Technical analysis by MMFlowTrading about Symbol PAXG: Sell recommendation (11/18/2025)

MMFlowTrading

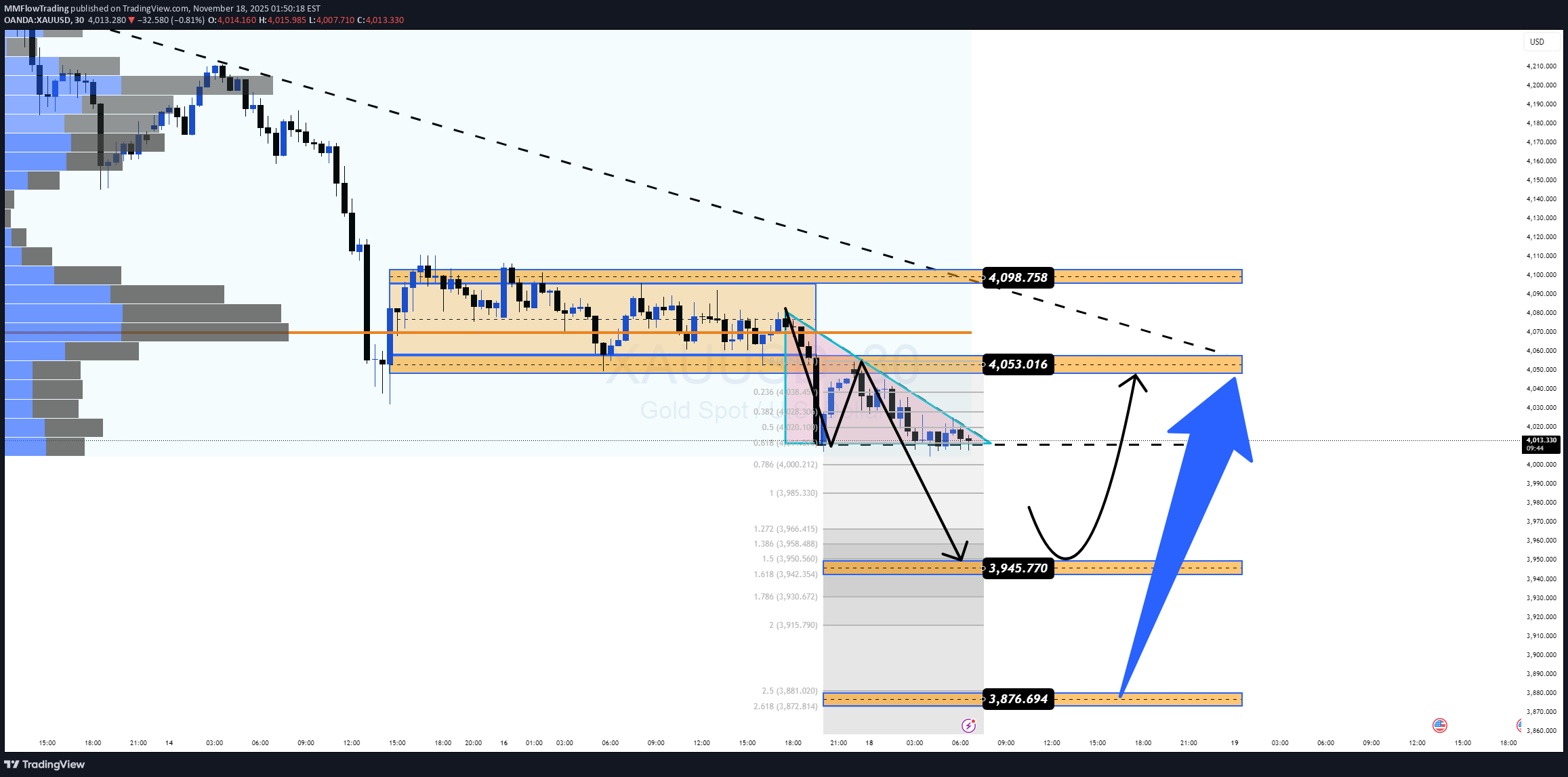

طلا زیر 4050 دلار گیر افتاد: آیا خرسها در کمین نقدینگی زیر 4000 دلار هستند؟

🔍 Market Context Gold has been under pressure for four consecutive sessions as expectations for a December Fed cut fade. The Dollar is supported by growth worries but not strong enough to trigger a clean risk-off bid into gold. Result: XAU/USD keeps hovering near weekly lows, with sellers patiently watching the 4,000$ liquidity shelf. 📊 Technical Structure – H1 (MMFLOW View) Overall bias remains bearish, with price capped by a descending trendline from the recent 4,24x high. Price is compressing inside a tight 4,053–4,000$ distribution range, which also aligns with a Volume Profile POC around 4,053$. The last leg down is tracked with Fibonacci extensions: Key downside liquidity cluster: 3,945$ → 3,876$ (1.272–1.618 extensions). Current PA looks like a bear flag / tight consolidation under resistance – a classic setup for either: a clean break below 4,000$ into deeper liquidity, or a shakeout dip into demand before a sharp short-covering bounce. In short: gold is coiling under POC 4,053$, preparing either a final flush to 3,945–3,876$ or a squeeze back into the old value area. 🎯 Idea Scenarios (for study, not signals) Scenario 1 – Trend Continuation: Break of 4,000$ As long as H1 closes stay below 4,053$, bearish bias is valid. A decisive break and retest failure at 4,000$ opens the door toward: 🎯 3,945$ – first liquidity pocket / 1.272 ext. 🎯 3,876$ – deeper liquidity / 1.618 ext. & key demand. For existing shorts from higher, those zones are logical areas to scale out / manage exits. Scenario 2 – Liquidity Sweep Then Short-Covering Bounce If price spikes into 3,945$ ± a few dollars and shows: long downside wicks, or clear M15–M30 rejection structure, Gold could stage a counter-trend rebound toward: 4,000–4,015$, then 4,053$ (POC), and potentially 4,098$ if momentum extends. This would be a liquidity-reaction play, not a confirmed trend reversal unless bulls reclaim and hold above 4,098$. Invalidation of the bearish view A sustained move with H4 closes above 4,098$ would weaken the current down-structure and force a reassessment of the medium-term bias. ⚜️ MMFLOW TRADING Insight When price is trapped under POC, patience beats FOMO. Let the market either: break and accept below 4,000$, or reclaim 4,053$–4,098$ …before committing heavily. Bears still have the upper hand, but bulls will only regain narrative if they defend 3,945–3,876$ and push price back into the old value area. “In a downtrend, your job isn’t to call the bottom – it’s to sell weak rallies and let liquidity do the heavy lifting.”