Technical analysis by emreyavuz84 about Symbol EGLD: Buy recommendation (12/5/2025)

EGLD در کف قیمت تاریخی: فرصت خرید با پاداش ریسک خیرهکننده تا 18 برابر!

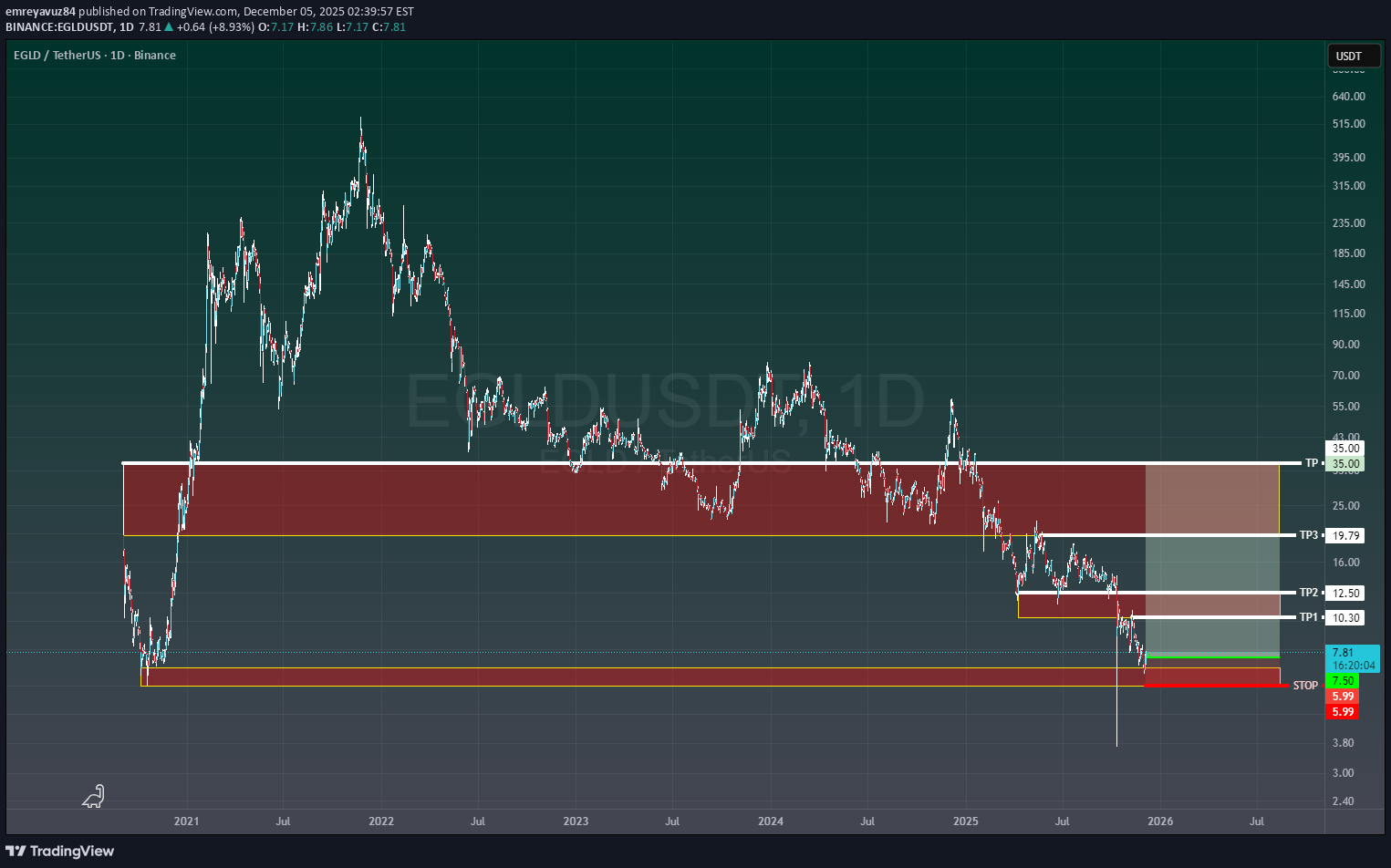

Chart Context: • Pair: EGLD/USDT • Timeframe: 1D • Exchange: Binance • Structure: Multi-year downtrend, now testing historical demand zone. Analysis: EGLD has completed a full cycle from its 2021 peak (> $500) into a prolonged structural decline. Price recently swept deep liquidity at $5–$6 , signaling capitulation and absorption. This zone aligns with historical demand and offers asymmetric risk/reward for tactical longs. Key Levels: • Entry: $7.50 • STOP: $5.99 (below capitulation wick) • TP1: $10.30 • TP2: $12.50 • TP3: $19.79 • TP4: $35.00 Risk/Reward Profile (Entry $7.50): • Risk: $1.51 • TP1: Reward $2.80 → 1.85R • TP2: Reward $5.00 → 3.31R • TP3: Reward $12.29 → 8.14R • TP4: Reward $27.50 → 18.21R • Blended R (25% scale-out each TP): ~7.88R Execution Plan: • Initial STOP: $5.99 • Scale-out: – TP1: 10% – TP2: 20% – TP3: 30% – TP4: 40% • Trail: – Move to break-even after TP1 – Structure-based trailing after TP2 – ATR trail after TP3 Market Maker Perspective: • Liquidity sweep into $5 zone suggests inventory accumulation. • Path of least resistance: fill inefficiencies toward $10–$12, then target buyside liquidity near $20+. • Macro trend remains bearish; this is a counter-trend play , not a confirmed reversal until $15+ is reclaimed. Risk Disclaimer: This is not financial advice . Crypto assets are highly volatile. Manage risk strictly and size positions conservatively.