Technical analysis by ProjectSyndicate about Symbol PAXG: Sell recommendation (11/16/2025)

طلا هفته آینده: سطوح حیاتی حمایت و مقاومت و پیشبینی تریدرها

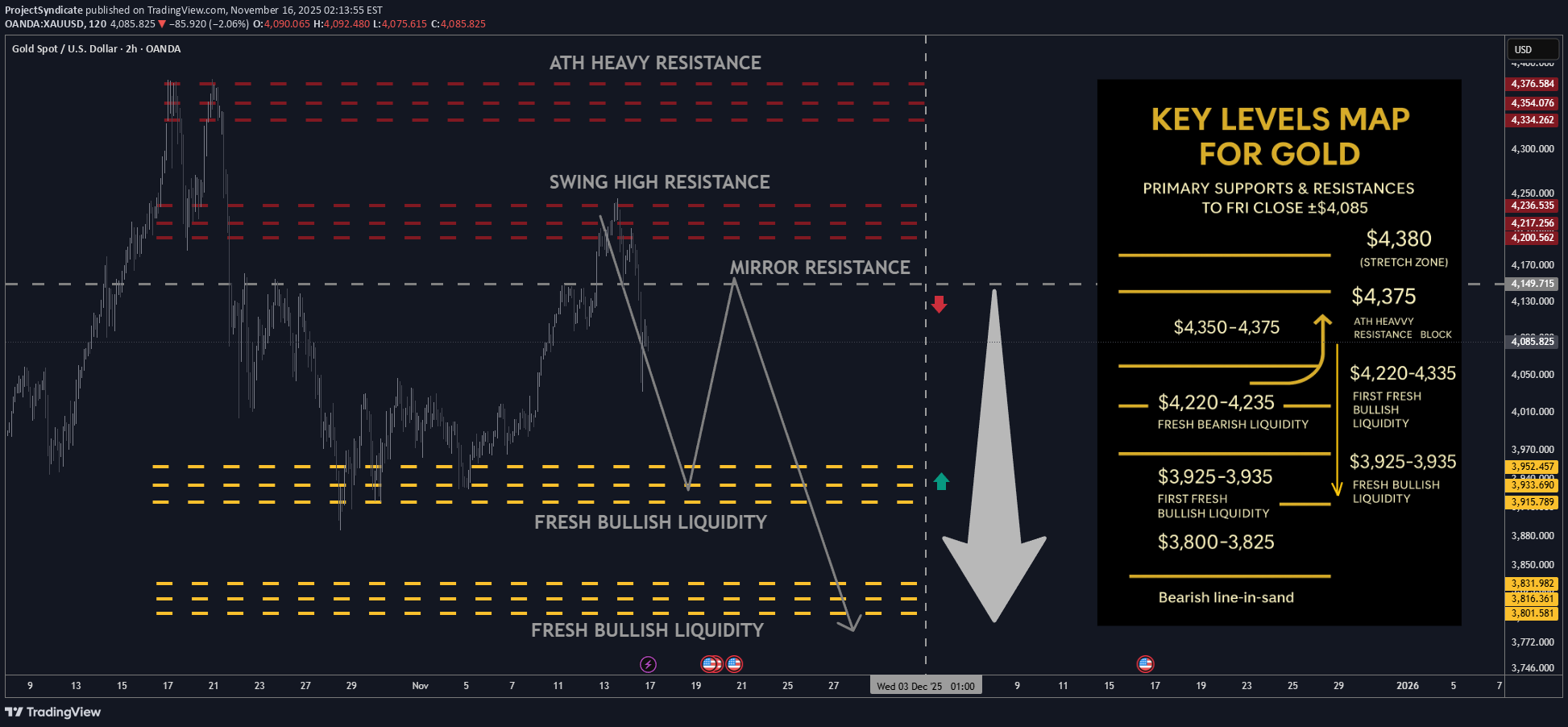

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: ~$4,244 → ~$4,085 — buyers punched through $4.20k but sellers defended the $4,220–4,250 band; weekly close is soft but still comfortably above $4k and mid-range. 📈 Trend: Bullish but in corrective / two-way mode ; treating current tape as range-trade while below the $4,350–4,375 ATH supply block. 🛡 Supports: $3,925–3,935 fresh bullish liquidity → $3,800–3,825 deeper demand pocket— key shelves where dip-buying is expected. 🚧 Resistances: $4,220–4,230 short-term fade zone → $4,350–4,375 (ATH heavy resistance block). 🧭 Bias next week: Preference to fade strength into $4,220–4,230, targeting a rotation back into $3,925–3,935. Alternative is to buy dips into $3,925–3,935 and ride the range back toward $4,220–4,230. Invalidation on sustained acceptance above $4,350–4,375; loss of $3,800–3,825 risks deeper mean reversion. ________________________________________ ________________________________________ 🔝 Key Resistance Zones •$4,220–4,230 — immediate weekly ceiling; aligns with your noted resistance block, attractive area to initiate shorts on first tests. •$4,350–4,375 — prior ATH / “heavy resistance block”; any spike here is a fade candidate unless price accepts above it on strong volume. 🛡 Support Zones •$3,925–3,935 — fresh bullish liquidity; preferred first take-profit for shorts and primary dip-buy zone. •$3,800–3,825 — deeper fresh liquidity; failure here would signal a more meaningful correction, not just a pullback in an uptrend. ________________________________________ ⚖️ Base Case Scenario Range/consolidation between roughly $3,800–$4,230: •First pushes into $4,220–4,230 are sellable for rotations toward $3,925–3,935. •As long as weekly closes keep rejecting the ATH block $4,350–4,375, bias stays “sell strength, buy clean liquidity dips.” 🚀 Breakout / Breakdown Triggers •Bull trigger: Sustained acceptance above $4,350–4,375 multiple sessions holding above and using that band as support would shift tone back to full-on trend and reopen the path toward and beyond prior extremes (~$4,400+). •Bear trigger: A decisive daily close below $3,800 turns the current “healthy pullback” into a deeper correction, opening room toward prior lower shelves sub-$3,750 and likely volatility expansion. ________________________________________ 💡 Market Drivers to Watch •Fed & real yields: Odds of a December cut have ramped up again; any hawkish pushback or hotter data could cap rallies near resistance. •U.S. fiscal/political risk: Shutdown and fiscal brinkmanship are still in the background; resolution headlines could briefly pressure gold, while renewed instability supports the bid. •Flows & positioning: ETF and central-bank demand remain supportive, but after a 60% YTD run, fast money is quick to take profits into strength. •Cross-asset behavior: Watch that equity–gold correlation; if risk-off hits and gold still sells with stocks, dips could run further before strategic buyers step in. ________________________________________ 🔓 Bull / Bear Trigger Lines •Bullish above: $4,350–$4,375 (sustained acceptance; ATH block reclaimed as support). •Bearish below: $3,800 (opens risk of deeper liquidation below the current liquidity shelves). ________________________________________ 🧭 Strategy for this week Primary plan – short from resistance (your core idea): •Entry zone: Scale into shorts around $4,220–4,230 front edge of the resistance block. •TP #1: $3,925–3,935 fresh bullish liquidity; consider closing most size here. •Runner / extension: If momentum extends lower, watch $3,800–3,825 for final profit-taking; below here the profile shifts into deeper correction mode. •Risk: Hard invalidation if price accepts above $4,350–4,375 daily closes holding above and successful retests. Alternative plan – buy the dip into liquidity: •Entry zone: Stagger bids around $3,925–3,935 and, for more aggressive positioning, into $3,800–3,825. •Exit zone: First target back into $4,220–4,230; consider de-risking heavily as you approach that resistance band. •Risk: Cut or reduce if price fails to hold above $3,800 on a daily closing basis or if selling accelerates on high volume through that shelf.🔱 GOLD WEEKLY SUMMARY 💰 High/Close: 4,244 → 4,085 — sellers defended 4,220–4,250. 📊 Trend: Bullish but corrective; range-trade while < 4,350–4,375. 🏰 Resistance: 4,220–4,230 (fade zone) → 4,350–4,375 (ATH block). 🛡 Support: 3,925–3,935 (fresh liquidity) → 3,800–3,825 (deep demand). 🎯 Bias: Sell strength → 4,220/4,230 → target 3,925/3,935. 🏹 Alt Plan: Buy dips at 3,925/3,935 toward 4,220/4,230. 🚀 Bull Trigger: Break & hold above 4,350–4,375. ⚠️ Bear Trigger: Daily close < 3,800. 🌐 Drivers: Fed cuts, USD/yields, fiscal risk, ETF/CB flows. ⚒️ Risk: Invalidate shorts on acceptance above 4,350–4,375.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀