Technical analysis by Actualjustice about Symbol PAXG: Buy recommendation (11/8/2025)

Actualjustice

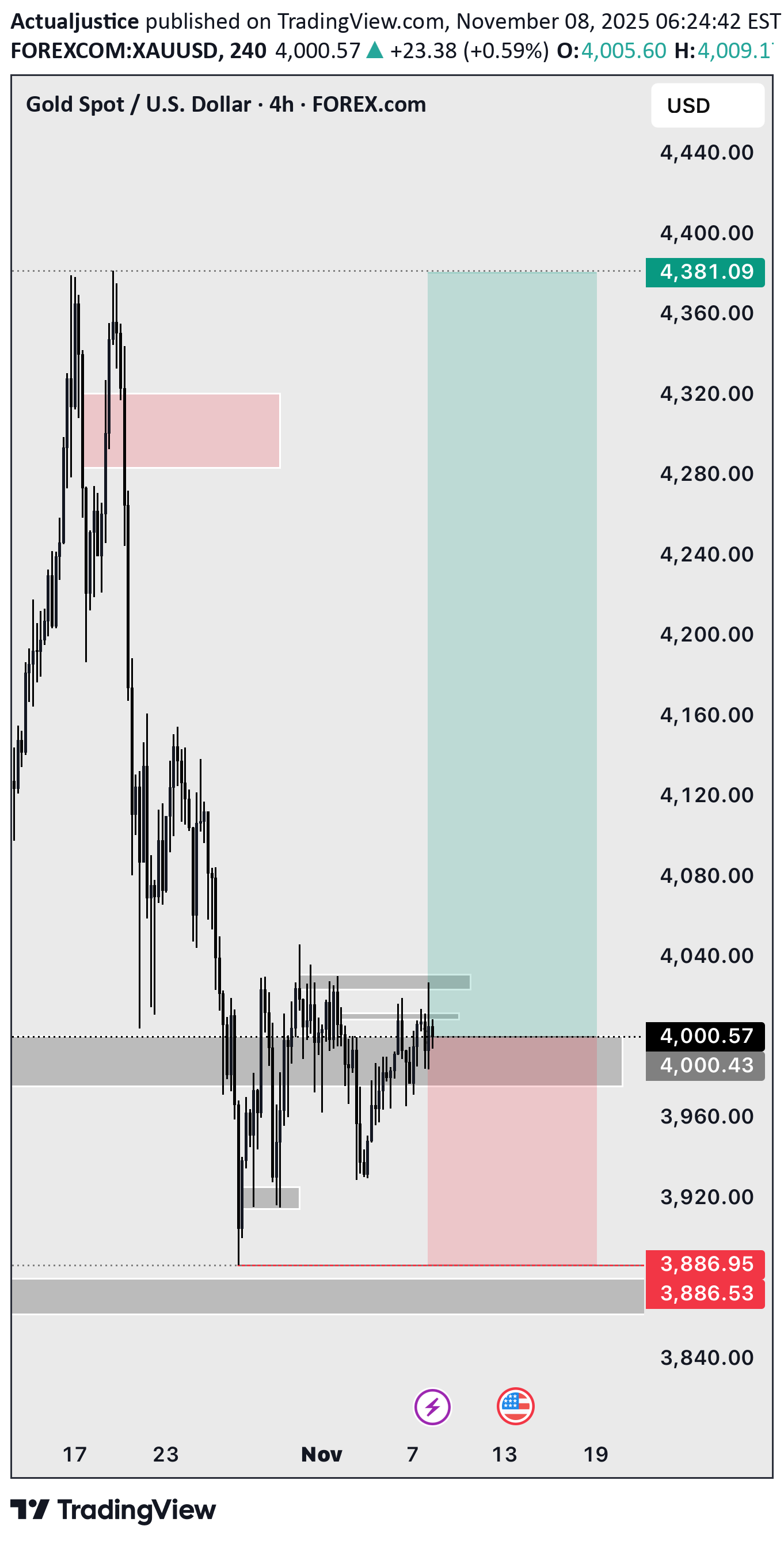

پیشبینی طلا (XAU/USD): مسیر صعودی کوتاهمدت تا هدف 4360 دلار

XAUUSD Bias: Short-term bullish retracement toward prior high Price is currently reacting from a well-defined support zone around the 4,000 region, where buyers have shown repeated willingness to step in. The market has consolidated within this zone, forming a series of higher lows, which signals accumulation and potential exhaustion of the previous bearish leg. My entry aligns with the structural demand. The rejection wick at the base of the zone suggests failure to break lower, strengthening the case for a bullish move. As long as price holds above the marked support, the market maintains a realistic path toward the previous swing high above 4,360, which is the projected target. The bullish target area also aligns with the broad imbalance / inefficiency zone created during the earlier sell-off. Markets commonly retrace to rebalance these areas before deciding on the next major directional move. Your stop-loss placement below 3,886, under the structural low and beneath the liquidity sweep, is logical. If price violates this level, it would invalidate the bullish thesis and confirm continuation to the downside. In summary: • Market is respecting a valid demand zone. • Accumulation structure favors a bullish corrective leg. • First major liquidity pool sits above 4,360 (your target area). • Stop-loss below 3,886 protects the trade idea while honoring market structure. ⸻ Devil’s Advocate — What Could Break This Plan? To strengthen your thinking, here are the strongest counter-arguments: 1. The “demand zone” may actually be redistribution. If this is a bearish continuation, the sideways movement could simply be sellers reloading before pushing price to new lows. 2. Liquidity above 4,360 might NOT get hit yet. Price could rally halfway into the inefficiency and reject aggressively without filling the entire imbalance. ⸻ Three Clarifying Questions you should ask(to tighten your analysis) 1. What confirms for you that this is accumulation and not redistribution? 2. If price only retraces to the midpoint of the imbalance (around 4,260), do you still hold full TP at 4,360? 3. What invalidation level—besides the SL—would signal loss of bullish momentum?