Technical analysis by EconomicanalysAbdulRahman about Symbol PAXG: Buy recommendation (12/23/2025)

EconomicanalysAbdulRahman

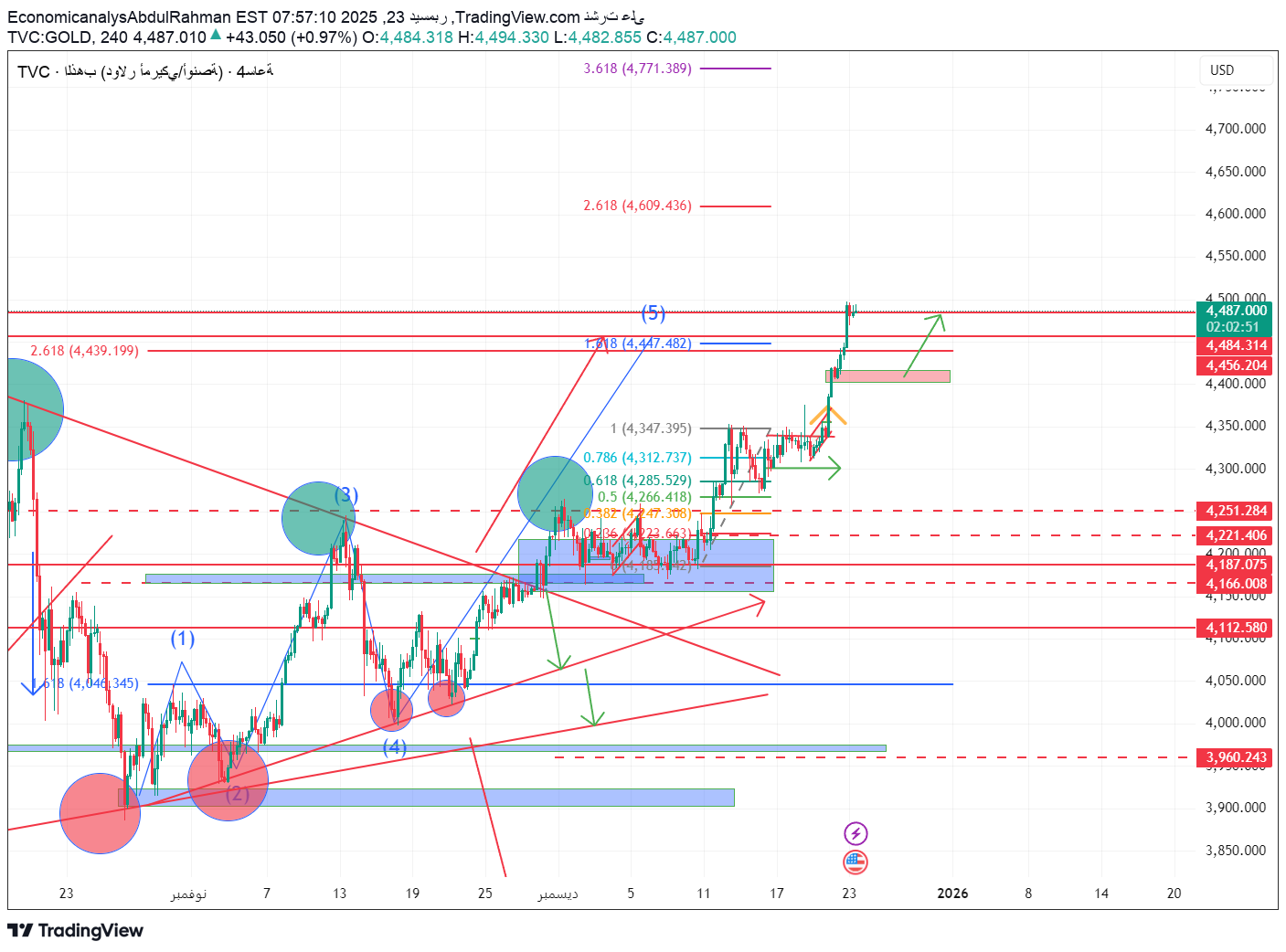

4490 ليست النهاية!| قراءة جريئة لمستقبل الذهب بعد القمة التاريخي

📊 Comprehensive gold analysis | The fifth wave is complete and eyes are turning to 2026 📅 Date: December 23, 2025 📈 Instrument: Gold XAUUSD ⏱ Time frame: 4 hours/daily 🔴The bigger picture – what happened? Gold ended a historic upward journey that started from areas below 4000, and recovered all of its previous losses, reaching today approximately $4490, achieving: ✔️ Completion of the fifth wave (Wave 5) according to Elliott’s theory ✔️ Breaking successive historical peaks without deep corrections ✔️ Strong purchasing momentum supported by technical and fundamental factors But...here begins the most dangerous stage. 🧠 Advanced technical analysis 🔹 Elliott and Fibonacci: Wave (5) is completed near: 1.618 – 2.618 Fibonacci The price is approaching a historical overbought zone 🔹 Current resistance areas: 4490 – 4505 → Immediate resistance 4560 – 4600 → Powerful display area 4700 – 4750 → Stretch target in case of abnormal momentum 🔹 Important support areas: 4475 – 4445 → first support (breakout/confirmation area) 4350 – 4300 → Structural support 4180 – 4120 → Axial support 3960 – 3900 → Long-term strategic support 🔄 Expected scenarios (from now until the beginning of 2026) 🟢 Positive scenario (continuation of the rise): Price stability above 4470 A quick retest then: 🎯 4560 🎯 4700 (speculative extension) This scenario needs: Dollar weakness Escalating economic/geopolitical risks 🔴 Likely scenario (health correction): Failed to hold above 4500 Gradual correction towards: 4350 Then 4180 – 4120 This patch: It is not a reflection Rather, it will regroup before a new wave in 2026 🧭 Projection of the movement to the beginning of 2026 If A-B-C correction is complete: We expect a new momentum wave that may target: 4800 Then 5200 in the medium term Gold historically: He ends the year with momentum The new year begins with a violent movement 🪙 Important tips for traders and holders of physical gold 🔹 Speculators: No chasing to buy at the tops Sell only with confirmation signals Strict capital management 🔹 Investors and Physics: Any correction is a buying opportunity Gold is still a protection asset, not just speculation 🧨 Conclusion Gold does not move in vain... What we are witnessing now is a repricing of the financial system. The current peaks may not be the end, But it is certainly a turning point before a new phase in 2026. 📌 Monitor price behavior... not just price