Technical analysis by DECRYPTERS about Symbol PAXG on 12/19/2025

DECRYPTERS

Gold Holds Near Record Highs as Rate Cuts & Geopolitics Support

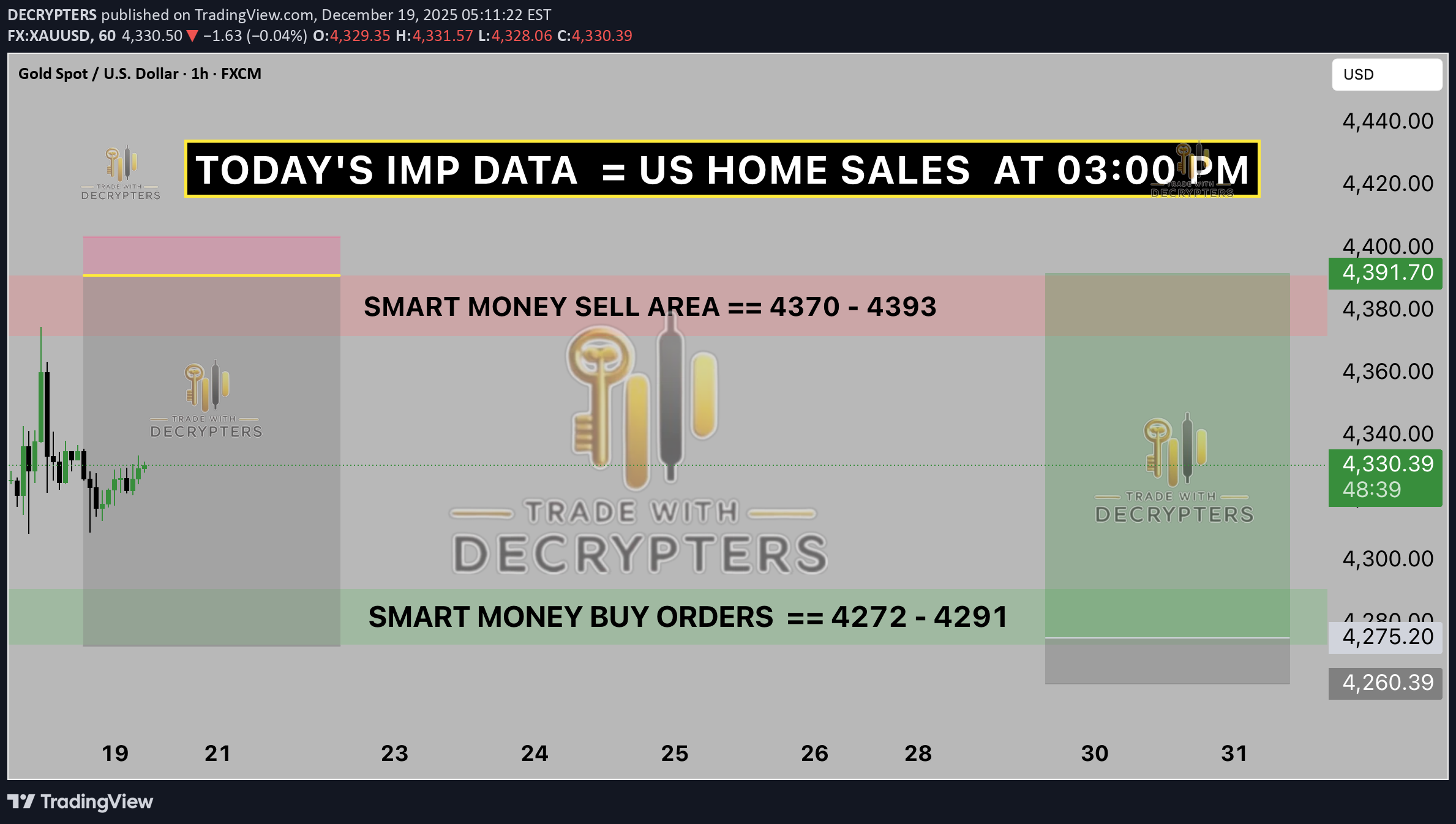

XAUUSD GOLD ANALYSIS Global Uncertainty and Rate Cuts Keep Gold Firm Near Record Highs (December 19, 2025) Welcome back to Trade with DECRYPTERS 🔍📈 Market Overview 📊 Gold prices were volatile on December 18, 2025, but ultimately closed slightly lower, with XAU/USD trading between roughly $4,301 and $4,348 before settling near the $4,323–$4,333 area. A bullish attempt toward prior record highs was rejected, yet the pullback lacked strong bearish momentum, signaling healthy consolidation rather than trend weakness. Geopolitical tensions, including U.S. actions on Venezuelan oil and ongoing Russia Ukraine risks, continued to provide underlying safe haven support. Conclusion 🧭 Gold remains firmly positioned in a structural bull market, consolidating near record highs above $4,300 while showing no signs of a major trend reversal. Supportive fundamentals such as lower interest rates, subdued real yields, strong central bank accumulation, and resilient investor demand continue to underpin prices. Ongoing geopolitical tensions and trade uncertainties reinforce gold’s role as a core safe haven asset despite periods of risk on sentiment in equities. While short term consolidation may persist due to profit taking and stable volatility, downside pressure remains limited. Key Fundamentals 🔑 📈 Price & Trend Gold consolidating near record highs at ~$4,325–$4,327; up over 60% YTD, bullish structure intact. 🏦 Fed Policy & Rates Strongly bullish December 25 bps rate cut to 3.5–3.75%; further easing priced for 2026 as labor market cools. 🏛️ Central Bank Buying Very strong support approximately 634 tonnes YTD, led by Poland, Kazakhstan, Brazil; reserve diversification continues despite high prices. 🌍 Geopolitics Supportive Venezuela oil tensions, Russia Ukraine stalemate, Middle East risks, and trade uncertainty drive safe haven demand. 💵 US Dollar Mixed to negative broader USD weakness supports gold; recent dollar resilience limits upside short term. 📊 Investor Demand Positive strong ETF inflows; combined investor and central bank demand near 980t in Q3 up 50% YoY. 🔥 Inflation & Macro Risk Bullish debt expansion, inflation persistence, and stagflation risks keep gold attractive. 💍 Jewelry Demand Mild drag down approximately 34% in key markets due to high prices, but outweighed by investment demand. The delayed U.S. CPI release added short term caution, though softer inflation reinforced expectations of potential Federal Reserve rate cuts in 2026. Geo Politics 🌐 🛢️ US Venezuela Oil Blockade Strongly bullish aggressive US enforcement, tanker seizures, and military presence heighten energy risks and sanctions uncertainty, boosting safe haven demand. ⚔️ Russia Ukraine War Stalemate Bullish prolonged conflict with no meaningful diplomatic progress sustains geopolitical risk and supports gold. 🌏 US China Trade Tensions Positive renewed tariff threats and trade war rhetoric increase global economic uncertainty, favoring gold as a hedge. 🔥 Middle East Conflicts Mildly positive reduced escalation versus mid 2025, but ongoing regional instability keeps baseline safe haven support intact. Risk On Risk Off Analysis 🔄 US Treasury Yields 📉 2Y approximately 3.8–4.0% stable reflects near term Fed outlook 10Y approximately 4.12–4.14% slightly lower supportive for gold 30Y approximately 4.8–4.9% mild easing on growth caution Yield Impact on Gold ✨ Lower and range bound yields reduce opportunity cost of holding gold Subdued real yields remain a key tailwind Equities Risk On Tone 📈 S&P 500 approximately 6,775 up 0.8% Nasdaq approximately 23,006 up 1.4% Equity strength competes for flows, capping gold upside short term US Dollar DXY 💵 Approximately 98.4–98.5 weak YTD with mild rebound Overall USD weakness remains supportive for gold Volatility VIX 📊 Approximately 16.9–17.4 low and complacent Limits near term safe haven demand Cross Market View 🔎 Bonds up yields down bullish for gold Stocks and gold rising together in 2025 due to lower rates Risk on favors consolidation, not reversal Key Insights From Credible Sources 📚 Gold and silver strengthened as expectations grew for much lower interest rates, with political pressure favoring aggressive easing toward 1%, reducing gold’s opportunity cost. Ongoing rate cuts, Fed pressure, and fiscal stress are seen as structurally bullish for precious metals into 2026. Tariffs and trade tensions continue to fuel safe haven demand, reinforcing gold’s role as a hedge against economic and currency instability. Central bank and BRICS gold accumulation is viewed as strategic protection against de dollarization risks and trade wars. 🙌 Support the Analysis 👍 Like the post 💬 Comment your key levels 📈 Share your charts with the community Let’s grow together 🚀 Best Regards M. Moiz Khattak Founder 🟡 TRADE WITH DECRYPTERS 📊