Technical analysis by EconomicanalysAbdulRahman about Symbol PAXG on 12/18/2025

EconomicanalysAbdulRahman

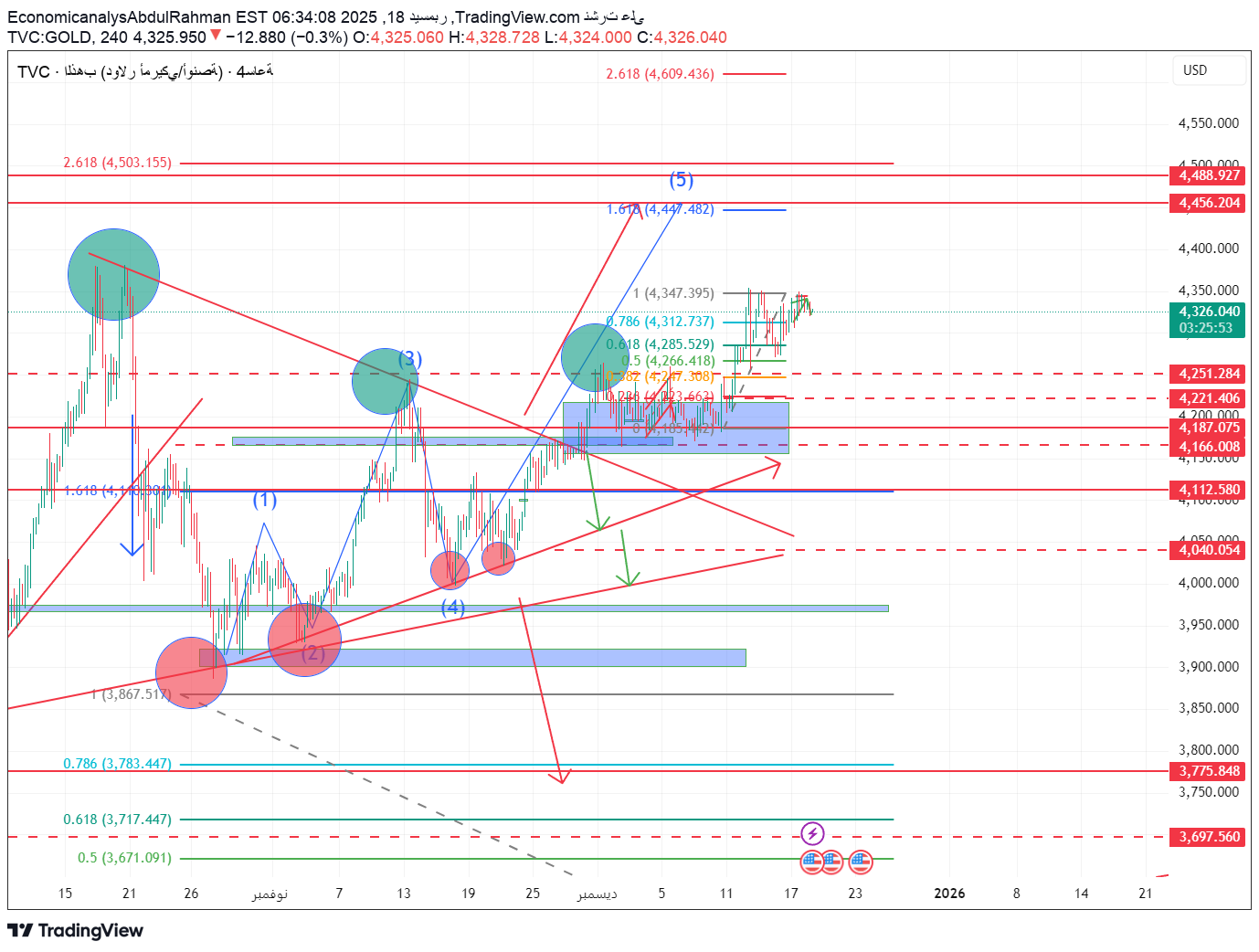

السوق يحبس أنفاسه: الذهب أمام اختبار مصيري اليوم

🔍 XAUUSD gold analysis today – Thursday, December 18, 2025 Will gold continue to rise or are we witnessing a correction with the US CPI inflation data? During the recent sessions, gold witnessed a strong recovery and succeeded in recovering all of its previous losses, confirming once again that any decline is still met with clear purchasing demand. The current movement shows that gold is moving within a medium-term upward trend, with natural fluctuation resulting from the markets waiting for the US CPI data for November, which will have a direct impact during the American period. 📈 General trend and price behavior The general trend on the 4-hour time frame: bullish Price lows are constantly rising Price keeps trading above key demand areas The current move represents a consolidation below important resistance and is not a signal of weakness Stability above the 4185 – 4220 area reinforces the positive scenario, and confirms that any decline currently is merely a correction within the upward trend. 🟢 Potential Buy Zones Zone One – Corrective Buying: 4250 – 4220 Strong horizontal support Convergence with Fibonacci levels 0.382 – 0.236 Suitable for daily and speculative trading Zone 2 – Stronger Buy: 4185 – 4165 Clear demand zone on the chart Suitable for swing contracts Third Zone – Investment Purchase / Viscal: 4040 – 4000 Long-term structural support Only breaking this area changes the positive outlook 🔴Sell and profit-taking zones (Sell / TP Zones) 4347 → Nearby resistance and current peak 4447 – 4456 → Fibonacci extension 1.618 4488 – 4503 → Strong historical resistance It is preferable to take partial profits and not sell completely as long as the price is above the main support areas. 🎯 Expected goals if the rise continues In the event of a clear breakthrough and higher stability 4347: First target: 4447 Second goal: 4488 Third goal (extended): 4503 - 4600 later Reaching 4,500 levels before the end of the year remains a strong scenario if economic data is supportive of gold. 📉 Alternative scenario (possible correction) If CPI data is higher than expectations: Breaking 4250 → falling towards 4220 Broken 4185 → Visit 4120 Breaking 4040 only = structural change in trend As long as the price is above 4185, the upward trend remains the likely scenario. 📊 Impact of US CPI data today Data less than expected: dollar weakness, gold’s rise accelerates, resistance is easily breached Higher than expected data: temporary selling pressure and a healthy correction create new buying opportunities It is preferable to avoid entering before the news is released and wait for the movement to stabilize after the announcement. ⏰ Expectations during the American period High volatility Fast movements and stop loss tests The best opportunities appear 15-30 minutes after the data is released 💡 Important tips for traders and holders of physical gold Don't chase price peaks Capital management is essential Splitting trades is better than full entry Viscal Gold Holders: Hold is still the best option The general trend supports continued repricing of gold in the medium term 🟡 Conclusion Gold is still moving with clear positivity as long as it maintains trading above the 4185 area. Any decline in prices represents an opportunity, not a threat, while breaching current resistances may open the way to new historical levels in the coming weeks. The analysis is purely technical and not a direct recommendation, and risk management is the responsibility of every trader.