Technical analysis by TuffyBro about Symbol BTC: Buy recommendation (12/12/2025)

TuffyBro

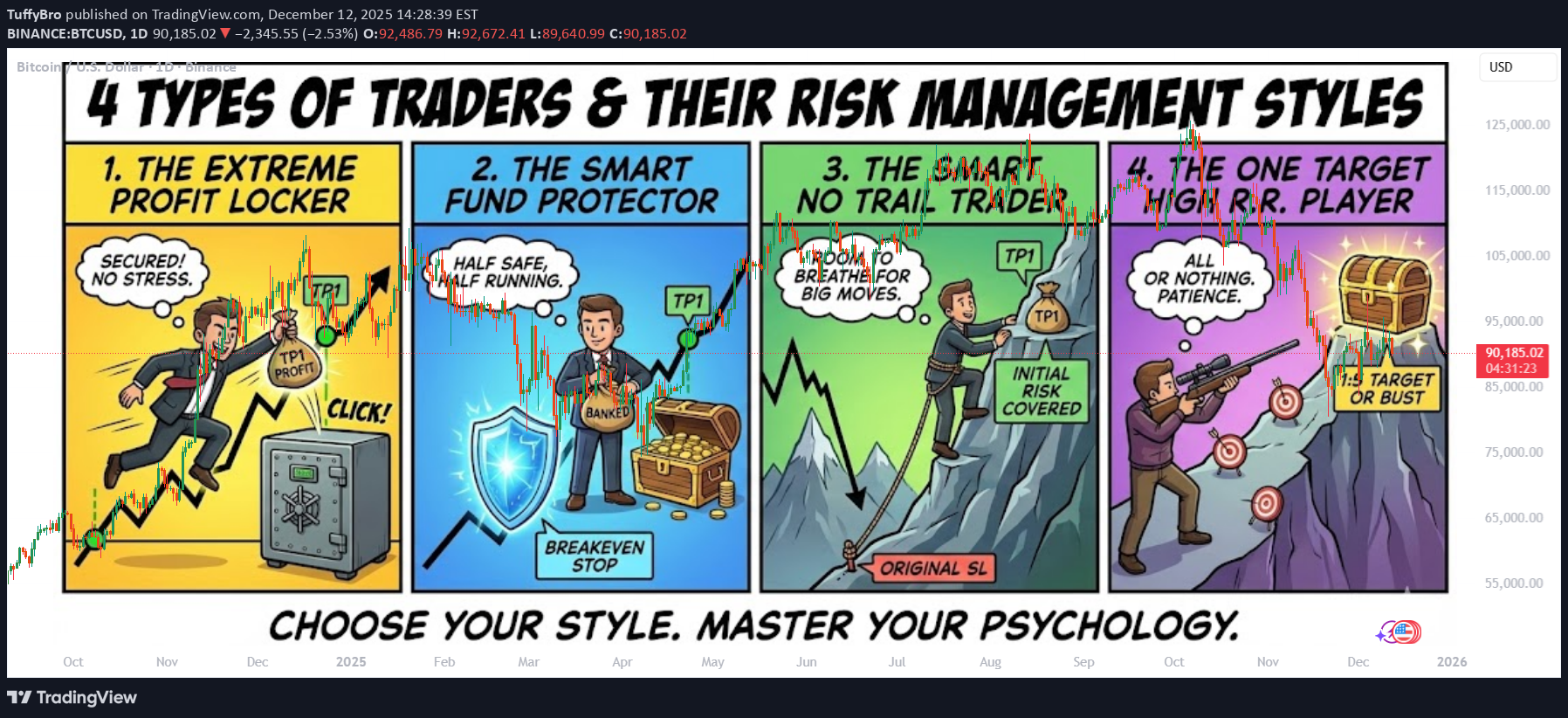

4 TYPES OF TRADERS & THEIR RISK MANAGEMENT STYLES (MASTERCLASS)

In the world of trading, your personality dictates your strategy. There is no "one size fits all" approach to closing a trade. Some traders prefer peace of mind, while others chase maximum potential returns. Below are the four main types of traders based on how they handle Take Profit (TP) levels and risk. Identifying which one you are the first step to consistency. 1) THE EXTREME PROFIT LOCKER This trader closes the entire position the moment TP1 is hit or at a certain level like 1R. PROS: Immediate Profit: The moment TP1 is hit, the profit is secured in the wallet. Zero Stress: No more emotional pressure or chart watching since the trade is fully closed. Safety: No chance of the trade reversing into a loss because you are already out. CONS: FOMO (Fear Of Missing Out): You completely miss TP2, TP3, or any massive continuation rallies. Limited Upside: You are capping your winners early, which means you need a higher win rate to be profitable long-term. 2) THE SMART FUND PROTECTOR This is the most balanced approach. This trader usually books 50% to 80% of the profit at TP1 and shifts the Stop Loss to Breakeven for the remaining position. PROS: Capital Preservation: Both the initial capital and a portion of the profit are locked in immediately. Stress-Free Runners: You are "safe" even if the trade reverses, as the worst-case scenario is breaking even on the remainder. Psychological Comfort: It is easier to hold for big targets when you have already banked money. CONS: Premature Stop-Outs: If price pulls back to entry after TP1 (a common occurrence) and then rallies, you get stopped out at breakeven and miss the big move. Regret: You may feel frustration when the market pumps hard, but you are only holding a tiny "moon bag" position. 3) THE SMART NO TRAIL TRADER This trader focuses on math over comfort. Instead of closing fully or moving to breakeven immediately, they scale out based on their initial risk. For example, if their risk was $100, they lock in $100 profit at TP1 and keep the rest running without moving the Stop Loss to breakeven. PROS: Maximum Potential: This style gives the best chance to ride big trends and catch all TPs. Balanced Math: At every TP, they cover their potential loss, ensuring the math works in their favor. Room to Breathe: By not rushing to breakeven, they avoid getting stopped out by standard market volatility before the real move happens. CONS: Reversal Risk: If the trade reverses completely from TP1, they might end up with nothing or a full loss. High Stress: Requires active monitoring, patience, and a strong stomach to watch profits turn into drawdowns during pullbacks. Whipsaw Danger: Many trades pull back after TP1. This trader risks giving back open profits in exchange for the chance of a home run. 4) THE ONE TARGET HIGH R.R. PLAYER This trader operates with a "sniper" mentality. They do not take partial profits. They only lock profit at a specific, high-value level (e.g., 1:3 or 1:5 Risk-to-Reward). It is usually "All or Nothing." PROS: Profitability with Low Win Rate: Because the winners are so big (3x or 5x the risk), you can be profitable even if you lose 60% of your trades. Efficiency: One winning trade covers multiple small losses. CONS: Low Win Rate: Since you target high rewards, price will reach your target less often. Psychological Difficulty: This requires extreme patience and experience. It is mentally painful to watch a trade go up 2R (2x profit) and then reverse to hit your Stop Loss, but that is the cost of this strategy. SUMMARY - Each style has its own specific advantages: The "Profit Locker" sleeps best at night. The "Fund Protector" survives the longest. The "No Trail Trader" maximizes trends. The "High R.R. Player" plays the long-term probability game. Choose the style that fits your risk appetite and how much time you can actively watch the charts. - TUFFYCALLS