Technical analysis by EconomicanalysAbdulRahman about Symbol PAXG: Buy recommendation (11/24/2025)

EconomicanalysAbdulRahman

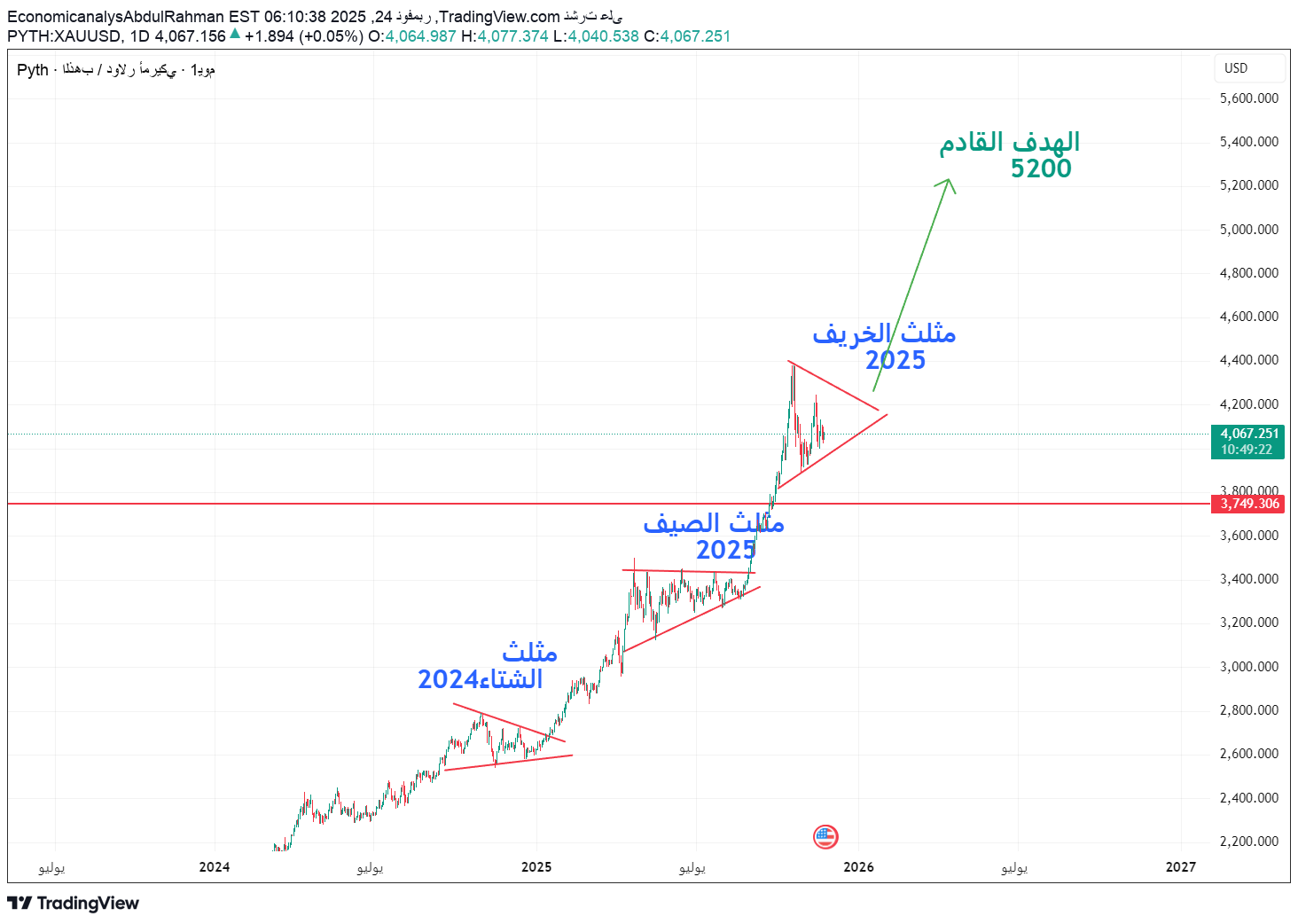

رمز الذهب: مثلث السرّي يقود إلى قفزة تاريخية فوق 5200 دولار!

Technical + fundamental reading on the “Autumn Triangle 2025” pattern and setting the next target 5200 Gold returns today to prove that it is not just a hedging tool... but rather the new leading asset of the global financial system. On the chart, the same technical imprint that preceded the previous strongest upward waves is repeated, but this time within a larger and deeper structure: the 2025 Autumn Triangle. This pattern is not just consolidation... but rather a stage of price pressure before a breakthrough movement that may change the rules of the game during 2026. 🔹 First: Technical analysis - repeating a pattern that is not repeated often On the chart (attached): Gold ended the winter triangle 2024 → followed by a strong rise. Then the summer triangle of 2025 was formed → a stronger bullish explosion. Now we are inside the 2025 Autumn Triangle... which is larger, wider, and extends over a much higher price range. Why is this model important? Huge accumulation at historical peaks → indicates the entry of institutions, not speculators. Decreased fluctuation volume within the triangle → price pressure in preparation for the launch. The structure of the waves within the pattern indicates the end of the fourth wave and preparation for the fifth impulsive wave. Main technical levels: Pivotal support: 3740–3800 (Breaking it only delays the rise, but does not cancel it within the general trend) Time-price zone for peak pressure: end of November – mid-December 2025 The upper side of the triangle: the key to the explosion The complete technical goal of the model: 🔥 4800 - 5200 dollars The target of 5200 is not a random number... but a direct measurement of the length of the previous wave (summer window wave) + projection of Fibonacci extensions + measurements of previous triangle breakouts. 🔹 Second: Fundamental analysis - why does everything support a breakout? Today’s fundamentals are not neutral...but are aligned in an unprecedented way in favor of gold: 1) The Fed is on its way to cut rates Markets are pricing interest at 3.75% through 2026. This means: Dollar weakness Real yield decline High demand for hard assets 2) Central bank purchases More than 8,200 tons since 2013 – the largest buying wave in modern times. 95% of central banks plan to buy more. This is not a coincidence... but a slow restructuring of the global monetary system. 3) Geopolitical tensions Middle East Pacific Ocean Eastern Europe All of which fuel the demand for gold as a first resort. 4) Mine supply is slowing down The annual increase has become the weakest in 12 years. Basic takeaway: What is happening is not an “up cycle”... Rather, it is a re-pricing of the system where gold returns to becoming a global reserve asset. 🔹 **Third: The expected scenario** 📈 Main scenario (likely): Bullish breakout Going beyond the side of the triangle → opening the way towards: 4200 4500 4800 5200 (main target) A big triangle means a big wave… just like in the summer of 2025 but on a larger scale. 📉 Alternative scenario (unlikely but possible): Correction to 3740–3800 Rebound and rise again The uptrend remains strong as long as we do not break 3740 with clear daily closings 🟩 The golden conclusion Gold is now in a pressure phase ahead of the biggest possible move in the next decade. The similarity between the 2024 and 2025 triangles adds tremendous weight to the breakout scenario. At the same time… Global fundamentals create a rare environment that pushes the price above 5000 easily. This is no ordinary climb... Rather, it is a move to a completely new price level.