Technical analysis by Crypto_robotics about Symbol BTC on 12/8/2025

Analytics: market overview and forecasts

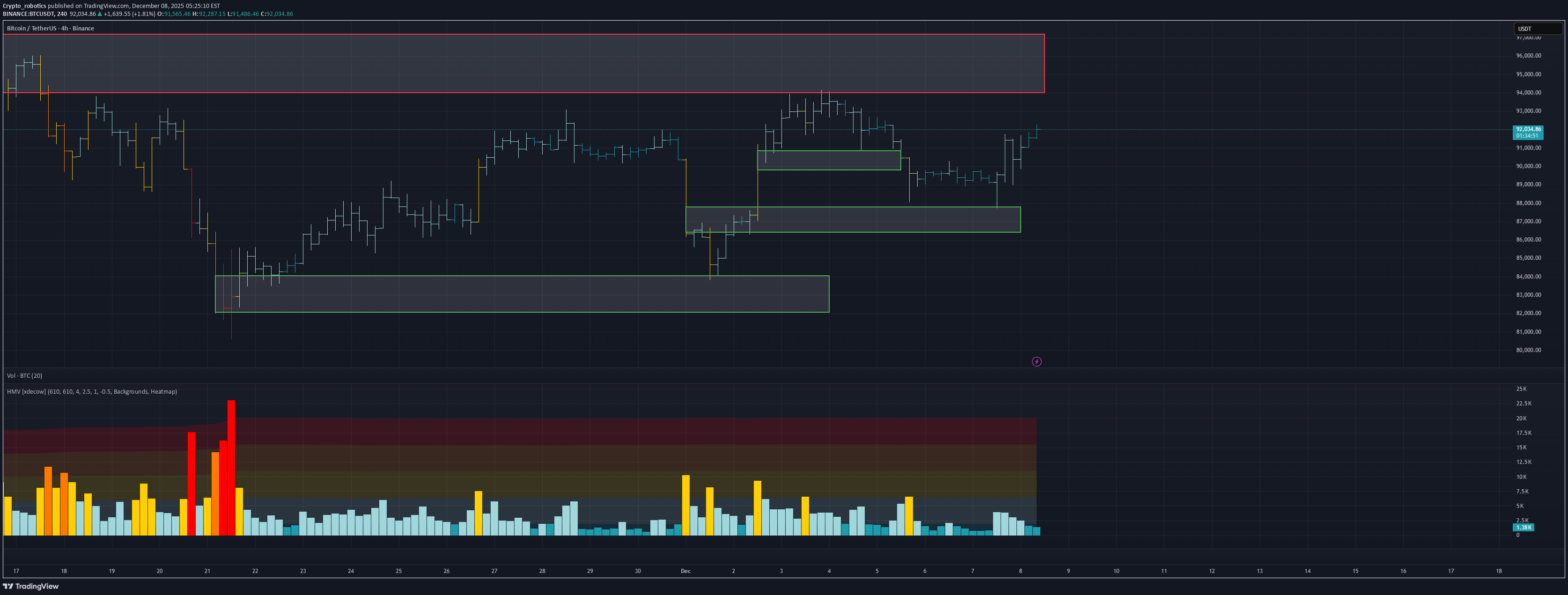

WHAT HAPPENED? Last week, for bitcoin, we reached the upper limit of a significant support zone and almost immediately received a powerful boost. This led to a change in the local trend to an upward one. As part of the growth, the resistance of $94,000-$97,500 (volume zone) was reached, from which the correction began. Now we've pushed off from the support of $87,800-$86,400 (volume zone) and maintain the upward context. WHAT WILL HAPPEN: OR NOT? The movement potential is aimed at updating the local maximum. To fully reverse the trend, the buyer needs to demonstrate more strength. The $94,000-$97,500 zone remains relevant, as a significant part of it hasn't been tested. The implementation of a positive scenario is possible both through a confident breakdown of this range, and through the formation of a weak correction in terms of volume and price action. A negative factor for the development of the long rally this week is the selling pressure on the spot market, as seen by the cumulative delta. The situation is better in futures, but the market needs more "fuel" for a final turnaround. Alternative scenario: with a strong defense of the nearest resistance, a sideways trend may form in the range of $84,000-$94,000. Buy Zones $87,800–$86,400 (volume zone) $84,000–$82,000 (volume anomalies) Sell Zones $94,000–$97,500 (volume zone) $101,000–$104,000 (accumulated volumes) $105,800–$106,600 (local resistance) IMPORTANT DATES We're following these macroeconomic developments this week: • Tuesday, December 9, 15:00 (UTC) — publication of the number of open vacancies in the labor market (JOLTS) USA for October; • Wednesday, December 10, 2:45 (UTC) — announcement of Canada's interest rate decision; • Wednesday, December 10, 19:00 (UTC) — US FOMC statement and economic forecasts, as well as the announcement of the US Federal Reserve interest rate decision; • Wednesday, December 10, 19:30 (UTC) — US FOMC press Conference; • Thursday, December 11, 9:00 (UTC) — press conference of the National Bank of Switzerland; • Thursday, December 11, 13:30 (UTC) — publication of the number of initial applications for unemployment benefits in the United States for the week; Friday, December 12, 7:00 (UTC) — publication of the UK GDP for October, as well as the German consumer price index for November. *This post is not a financial recommendation. Make decisions based on your own experience. #analytics