Technical analysis by FXOpen about Symbol PAXG on 11/11/2025

پایان تعطیلی دولت آمریکا: طلا به کدام سمت میرود؟ (تحلیل قیمت طلای پس از بحران)

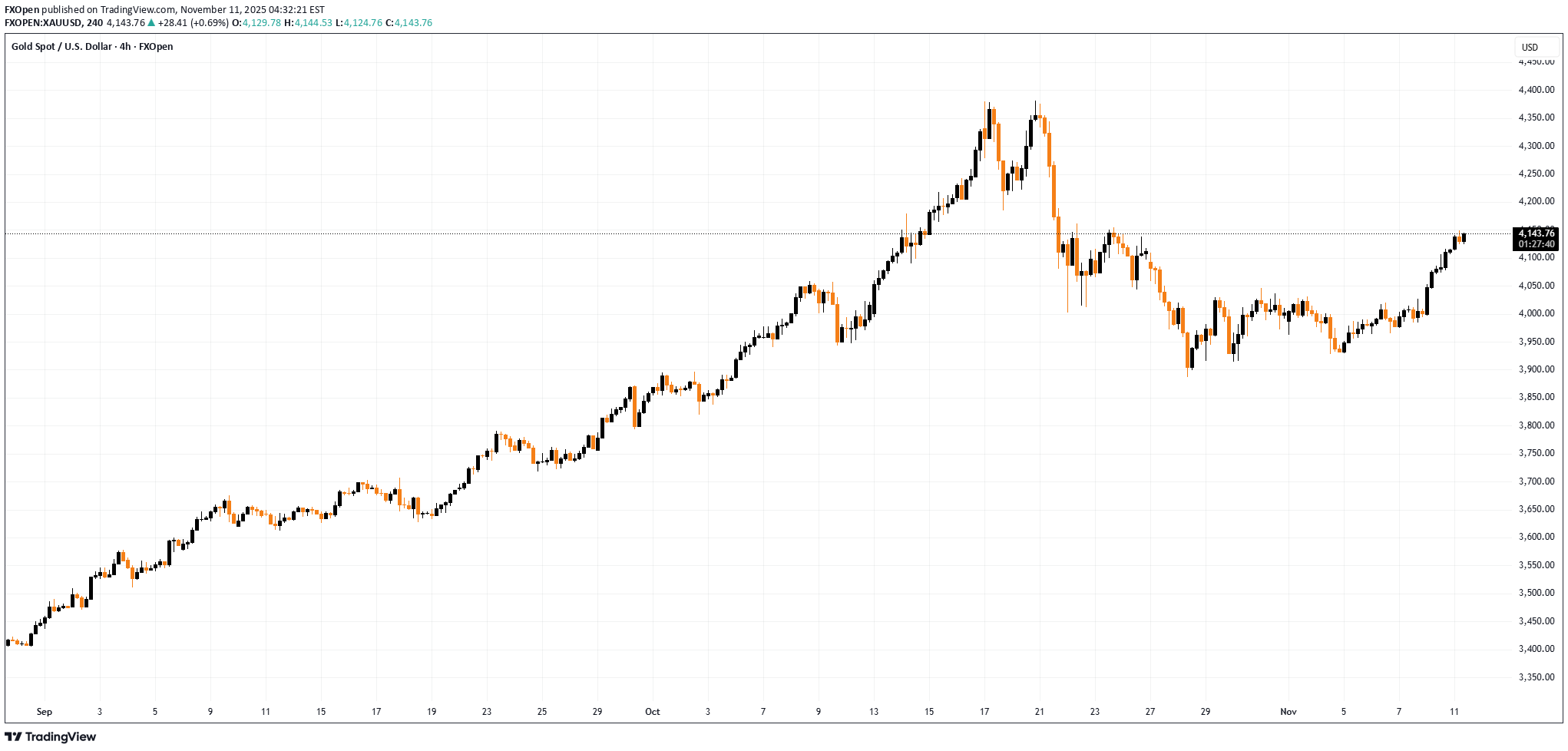

The Shutdown Ends: How Will Gold Prices React? According to Reuters, the U.S. Senate on Monday approved a compromise deal to bring an end to the longest government shutdown in the country’s history. During the shutdown: → millions of Americans lost access to food assistance programmes; → hundreds of thousands of federal employees went without pay; → air travel was severely disrupted. The uncertainty surrounding the potential continuation of the shutdown appears to have contributed to a breakout in the price of gold (as a traditional safe-haven asset) above its recent consolidation zone, marked by black lines on the chart. However, further gains could be capped not only by fading risk aversion but also by a less obvious resistance level, which the XAU/USD rate has reached today. Technical Analysis of the XAU/USD Chart Using the key pivot points (highlighted in bold), we can trace a descending channel, with the gold price now testing its upper boundary, where resistance may emerge. Another argument supporting this view is that the price currently sits around the 50% retracement level of the A→B downswing. This area may attract sellers seeking to defend the downward trajectory of gold. Whether this resistance line holds — or the bulls attempt to reignite the autumn rally — will largely depend on the tone of upcoming economic releases (delayed by the shutdown) and their impact on market expectations for a possible Federal Reserve rate cut. This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.