Technical analysis by GoldFxMinds about Symbol PAXG on 12/14/2025

GoldFxMinds

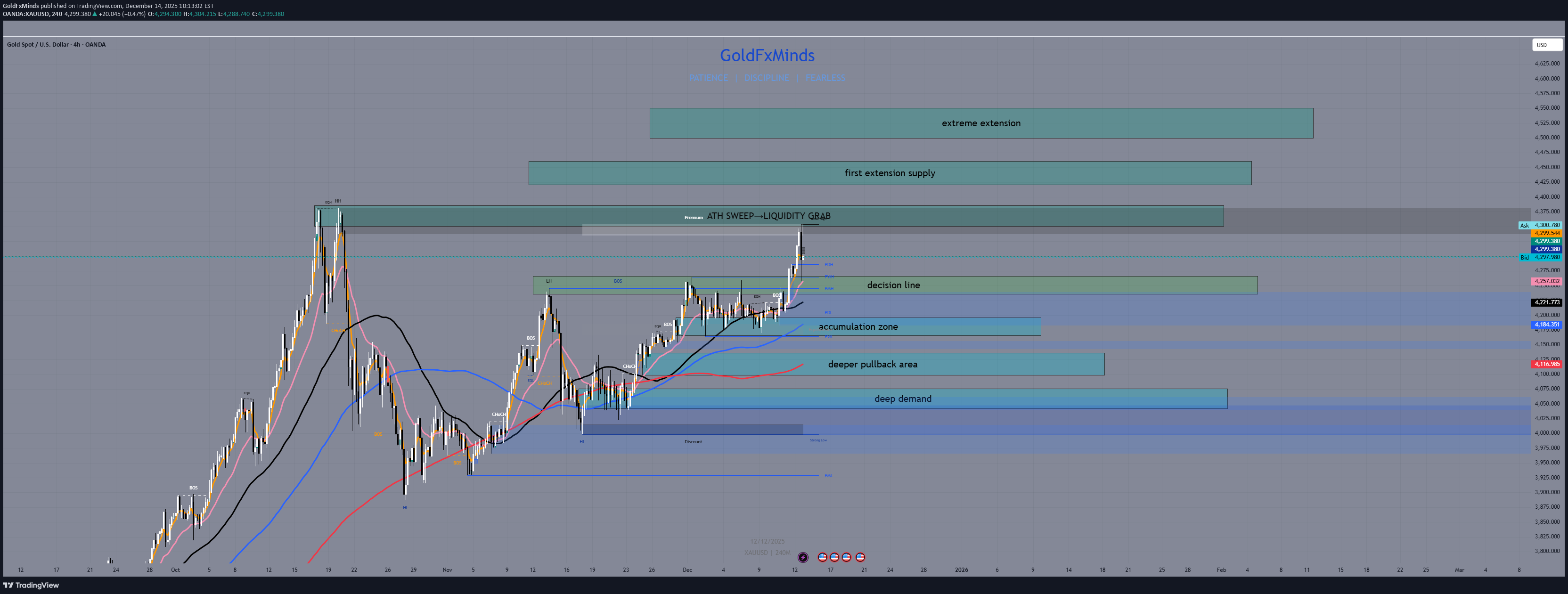

Gold – H4 Outlook | Continuation or Pullback

Hey traders, On the H4 chart, gold has already delivered a strong bullish move. The impulse from 4000 to 4355 is complete, and price is no longer pushing higher in a clean way. Instead, the market is slowing down, reacting more often, and starting to rotate. This is not a bearish market. But it is also not a market to chase. From here, price has two clear options: either it continues higher, or it pulls back to build value again. H4 Context The overall structure remains bullish. Higher highs and higher lows are still intact, and there is no structural break on H4. However, price is already far from the base of the last impulse. That means: buying high carries more risk selling only makes sense near extremes the middle is a waiting area At this stage, location matters more than direction. ⚪ Decision Zone 4235 – 4265 | Decision This is the key area on the H4 chart. If price holds above this zone, the market keeps the door open for continuation If price breaks below this zone, the market shifts into pullback mode H4 closes around this area are what matter, not quick spikes. This zone decides whether gold pushes higher first or corrects lower first. 🟦 H4 Buy Zones If price moves below the decision zone, these are the areas where buying starts to make sense again within a bullish structure. 4165 – 4195 | Accumulation This is the first buy zone. Price can slow down here and build a base. If the trend is strong, buyers should defend this area and prevent a deeper pullback. 4100 – 4135 | Pullback This is the main correction zone on H4. A move into this area is normal after the last impulse and does not damage the trend. This is where continuation is often rebuilt. 4045 – 4075 | Deep pullback This is the last buy zone on H4. If price reaches this area, the market is correcting deeply, but the bullish structure can still survive. Below this zone, the structure starts to weaken. 🟥 H4 Sell Zones On H4, selling only makes sense at clear extremes. 4350 – 4385 | ATH sweep This is the area above the highs where stops sit. Fast spikes and emotional buying often happen here, followed by hesitation or rejection. 4420 – 4460 | Extension trap Price is stretched in this zone. Breakouts here often fail if there is no strong follow-through. 4500 – 4550 | Extreme extension This is a very stretched area. If price reaches this zone, the market is no longer trending cleanly and is likely distributing. Bullish Scenario The bullish scenario stays valid as long as price holds above the decision zone. If gold stays above 4235 – 4265, the market can attempt another push higher. The first area to watch is 4350 – 4385. A clean break above that zone can lead to higher extensions, but those moves would already be late-stage. Continuation requires holding above the decision zone, not just quick wicks. Bearish Scenario The bearish scenario activates only if price breaks below the decision zone. A break below 4235 – 4265 shifts the market into pullback mode: first reaction area is 4165 – 4195 if that fails, price can move toward 4100 – 4135 a deeper correction can reach 4045 – 4075 As long as price holds above 4045, this remains a pullback, not a trend reversal. Final Thought Gold is still bullish on H4, but this phase is not about prediction. It’s about waiting for price to come into the right areas and reacting there. Buy lower. Sell higher. Wait in between. What do you think: continuation above the decision zone, or pullback into accumulation first? Drop your thoughts below 👇, follow GoldFxMinds for more clean H4 outlooks, and let’s read the market together. 🚀✨