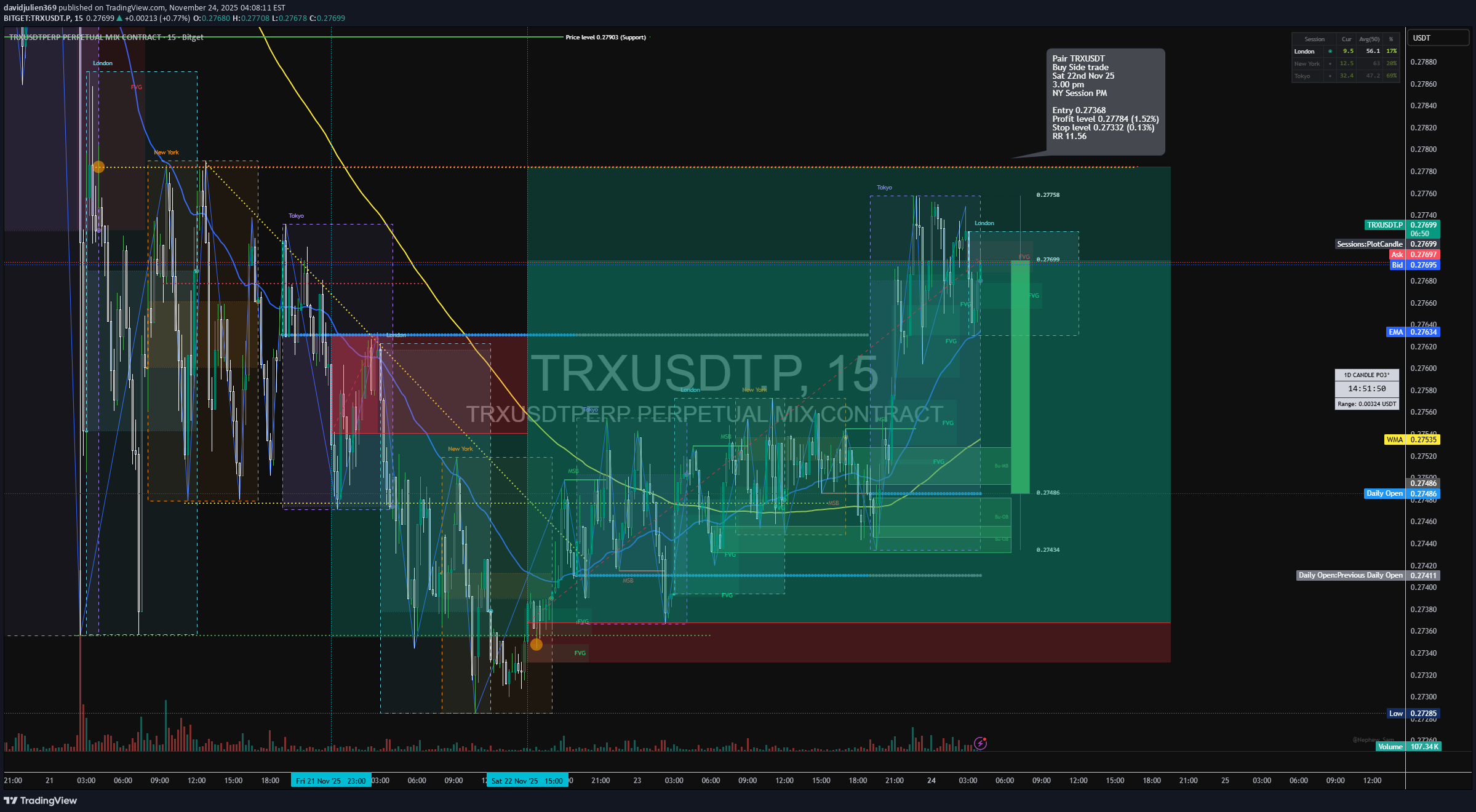

Technical analysis by davidjulien369 about Symbol TRX: Buy recommendation (6 hour ago)

davidjulien369

تحلیل دقیق معامله خرید بلندمدت TRX: استراتژی ICT و وایکوف برای سود 1.52 درصدی

15min 📘 TRXUSDT.P – Trade Journal Entry (15-Min Chart) Sat 22nd Nov 25 — 3:00 pm — NY Session PM Buyside Trade 🟦 TRADE SUMMARY (Tab 1 — Blue) Pair: TRXUSDT.P Direction: Buyside Trade Date: Sat 22nd Nov 25 Time: 3:00 pm Session: NY Session PM Timeframe: 15m 🟩 TRADE PARAMETERS (Tab 2 — Green Transparent) Entry: 0.27588 Profit Level: 0.27784 (+1.52%) Stop Level: 0.27352 (–0.13%) Risk-to-Reward: 11.56 R 30min 🟨 MARKET CONTEXT & STRUCTURE 1. Trend Context TRX recovered from a heavy markdown cycle seen on the 30m structure. The 15m chart shows a micro accumulation zone beneath the 200 EMA, then a displacement above the structure. NY PM session creates a clean shift in order flow, reclaiming: The NY AM high, the FVG left during the earlier breakdown and the intraday session midpoint 2. Key Structure Points BOS at 0.2754 marks a bullish transition. The 50 EMA flips upward and crosses the 200 EMA — momentum confirmation. Series of higher lows formed after the BOS → clear buyside continuation model. 🟪 LIQUIDITY Sell-Side Liquidity Removed Liquidity swept below 0.2738, creating a final inducement. NY PM grabs sell-side beneath the Asian and London session lows. This clears the path for Algorithmic Repricing. Buyside Liquidity Targets First cluster at 0.2775–0.2780 HTF resistance levels at 0.2795–0.2802 TP lands inside the first premium inefficiency. Liquidity Narrative Summary Sweep → Displacement → FVG → OB Tap → Expansion (buyside model) 🟧 ICT MODEL BREAKDOWN Model Used: Sell-Side Sweep → BOS → FVG → PD Array → Buyside Delivery 1. Inducement London + Tokyo lows + NY early lows all swept before entry. 2. Displacement Strong bullish displacement candle breaks above the 0.27540 BOS level. 3. Entry Type Entry sits directly inside a: Bullish FVG Discount Retracement (OTE zone) Order Block Retest Aligned with session timing (NY PM) 4. Target Logic TP hits first internal buyside inefficiency. Secondary targets remain valid at 0.2795–0.2810. 🟫 WYCKOFF ALIGNMENT PhaseTRX Reaction Phase ASelling climax & AR Phase BAccumulation under 50/200 EMA Phase CSpring: final liquidity sweep at 0.2738 Phase DSOS + LPS zone (Entry 0.27588) Phase EMarkup into buyside targets 🟩 VOLUME & CONFIRMATION Volume spikes confirmed the BOS. Retracement into FVG shows volume tapering → bullish absorption. No heavy sell volume returned — confirming algorithmic buy program. 🟥 OUTLOOK / CONTINUATION If TRX holds above 0.2750–0.2753, further markup remains likely. Extended upside zones: 0.2800 0.2820–0.2830 Invalidation: Break below 0.2734 kills the buyside ideaStop level moved (0.85%)Trade updated Pair TRXUSDT Sell Side trade Sat 22nd Nov 25 3.00 pm NY Session PM Entry 0.27368 Profit level 0.27784 (1.52%) Stop level 0.27332 (0.13%) RR 11.56 Target reached Mon 24th Nov 25 8.00 am Profit level 0.27601 (0.85%) RR 6.47 Trade Duration 1 day, 17 hours, 0 minutes