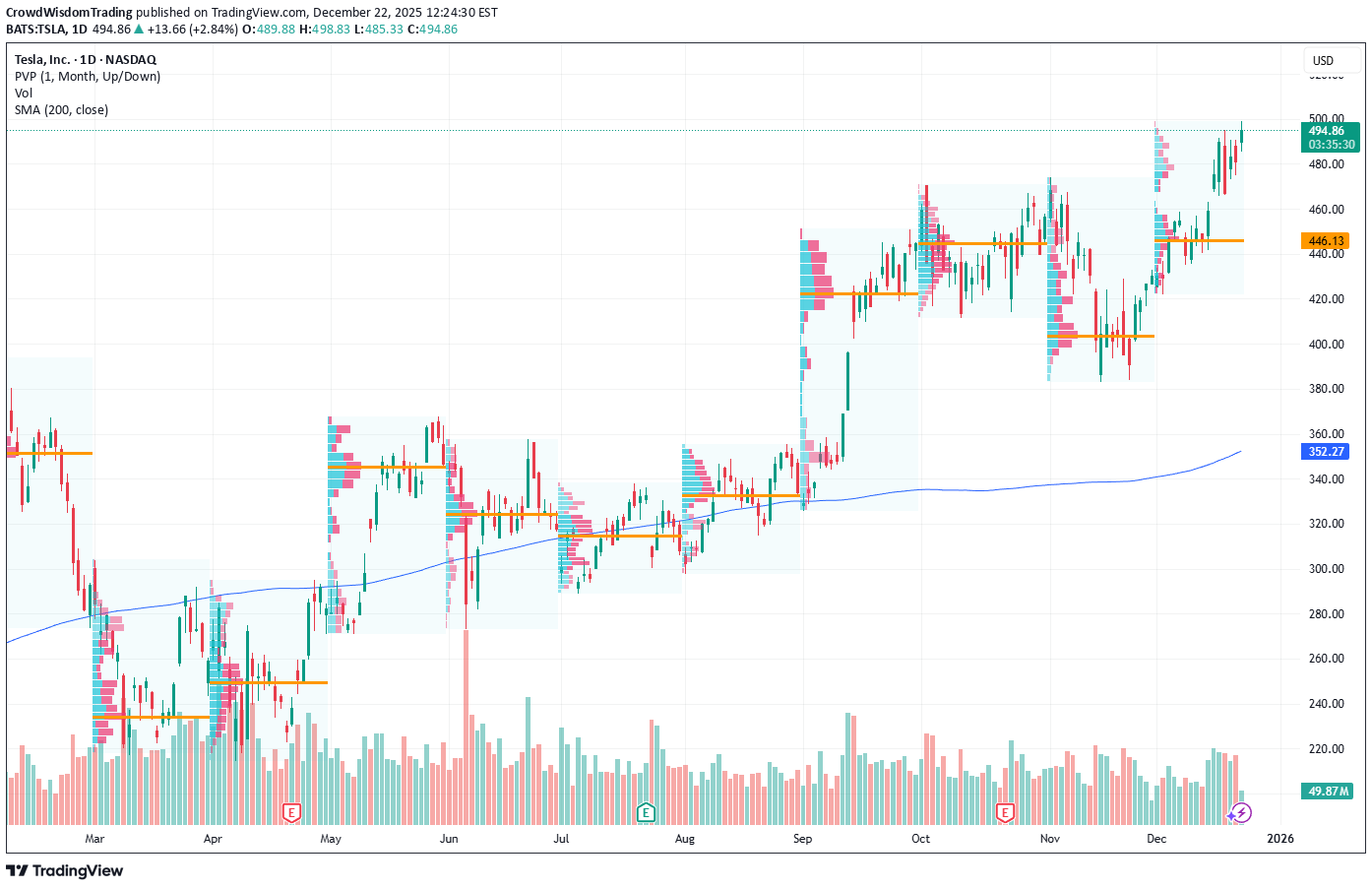

Technical analysis by CrowdWisdomTrading about Symbol TSLAX: Buy recommendation (12/22/2025)

Tesla coils near record highs with traders targeting a $500 brea

Current Price: $481.2 Direction: LONG CRITICAL: You MUST choose either LONG or SHORT. NEUTRAL is FORBIDDEN and will cause your post to be rejected. Confidence Level: 68% (Based on strong alignment across professional traders repeatedly highlighting bullish momentum, breakout patterns, and $500+ targets, with only limited short‑term caution) Targets: - T1 = $495 - T2 = $520 Stop Levels: - S1 = $468 - S2 = $450 **Wisdom of Professional Traders:** This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high‑probability trade setups. When I step back and look at the trader consensus around Tesla, the message is pretty clear: most professional traders are positioning for continuation higher, not a breakdown. Across dozens of trader analyses, Tesla is repeatedly described as bullish, coiled, and ready for another leg up, with $500 acting as the key psychological magnet. **Key Insights:** Here’s what’s really driving this setup. Several professional traders are pointing to Tesla’s tight consolidation just under all‑time highs as a classic continuation pattern. Pennants, bull flags, and coiled price structure came up again and again, with traders stressing that repeated holding above the $470–$475 zone keeps the bullish structure intact. That’s a strong message. When price refuses to break down despite heavy attention, it usually means supply is getting absorbed. Another factor that stood out is how often traders mentioned $500 as a near‑term objective, not a distant dream. This level was referenced across many different analyses, often with follow‑through targets at $520 once $500 is cleared. A few traders even highlighted aggressive call flow and gamma exposure around $500, which tends to act like a price magnet if momentum stays intact. That kind of reinforcement across technicals and options positioning adds weight to the bullish case this week. **Recent Performance:** You can see this play out clearly in the price action. Tesla has climbed aggressively over the past month, pushing from the low $430s into the high $480s, while printing multiple record highs along the way. Instead of selling off hard after those highs, the stock has gone into orderly consolidation, holding gains and grinding sideways near the top. That’s usually the behavior you see before continuation, not before major breakdowns. **Expert Analysis:** Professional traders I’m tracking keep coming back to two key levels: support in the $468–$475 zone and upside pressure toward $500. Many traders noted that even brief dips toward the mid‑$470s have been bought quickly, which tells me buyers are still in control. A few traders did mention that Tesla can be volatile and emotional, but even those voices framed pullbacks as buying opportunities rather than trend reversals. What’s also interesting is that several traders explicitly warned against fighting this momentum. Phrases like “don’t short this until structure breaks” and “greater risk is missing upside” showed up more than once. When trader wisdom consistently leans that way, I prefer to respect it, even if the stock feels extended. **News Impact:** On the news side, optimism around autonomy, robo‑taxis, and Tesla’s expanding energy business continues to support the narrative. While EV sales growth is no longer the headline driver, traders are clearly pricing Tesla as a future‑focused AI, robotics, and energy platform. Positive macro tone, falling volatility, and strong tech sector momentum are also acting as tailwinds for high‑beta leaders like Tesla this week. **Trading Recommendation:** Putting it all together, I’m staying LONG on Tesla. As long as price holds above $468, the structure favors a push into the $495 area, with a realistic shot at $520 if $500 breaks cleanly. I’d manage risk tightly below $468 and step aside if $450 gives way, but until then, the collective wisdom of professional traders says the path of least resistance is still higher.