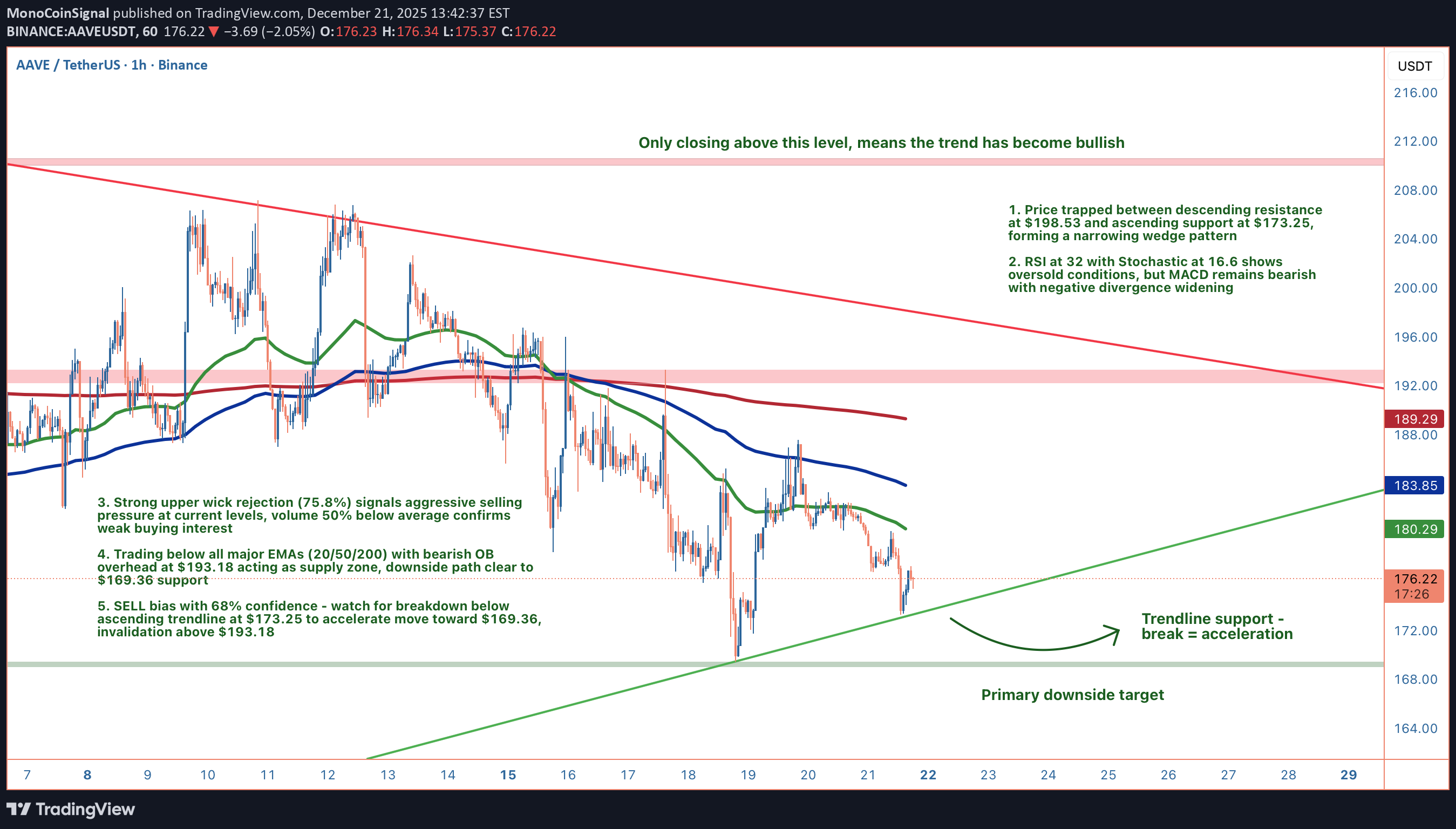

Technical analysis by MonoCoinSignal about Symbol AAVE: Sell recommendation (12/21/2025)

MonoCoinSignal

AAVE: The Squeeze Is On

We're watching a textbook compression pattern on AAVE—price trapped between ascending support at $173.25 and descending resistance at $198.53. These narrowing wedges don't last forever. The question isn't if it breaks, it's which direction and how violently. Current price: $175.48. 1. THE TECHNICAL REALITY 📉 • Wedge Compression: Ascending support at $173.25 (4 touches from $80.01) vs descending resistance at $198.53 (8 touches from $237.08) • Trend Structure: Trading below all three major EMAs (20/50/200)—path of least resistance is down • Rejection Signal: Massive 75.8% upper wick shows aggressive selling pressure defending higher prices • Volume Context: 50% below average ($51k vs $101k)—no conviction behind bounce attempts 2. THE INDICATORS ⚖️ Bearish Signals: • MACD bearish and diverging further negative (-1.98 vs -1.70 signal) • ADX at 30.3 confirms moderate trend strength pointing south • Bearish order block overhead at $193.18-$186.41 acting as supply ceiling • Lower high structure with deteriorating momentum Bullish Signals: • RSI at 32 screaming oversold • Stochastic at 16.6 in extreme territory • Ascending trendline at $173.25 has held for months The Conflict: We're oversold, but oversold can stay oversold in a trending market. Weak volume means any bounce lacks conviction. The trendline is the last line of defense. 3. THE TRADE SETUP 🎯 🔴 Scenario A: Breakdown (Primary Path - 68% Confidence) • Trigger: Rejection at $177-$179 zone (EMA20 resistance) • Entry: Break below ascending trendline at $173.25 • Target 1: $169.36 (swing low + bullish OB top) • Target 2: $162.19 (strong support low) • Stop: 4H close above $193.18 • R/R: ~1:0.5 on first target, but probability-weighted favorable 🟢 Scenario B: Bullish Reversal (Alternative) • Trigger: 4H close above $193.18 (flips bearish OB to support) • Entry: Retest of $193.18 as support with volume confirmation • Target: $210.36 (bullish change of character) • Invalidation: Failure to hold $193.18 on retest MY VERDICT The higher probability play is watching for breakdown below $173.25 and riding it toward $169.36. We've got alignment—bearish structure, deteriorating momentum, weak volume, rejection wicks. But that ascending trendline is the make-or-break level. If it holds with a volume spike, I'd reassess quickly. Until then, the setup favors the downside. Are you fading this oversold condition or playing the breakdown? What's your read on that $173.25 trendline?Played out exactly as predicted.