Technical analysis by pakoumal about Symbol QQQX on 11/8/2025

QQQ در کانون توجه: آیا صعود ادامه مییابد یا دامنه نوسان میشکند؟ (تحلیل 7 نوامبر)

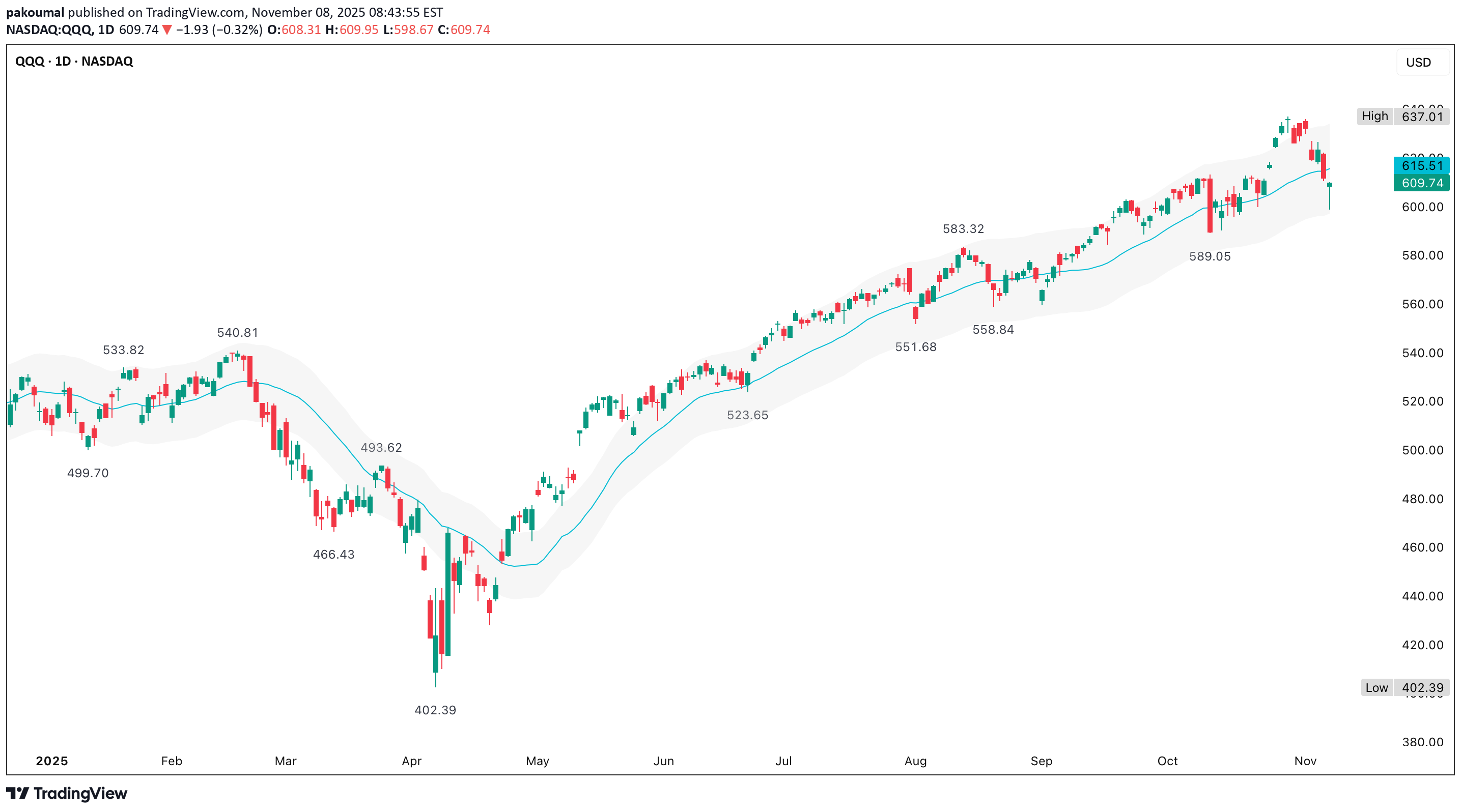

QQQ remains within statistical bounds of its uptrend A daily close back above $625 would re-open the path to $637+, while a close below $595 would warn that the current mean-reverting structure is breaking down The ±3% price envelope nicely visualizes how tightly QQQ has been hugging its midline trend & how contained volatility has been despite recent pullbacks The upper band (+3%) ≈ $635-$640 The lower band (−3%) ≈ $592-$595 The recent dip to ~$600 perfectly tagged the -3 % boundary, confirming that pullbacks have stayed within normal statistical volatility - a hallmark of a healthy uptrend Each prior test of the lower band (June, mid-August, early October) led to mean reversion & then fresh highs within 2-3 weeks A compression of price between $600-$620 while the ±3 % envelope narrows would likely precede a volatility burst for late November to early December Hold >$611 is constructive; targets $625 to $635 Close <$600 suggest trend fatigue; would signal risk of a move toward $585-$590