Technical analysis by TradingShot about Symbol SPYX: Sell recommendation (12/16/2025)

TradingShot

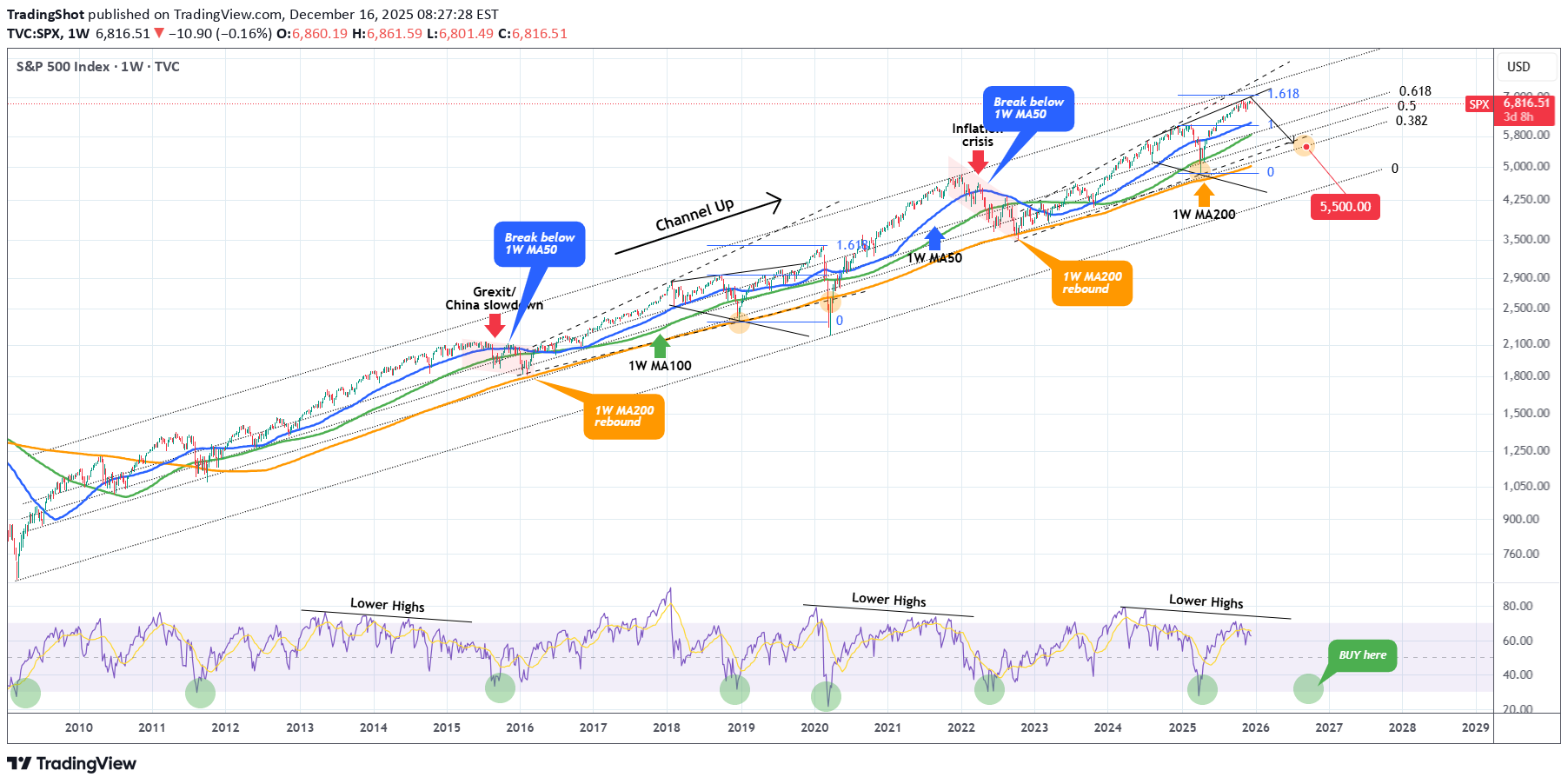

S&P500 Will it have a big correction in 2026 back to 5500?

The S&500 (SPX) has been trading within a massive 16-year Channel Up since the 2008 U.S. Housing Crisis. Within this pattern it has been repeating various shorter fractals as you can see on this chart it is one that truly stands out. That's the necessity of the market to correct back to its 1W MA200 (orange trend-line) every time it reaches a Top after an exhaustion rally. With the 1W RSI on a Lower Highs Bearish Divergence (against the price's Higher Highs), there is no better time to consider a market top, thus a strong correction, especially after such a non-stop exhaustion rally since the April 2025 Low. Based on the 1W MA200 trajectory, we make a fair estimate that contact can be achieved around the 5500 level, which will be our next long-term buy on stocks. Alternatively, if the 1W RSI approaches the 30.00 oversold level, without the index touching 5500, it will be a good idea to Buy regardless of the price. --- ** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. ** --- 💸💸💸💸💸💸 👇 👇 👇 👇 👇 👇