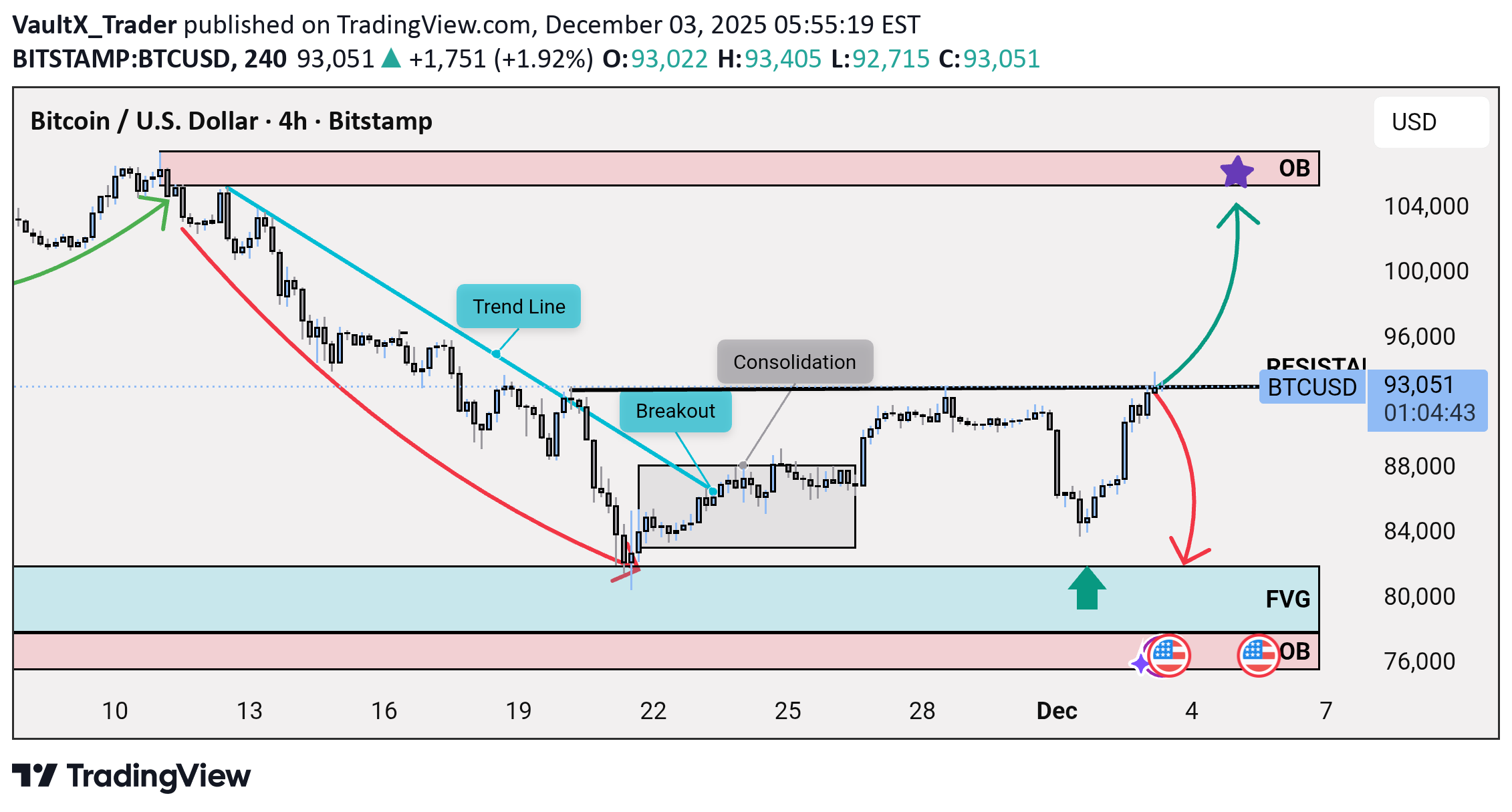

Technical analysis by VaultX_Trader about Symbol BTC on 12/3/2025

بیت کوین در دوراهی حیاتی: شکست مقاومت یا سقوط مجدد؟ (دو سناریوی معاملاتی)

Bitcoin has shown strong relative strength by rejecting the deep retracement down to the $80,000 Order Block (OB). It is now consolidating right beneath the major $93,000 - $94,000 resistance. This presents a critical juncture with two clear high-probability outcomes that define our trading plan. Scenario 1: Bullish Breakout (Primary Plan) The primary scenario is a definitive bullish continuation, triggered by clearing the immediate overhead resistance. Condition: A strong 4-Hour candle closes decisively above the $94,000 resistance level. Rationale: A confirmed breakout would signal the absorption of immediate selling pressure, validating the underlying bullish momentum and opening the path to the next structural highs. Target: Upon breakout confirmation, the market will likely target the Upper Order Block (OB) and psychological level near $100,000 - $105,000. Entry Strategy: Wait for the confirmed close above $94,000, or a smaller timeframe retest of the $94,000 level after the break. Scenario 2: Bearish Rejection (Contingency Plan) If the current resistance proves too strong and buyers fail to maintain momentum, the market will likely be forced to seek liquidity at a lower price. Condition: The price fails to break $94,000, shows a clear rejection candle pattern (e.g., a bearish pin bar or engulfing), and then breaks below the current consolidation support (e.g., below $90,000). Rationale: Failure at this resistance would indicate a lack of conviction from buyers, forcing the market to finally seek the liquidity and re-balance the efficiency at the Lower Order Block (OB)/FVG. Target: A failed breakout would target the $80,000 - $83,000 FVG/OB Demand Zone. Action: This would be a high-probability zone to place a Limit Buy Order as per the original analysis. Disclaimer: The market is at a pivot point. We trade what the chart confirms, not what we anticipate. Patience is key to confirming which of these two major scenarios plays out before committing to a trade.