Technical analysis by ProjectSyndicate about Symbol PAXG: Sell recommendation (11/9/2025)

تحلیل طلای هفته آینده: سطوح حیاتی حمایت و مقاومت برای معاملهگران

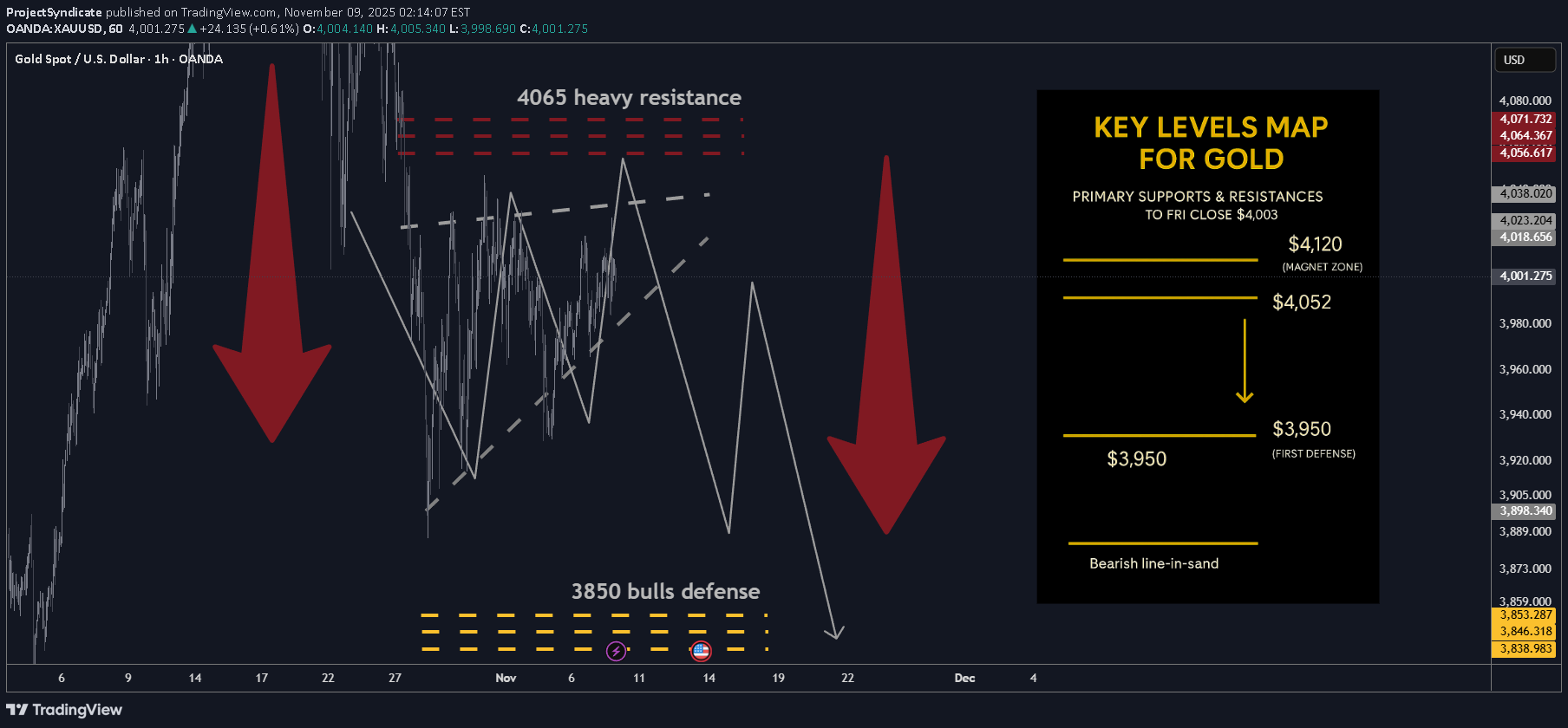

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: $4,024.9 → ~$4,003 — sellers faded upticks; weekly close soft but back above the round $4k. 📈 Trend: Neutral / mild correction inside range; not expecting immediate new highs while <$4,080–4,120. 🛡 Supports: $3,950 → $3,900 → $3,850 — pivotal shelves for bears’ take-profit and control. 🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply zones; first taps favored for fades. 🧭 Bias next week: Short sells into $4,040–$4,120; TP $3,950 then $3,850 (your plan). Invalidation on sustained reclaim > $4,120–$4,175; loss of $3,850 risks extension lower. 🌍 Macro tailwinds/headwinds (this week’s tape): •Narrative tone: Kitco flagged “razor’s edge” near $4,000 with mixed views (bubble vs. consolidation), while another Kitco piece framed the stall as a “healthy pause.” •WSJ flow: Headlines oscillated between “slips below $4,000” and modest up-days; net read is consolidation around $4k with quick two-way trade. •Levels: Spot finished the week essentially on $4k; intrawEEK high couldn’t clear early-week $4.02–4.03k cap. 🎯 Street view: After last month’s print above $4,000 (first ever), WSJ tone shifted to digestion; rallies still attract supply until a decisive reclaim of upper resistance. ________________________________________ 🔝 Key Resistance Zones •$4,040 — immediate ceiling; weekly high proximity, likely to cap first tests. •$4,080 — secondary supply ledge from recent failures. •$4,120 — upper band; acceptance above here starts to neutralize the correction. 🛡 Support Zones •$3,950 — first defense / first TP. •$3,900 — round-number shelf; loss invites momentum probes. •$3,850 — critical structural base and second TP; break risks downside acceleration. ________________________________________ ⚖️ Base Case Scenario Compression within a rising-wedge-like structure, ranging $3,850–$4,120. First pushes into $4,040–$4,120 are sellable for rotations toward $3,950 → $3,850 while the market respects weekly lower highs. 🚀 Breakout / Breakdown Triggers •Bull trigger: Sustained acceptance > ~$4,120–$4,175 turns the tone constructive again and reopens $4,200+. •Bear trigger: Daily close < $3,900 increases odds of full $3,850 test; failure of $3,850 risks momentum spill. 💡 Market Drivers to watch •Fed path / real yields (rate-cut odds vs. sticky inflation narrative in WSJ copy). •USD swings (no broad USD weakness → upside attempts stall). •ETF/CB flows (Kitco interviews highlight split sentiment; dip-buyers active, momentum players cautious). •Event risk (headline sensitivity remains high; quick squeezes into resistance possible). 🔓 Bull / Bear Trigger Lines •Bullish above: $4,120–$4,175 (sustained). •Bearish below: $3,900 → $3,850 (risk expands under $3,850). 🧭 Strategy for this week Short from resistance: Scale in around $4,040 → $4,080 → $4,120; TP #1: $3,950; TP #2: $3,850; Risk: Hard stop on a daily close above $4,120 (or intraday breach that holds on retest). Consider trimming if a news-driven squeeze tags $4,175 and fails.🏆 GOLD WEEKLY OUTLOOK — RANGE COMPRESSION PLAY 💰 $4,024 → $4,003 — Weekly close steady above $4k; sellers capped upside. ⚖️ Trend: Neutral / corrective; range-bound under $4,080–$4,120. 🏗 Structure: Rising wedge compression — momentum fading. 🎯 Strategy: Short $4,040–$4,120; targets $3,950 → $3,850. 🧱 Supports: $3,950 / $3,900 / $3,850 — bears’ take-profit zones. 🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply caps. 🌍 Macro tone: WSJ & Kitco — “consolidation near $4k,” real yields firm, USD mixed. 🔥 Bear trigger: Daily close < $3,900 → opens $3,850 test. 🚀 Bull trigger: Sustained > $4,120–$4,175 → reversal risk. 🧭 Bias: Sell strength, stay nimble; rising wedge = fade rallies, book profits on dips.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀Gold Bull Market Update and Outlook Q4 2025 / Q1 2026