Technical analysis by GoldFxMinds about Symbol PAXG on 12/14/2025

GoldFxMinds

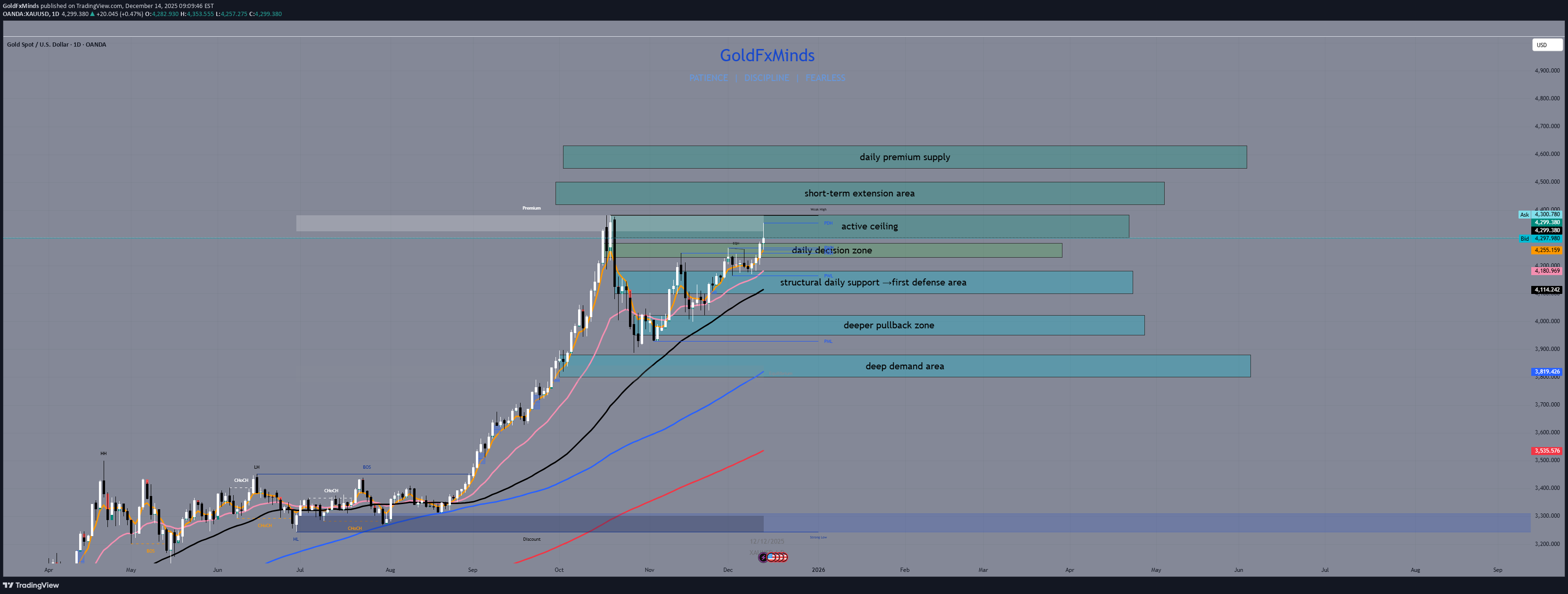

Gold – Daily Outlook (D1) | Trend Up, But Liquidity Is Building

Hey traders, On the daily chart, gold remains in a clear uptrend. Structure is intact, but the character of price has changed. Moves higher are slower, candles hesitate more, and reactions appear faster. This usually tells us one thing: liquidity is building. Daily Bias Bias stays bullish, as long as daily structure holds. Higher highs and higher lows are still respected. No daily close has flipped the structure bearish. However, price is stretched. From here, continuation is possible — but only if buyers manage liquidity correctly. Otherwise, the market looks for a reset. 🟥 Daily Zones Above – Where Exhaustion & Traps Can Appear 4300 – 4380 | Daily Exhaustion Area Price is already reacting here. Smaller candles and hesitation suggest buying pressure is thinning. This is where late buyers often get trapped if acceptance fails. 4420 – 4500 | Buy-Side Liquidity Area Above the current highs, liquidity is sitting. If price pushes here, expect stop runs and sharp reactions rather than clean continuation. 4550 – 4630 | Extension Trap Zone If price reaches this area, the move is late-stage. This is where upside extensions often turn into traps and fast reversals. 🟦 Daily Zones Below – Where Pullbacks Can Settle 4180 – 4100 | Shallow Pullback Zone A controlled pullback into this area keeps the daily trend clean. This is where buyers are expected to defend structure. 4020 – 3950 | Deep Pullback Zone A move here signals momentum cooling. Structure can still hold, but the market clearly needs time to rebalance. 3880 – 3800 | Sell-Side Liquidity Zone Below this area, sell-side liquidity is exposed. If price trades here, the daily trend is under serious pressure. ⚪ Daily Decision Zone 4230 – 4280 | Daily Imbalance Area This is where daily control shifts. Holding above → buyers absorb selling pressure Losing it → imbalance resolves lower toward pullback zones Daily closes around this area matter far more than intraday noise. Bullish Scenario If price holds above the imbalance area and buyers manage to absorb selling near the exhaustion zone, continuation remains possible — but it will likely be slow and tactical, not impulsive. Bearish Scenario If price fails to hold the imbalance area, the market starts correcting inefficiencies. A pullback toward the shallow or deep pullback zones becomes the natural path. This remains corrective unless sell-side liquidity is fully taken. Final Thought Gold is still trending higher. But right now, the market is more interested in liquidity and balance than speed. At this stage, waiting for price to show its hand is often the best trade. Are you seeing continuation — or signs of exhaustion? Drop your thoughts below 👇, follow GoldFxMinds for clean daily structure, and let’s trade what price does, not what we hope. ✨