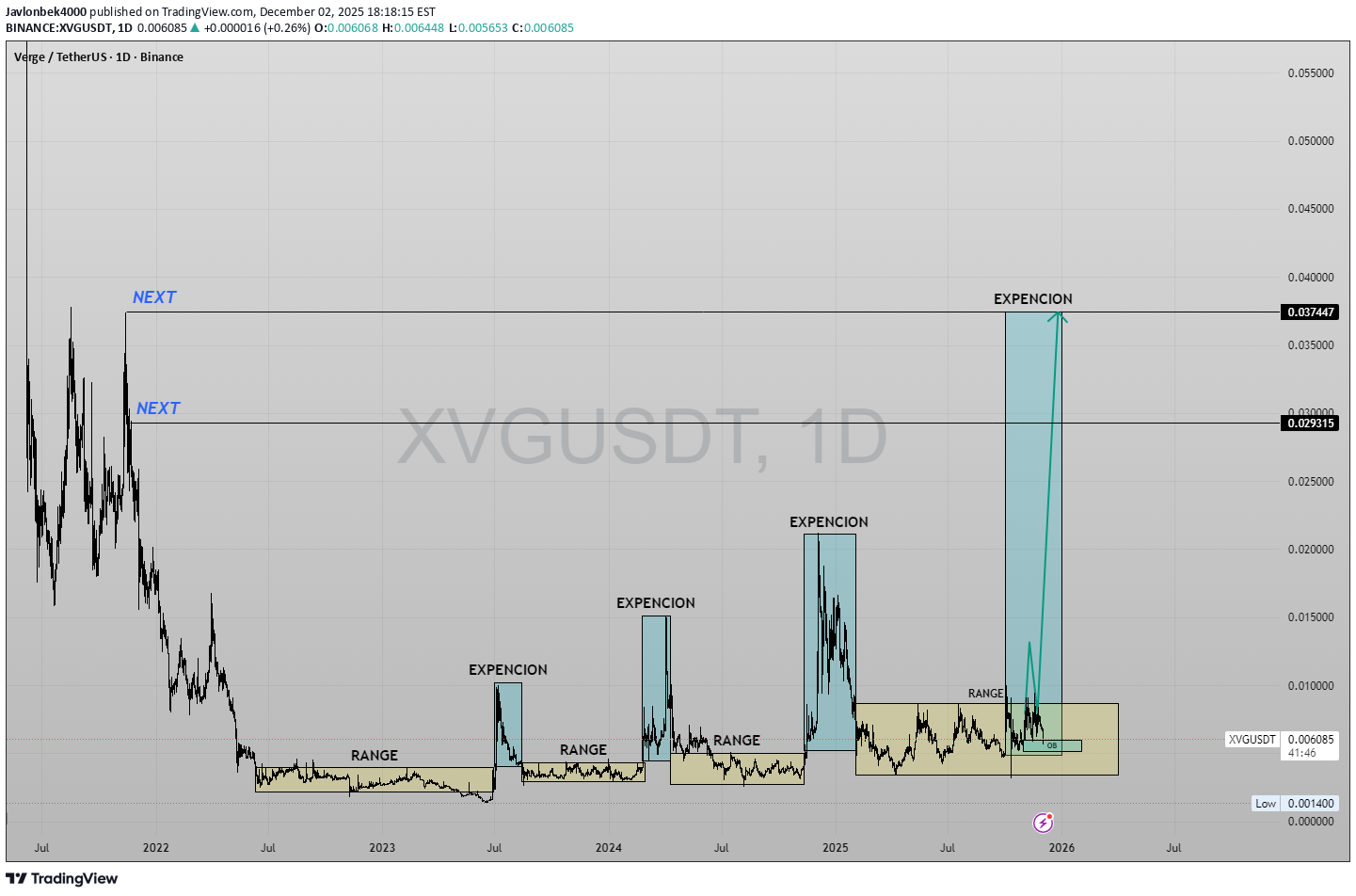

Technical analysis by Javlonbek4000 about Symbol XVG: Buy recommendation (12/2/2025)

Javlonbek4000

پیشبینی انفجار قیمت XVGUSDT: استراتژی نوسانگیری با اهداف صعودی بزرگ

XVGUSDT – 1D | Range → Expansion Cycle, Swing Plan with Targets XVG has been respecting a very clear “range → expansion” behaviour on the daily chart. Each time price spends a long period inside a horizontal range, it is followed by a sharp vertical expansion leg. The previous cycles are marked on the chart, and the current structure is again trading inside a similar range. As long as price holds above the current range low, my bias is for one more expansion from this base. Swing idea from the current range Entry zone: around 0.0061 – inside the range and above the local demand/OB. Invalidation (SL): below 0.0047 – a clean daily break under this level means the range support has failed and the idea is invalid. Risk from entry ≈ -22%. First target (TP1): 0.0087 – retest of the range high / first liquidity pocket. Reward from entry ≈ +40%, giving roughly 1 : 1.8 R:R. If the market repeats previous “range → expansion” cycles and macro conditions stay supportive, I am looking at the following higher-timeframe expansion targets: TP2 – “NEXT” level: 0.0293 – major HTF supply zone from the last impulsive sell-off and a logical area to secure large profits if an expansion starts. TP3 – final extension: 0.0374 – upper resistance and full measured-move objective for a complete range expansion. These levels are scenario targets, not guarantees. I will reassess the structure at each target and adjust risk accordingly. This is a personal trading plan, shared for educational purposes only and not financial advice.