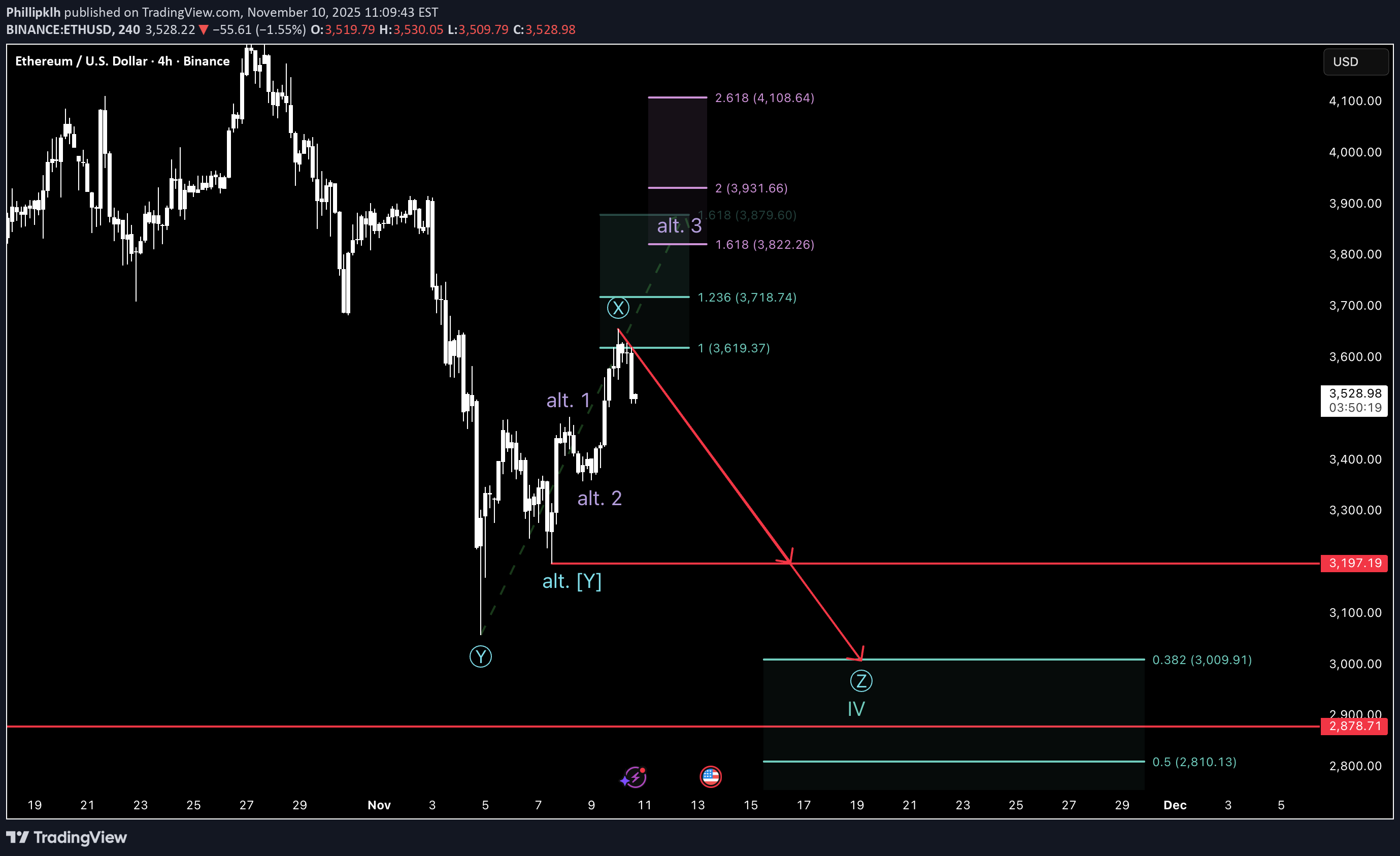

Technical analysis by Phillipklh about Symbol ETH: Sell recommendation (11/10/2025)

Phillipklh

تحلیل هفتگی اتریوم (ETH): آیا تزریق نقدینگی فدرال رزرو به معنای سقوط بزرگ بعدی است؟

The Deutsche Bank expects the Fed to start printing money in the beginning of December. In addition to that, we already saw a liquidity shortage in the past weeks, with the Fed reacting with a $21B liquidity injection into the system to keep the system running and prevent a bank run. After all that, there is also the massive debt of the US, which can't be paid off properly anymore and needs to be monetized by inflation. These factors lead to this point, where liquidity needs to be injected. Funding Rates show local highs, suggesting the local top is in. The liquidity heatmap shows liquidity above us, which leads to the thesis that after this move most traders are entering leveraged short positions now. The bottom could be in when Funding Rates flip negative. The current count as seen on the chart shows that the corrective movement isn't over and this has to reasons: Firstly, the indicators of the superior timeframe and cycle do not show signs of the end of this corrective movement and secondly, the current structure doesn't show the impulsiveness I'd like to see of a first wave. The alternative scenario is invalidated as we break the red market low, but the chances for the alternative scenario already lowered massively because of the big candle facing downwards. My favored position here is definitely a short but the chances getting liquidated or stopped out are very high. Stop loss would be at one peercent above the high of the X and take profit at the low of the Z.