Technical analysis by The-Thief about Symbol PAXG on 12/15/2025

The-Thief

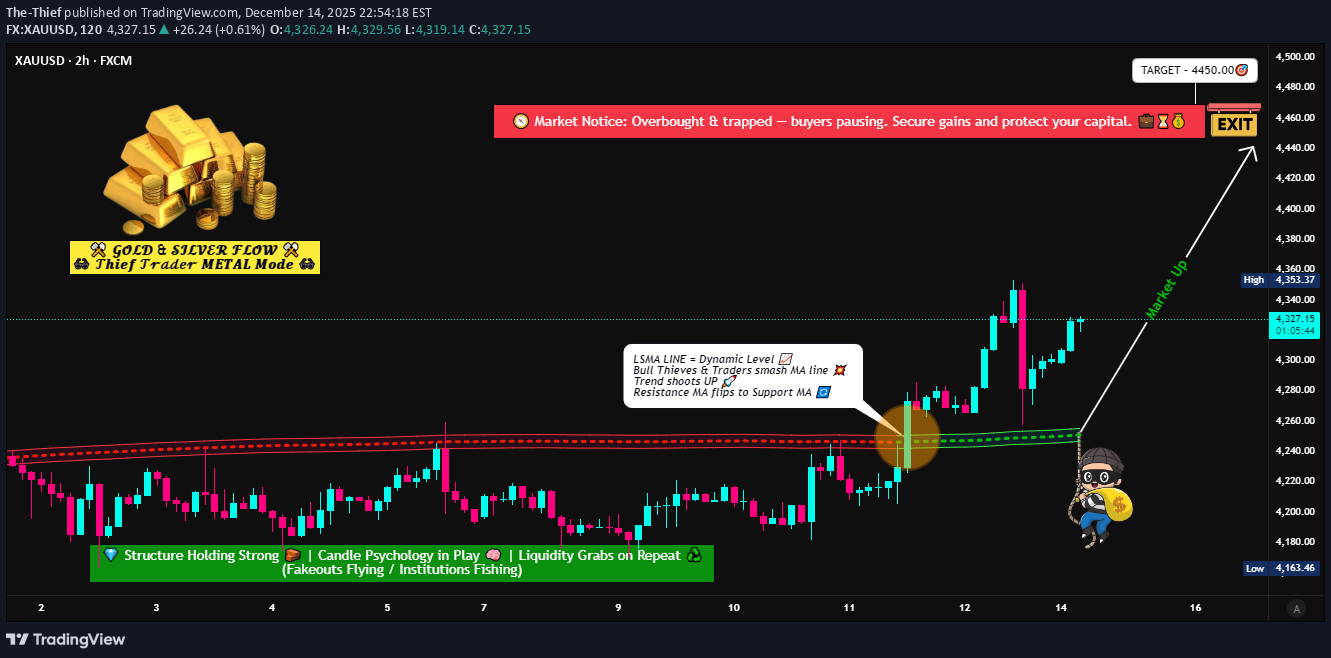

Gold Technical Outlook: LSMA Breakout Validated

🟡 XAU/USD Bullish Breakout Blueprint | LSMA Momentum Play 📌 Asset XAU/USD – GOLD vs U.S. Dollar ⏱️ Day Trade / Swing Trade 📊 Metals Market Opportunity 📈 Market Bias & Structure Bullish Bias CONFIRMED ✅ Gold has delivered a clean LSMA (Least Squares Moving Average) breakout, signaling a shift in momentum from consolidation to expansion. Price acceptance above LSMA suggests buyers are in control, with dips attracting demand rather than rejection. This structure favors buy-the-dip strategies rather than chasing price at highs. 🔓 Entry Strategy (Layered Position Building) Entry Style: Flexible / Any Price Level 🧠 Layered Entry System for Better Average Pricing Buy Limit Layers (Thief Strategy): • 4240.00 • 4280.00 • 4320.00 ➡️ Traders may add or reduce layers based on volatility, risk profile, and position sizing. ➡️ Layering helps smooth entries during pullbacks and avoids emotional execution. 🛑 Risk Management (Stop Loss) Protective Stop: 4220.00 🚫 ⚠️ Dear Ladies & Gentlemen (Thief OG’s): This stop level is not mandatory. Adjust your SL according to: • Account size • Volatility conditions • Personal risk rules Capital protection always comes first. 🎯 Profit Objective (Smart Exit Zone) Primary Target: 4450.00 💰 📌 Rationale for Exit: • Strong historical resistance • Overbought conditions likely • Liquidity trap potential • Corrective pullback probability increases 👉 Do not get greedy near resistance. Scale out or exit fully when conditions align. ⚠️ TP is guidance only — manage profits according to your own system. 🔗 Related Markets to Watch (Correlation Guide) 💵 DXY – U.S. Dollar Index Inverse correlation with Gold Weakening DXY = tailwind for XAU/USD Watch for breakdowns below key support zones 📉 US10Y / US2Y Treasury Yields Falling yields increase Gold’s appeal (non-yielding asset) Yield compression often fuels bullish Gold expansions XAG/USD – Silver Silver often lags then accelerates after Gold moves Strength in XAG confirms broader precious metals demand 📊 SPX500 / US500 Equity risk-off sentiment supports Gold Sharp equity corrections = safe-haven inflows into XAU 🧠 Final Notes ✔️ Trend-following structure ✔️ LSMA breakout confirmation ✔️ Layered entries for precision ✔️ Defined risk & logical exit zone 👑 TO THE THIEF OG's & SMART TRADERS Trade responsibly. This is a blueprint – adapt it to your style. Like & follow if you find this useful! Sharing boosts visibility for all. ✅ 🔔 Stay updated with my ideas for more data-driven setups. 📈 Trade smart, manage risk, and stack profits! Disclaimer: This is not financial advice. Past performance doesn’t guarantee future results. You are solely responsible for your trades. ✅ LIKE | ✅ FOLLOW | ✅ SHARE Let’s grow together! 🚀📊