Technical analysis by TheSignalyst about Symbol BTC on 12/24/2025

TheSignalyst

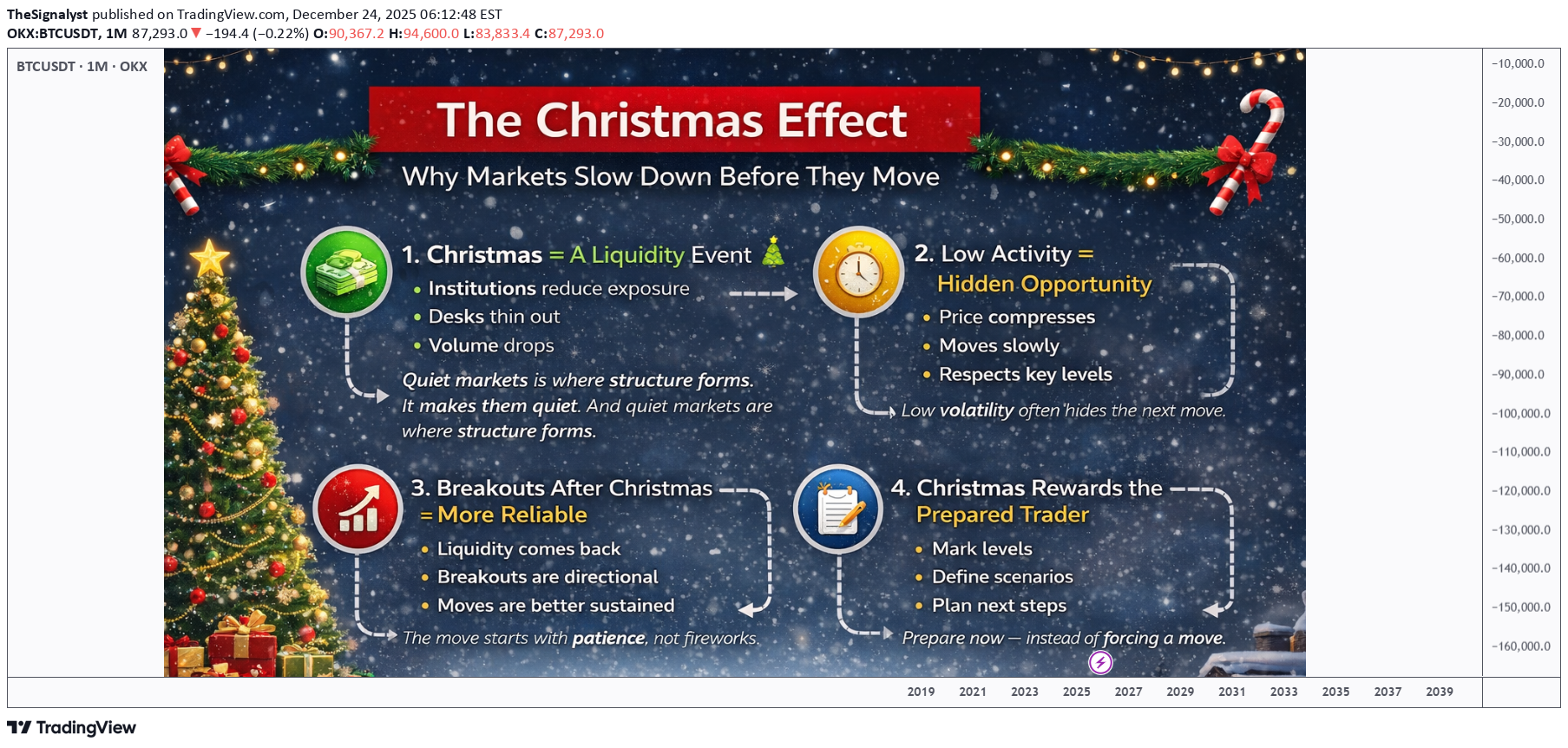

The Christmas Effect: Why Markets Slow Down Before They Move

Every December, traders ask the same question: Will we get a Christmas rally? But the real lesson Christmas teaches the market isn’t about rallies. It’s about behavior. 1️⃣ Christmas Is a Liquidity Event 🎄 As the year comes to an end: - institutions reduce exposure - desks thin out - volume drops - participation becomes selective This doesn’t make markets weak. It makes them quiet . And quiet markets are where structure forms. 2️⃣ Low Activity Doesn’t Mean No Opportunity During Christmas weeks, price often: - compresses - ranges tightly - respects key levels - moves slowly Many traders mistake this for boredom. Professionals see it differently. Low-volatility environments often act like wrapping paper... they hide the move that comes after the holidays. 3️⃣ Why Breakouts After Christmas Matter More When markets return to full participation in January, two things happen: - liquidity comes back - intent becomes clear That’s why post-Christmas breakouts tend to be: - cleaner - more directional - better sustained The move doesn’t start with fireworks. It starts with patience. 4️⃣ Christmas Rewards the Prepared Trader While most traders look for action, experienced ones: - mark levels - define scenarios - reduce overtrading - protect capital Christmas is not about forcing trades. It’s about preparing for the next chapter. Final Thought 🎄 The market doesn’t move because it’s Christmas. It moves because participants return. And the traders who respect the quiet season are usually the ones best positioned when the noise comes back. So here’s the question: Are you trying to trade Christmas… or preparing for what comes after it? ⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly. 📚 Stick to your trading plan regarding entries, risk, and management. Good luck! 🍀 All Strategies Are Good; If Managed Properly! ~Richard Nasr