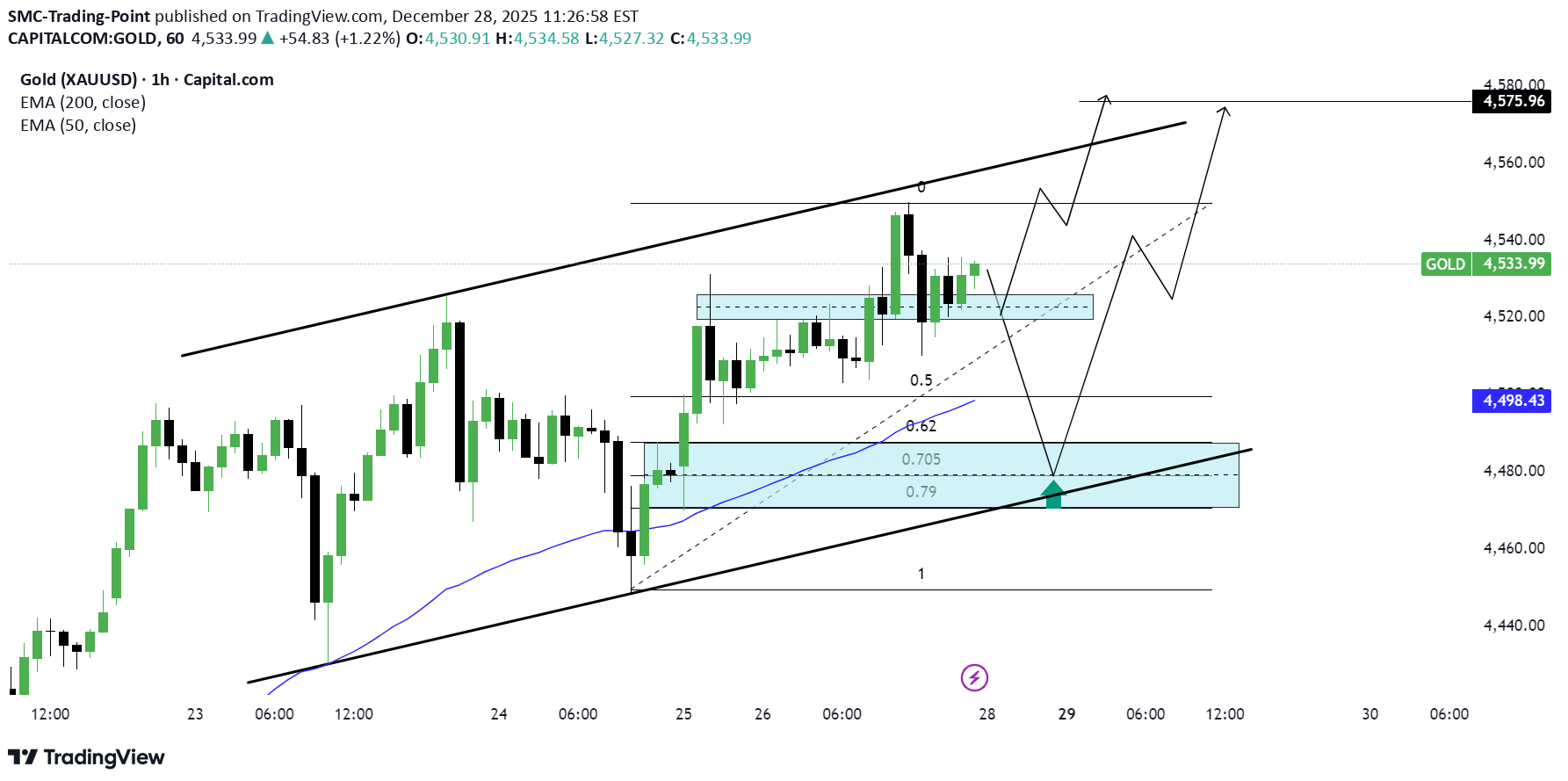

XAU/USD)Bullish trend analysis Read The caption

SMC Trading point update Technical analysis of XAUUSD (Gold) – 1H chart using SMC + Fibonacci OTE + trend-channel continuation. ⸻ Market Context • Bias: Bullish continuation • Price is respecting a well-defined ascending channel • Market structure remains higher highs & higher lows • EMAs: • EMA 50 above EMA 200 • EMA 50 acting as dynamic support • Recent consolidation near highs = absorption, not reversal ⸻ What Price Is Doing • After the impulsive rally, price paused at internal resistance • This pause is forming a controlled pullback • The projected path shows a dip into discount → continuation higher This is classic trend continuation behavior. ⸻ Key Buy Zone (Lower Blue Area) ~4,475 – 4,495 Strong confluence here: • SMC demand / order block • Fib OTE zone (0.705 – 0.79) • EMA 50 support (~4,498) • Rising channel support • Clear reaction point (green arrow) This is the high-probability long zone, not the current price. ⸻ Fibonacci Logic Measured from the impulse low → recent high: • 0.5 / 0.62 = shallow retracement • 0.705 – 0.79 = optimal trade entry (OTE) Institutions typically rebalance longs here in an uptrend ⸻ Trade Idea (Continuation Long) Buy on confirmation inside demand • Entry: 4,475 – 4,495 • Stop Loss: Below demand & channel (~4,455) • Targets: • TP1: 4,535 (recent high) • TP2: 4,560 • Final TP: 4,575 – 4,580 (marked target / upper channel liquidity) Risk–Reward: ~1:3 or better ⸻ Confirmation Triggers (Important) Only execute if you see: • Bullish engulfing or strong rejection wick from the zone • Lower-timeframe CHoCH • Failure to accept below the OTE zone • Momentum expansion after tapping demand ⸻ Invalidation • 1H close below ~4,455 • Acceptance below channel support + EMA 50 If this occurs → bullish continuation idea is invalid, and price may rotate deeper. ⸻Mr smc Trading point Summary This setup is a textbook bullish pullback: • Trend intact • OTE + demand + EMA confluence • Clear upside liquidity target Key edge: wait for price to come discount and confirm buyers, don’t chase highs. Please support boost this analysis