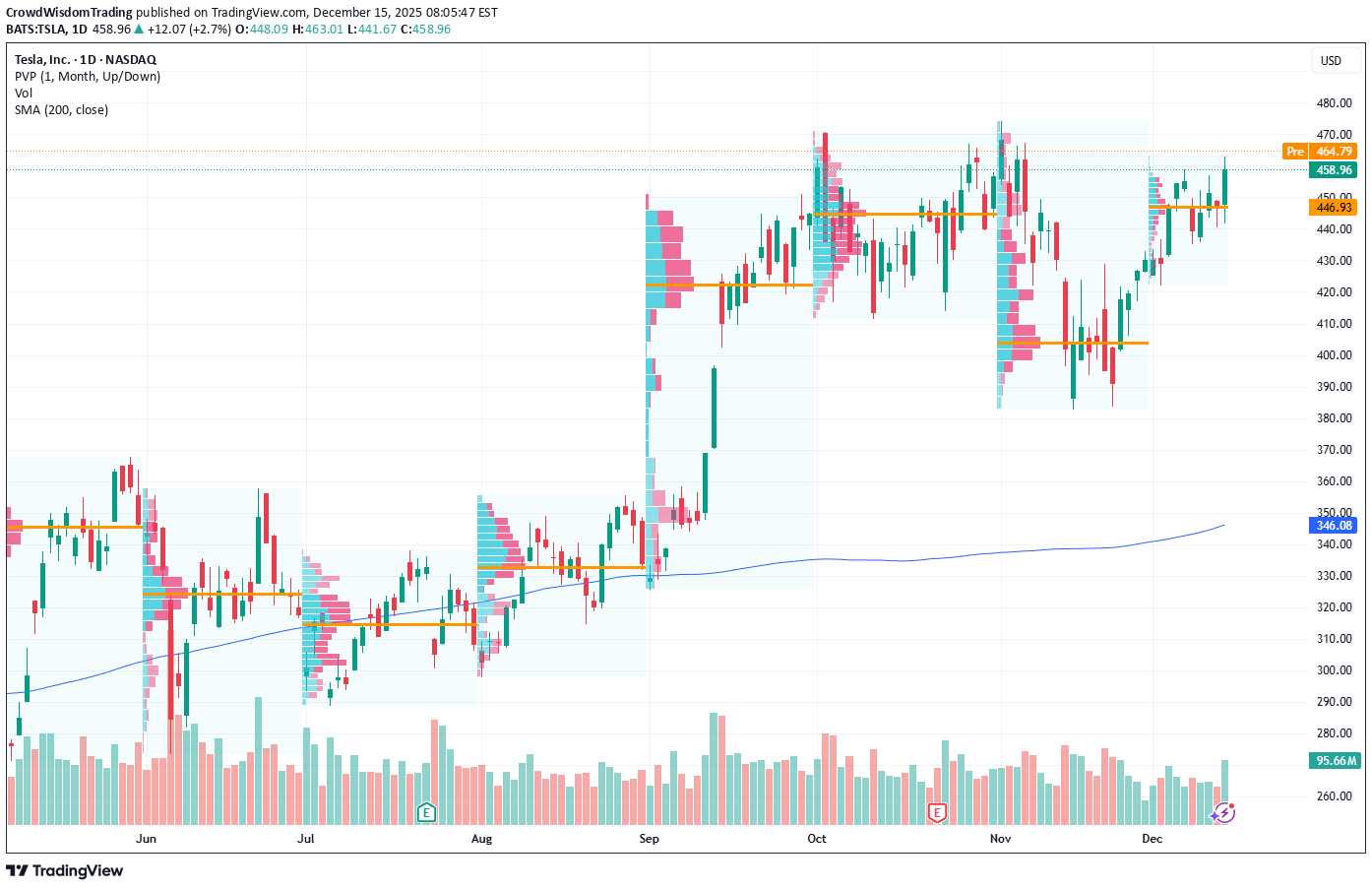

Technical analysis by CrowdWisdomTrading about Symbol TSLAX: Buy recommendation (12/15/2025)

Tesla poised for breakout as bullish momentum builds up

Current Price: $458.96 Direction: LONG Confidence Level: 68% (Based on clear bullish bias from multiple professional traders, strong call option flow, and price action holding above key EMAs despite mixed sentiment on X) Targets: - T1 = $465 - T2 = $475 Stop Levels: - S1 = $452 - S2 = $440 **Wisdom of Professional Traders:** I'm seeing the collective consensus from many professional traders leaning bullish on Tesla this week. Several traders highlight strong relative strength compared to the broader market, with repeated mentions of a potential run toward $470 and even $500 if the breakout holds. The wisdom of the crowd here is built on multiple factors: unusual bullish call flow, price holding above the 20‑ and 50‑day EMA, and clear technical formations like cup‑and‑handle and inverse head‑and‑shoulders patterns that traders watch for continuation moves. **Key Insights:** Here's what's driving this setup: Tesla just posted a strong Q4 production beat and announced an FSD beta 2.0 rollout for Q1 2026, which traders see as a near‑term catalyst. Across the board, I'm noticing repeated references to 460‑470 as the "battle zone" where Tesla often consolidates before pushing higher. The MACD remains bullish, RSI is elevated but not in reversal territory, and option flow last week was overwhelmingly in favor of calls — 97% call flow versus only 3% puts. What's interesting is that while some market watchers on X are cautious about valuation (PE > 300), the technical picture from professional traders shows price action defending support zones. The $450‑$452 area has been mentioned as a solid dip‑buy zone by multiple traders, with upside targets in the mid‑$470s this week. **Recent Performance:** Tesla is up 2.7% in the last 24 hours, closing strongly above both the 20‑ and 50‑day EMA. Volume came in about 10% above the 30‑day average, suggesting healthy participation. Over the past week, it's tested $465 resistance multiple times without breaking through, consolidating just below it — a common pre‑breakout behavior traders watch closely. **Expert Analysis:** Several traders I track have pointed out that Tesla is forming an inverse head‑and‑shoulders pattern around the 460 zone, with higher lows developing over the past few sessions. Others note that the $467‑$470 resistance cluster, once cleared, could quickly open the door to the $475‑$480 range. The unusually large call option purchases targeting $460 and $500 strikes reflect conviction among big players. Momentum indicators (MACD positive, histogram rising) support this bias. **News Impact:** The recent production and delivery beat for Q4 2025 has already lifted sentiment, though traders think it's not fully priced in yet. The announcement of the Full‑Self‑Driving beta expansion is being discussed as a major revenue driver, and footage of robo‑taxis running without safety drivers in Austin is helping to build the narrative. Potential regulation issues and valuation stretch are risks, but for this week, the news flow supports sustained bullish interest. **Trading Recommendation:** Here's my take: I’d look to enter on a dip toward $452‑$454, aiming for a break above $465 for T1 and riding momentum toward $475 for T2. Keep stops relatively tight below $450 (S1) and more conservative traders can use $440 (S2) as the ultimate fail‑safe level. Given the repeated trader mentions of these levels and strong call activity, this looks like a solid short‑term long trade for the week. Watch for a clean breakout through $467 — it could trigger a fast move to second targets.