Technical analysis by tradecitypro about Symbol BTC on 12/5/2025

تحلیل بیت کوین امروز: آیا سقوط بزرگ بعدی آغاز میشود؟ (تحلیل ۲۴۱)

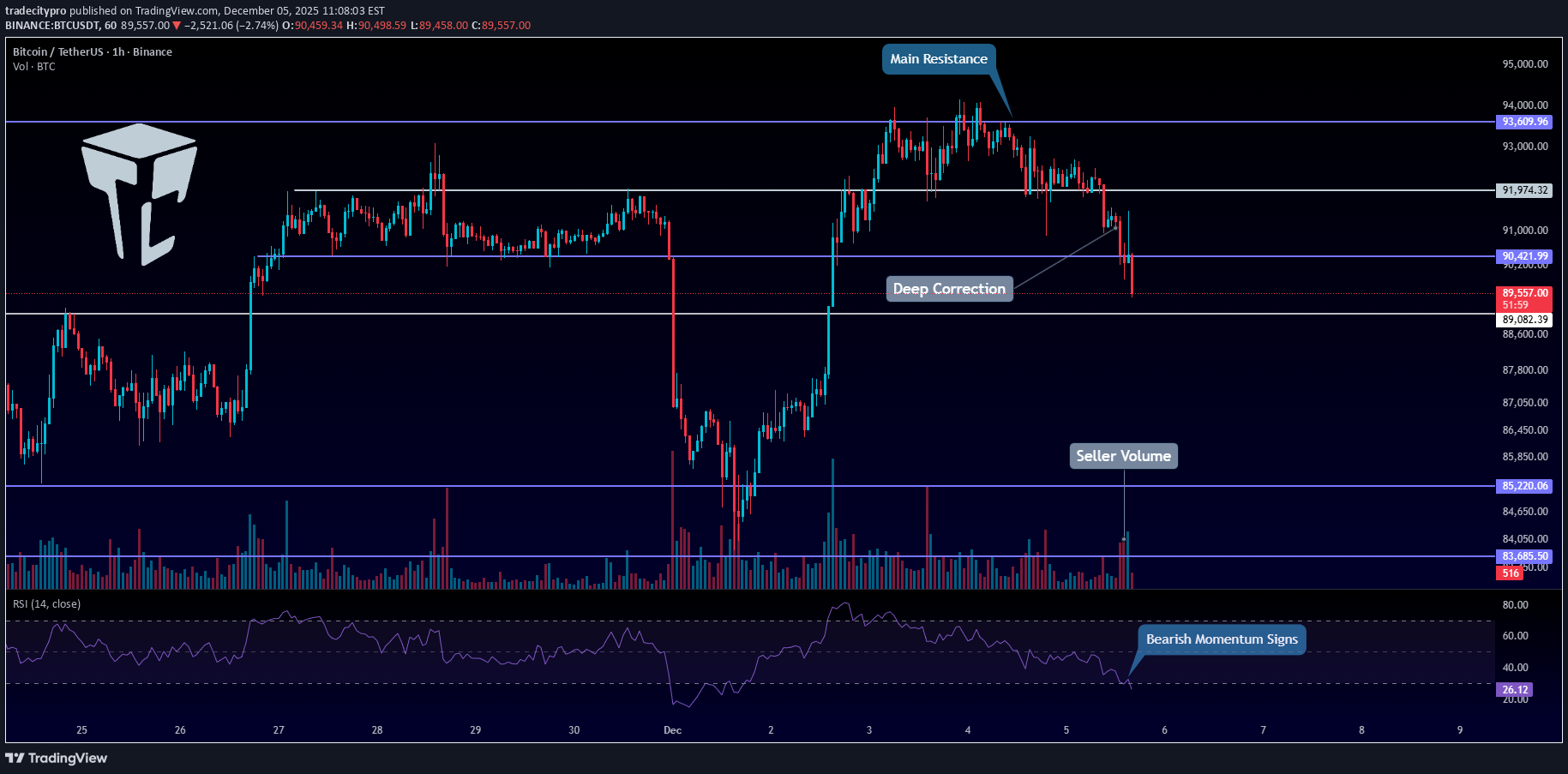

👋 Welcome to TradeCity Pro! Let’s move on to today’s Bitcoin analysis. The market is currently in a downward correction phase. ⏳ 1-Hour Timeframe Yesterday, Bitcoin corrected down to 91,974, and as I mentioned, the bullish momentum the market had was gone. 🔔 Now the correction has become deeper, and the price has fallen to 90,421. ✔️ The last candle we saw shows strong seller dominance, and with the high selling volume, it could very well be the beginning of a new downward move. 💥 The RSI oscillator, after resetting yesterday, has now dropped all the way to the 30 level, with the possibility of breaking below it and entering the oversold zone. 💫 If that happens, given the strong selling pressure and powerful red candles, the probability of a drop toward lower levels will increase significantly. 🧩 One area the price hasn’t reacted to properly is 89,082. 🎲 This level used to be very important for Bitcoin, but recently the price hasn’t respected it much. ⭐ If the price again fails to react to this level on the next move down, we can conclude that this support has weakened. ⚖️ However, in my opinion, if buyers are going to step in, this level is not a bad candidate for a reaction. 🔭 If Bitcoin gets supported at 89,082 and moves upward, it will form a higher low compared to 85,220, which increases the probability of a bullish structure forming. ☘️ But if 89,082 breaks, the downward move toward 85,220 will begin, and that could even signal the start of the next major bearish wave on the daily timeframe. ❌ Disclaimer ❌ Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel. Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.