Technical analysis by ELDORADOFX about Symbol PAXG on 11/5/2025

تحلیل طلای امروز: آیا طلا به ۴۰۰۰ دلار میرسد؟ (راهنمای معاملاتی جلسه آمریکا)

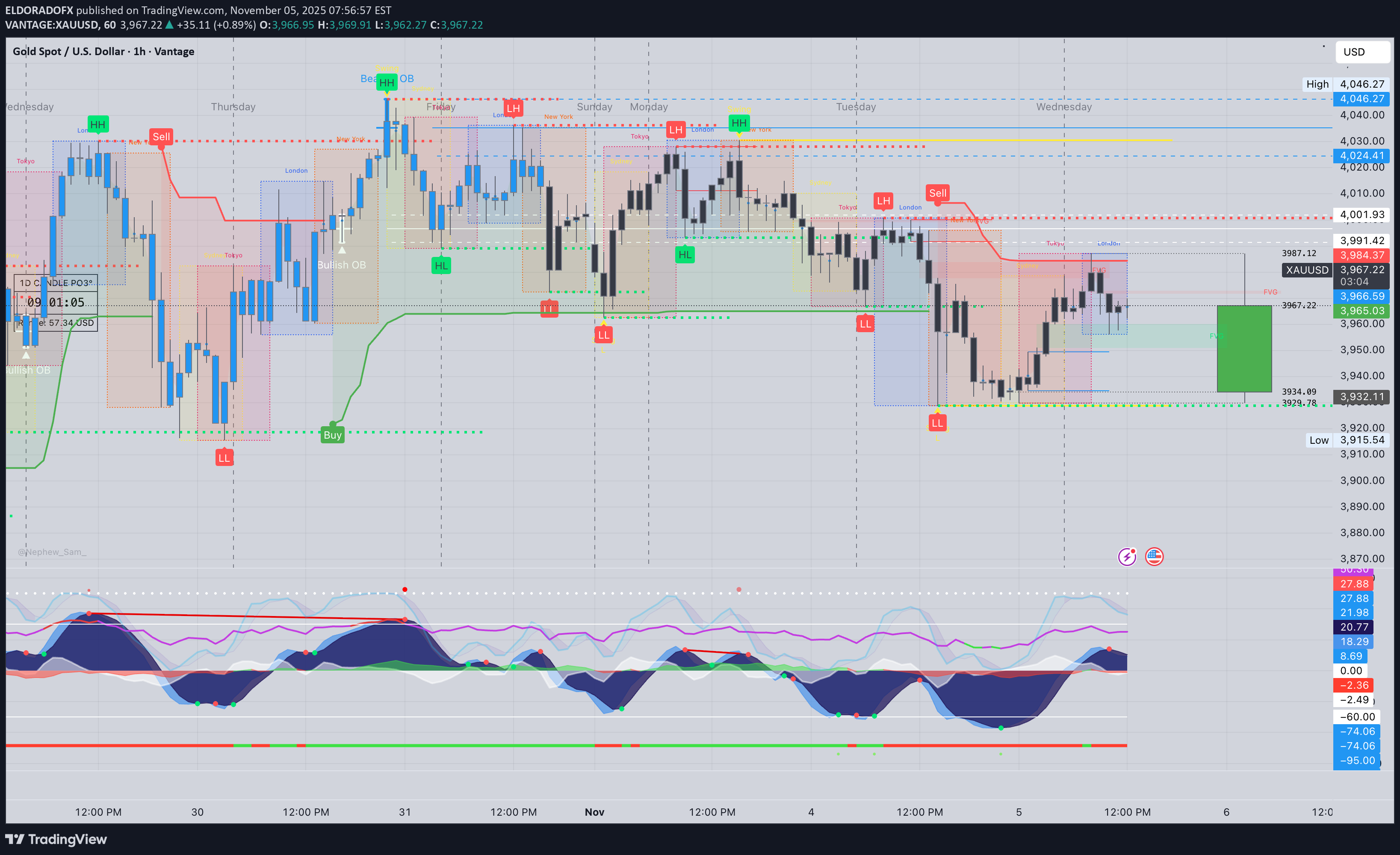

1️⃣ Market Overview Gold holds steady around $3,965, consolidating after yesterday’s rebound from $3,932 lows. The US session opens ahead of ADP Employment and ISM Services PMI, which are likely to drive volatility. The current price remains in a mid-term corrective phase after the sharp rally to $4,100, and sentiment leans mildly bullish as long as the $3,950 support remains intact. ⸻ 2️⃣ Technical Breakdown • Daily (D1): Gold continues its pullback after the rejection from $4,100, forming higher lows above $3,870 (100 EMA). RSI at 48 shows neutral-to-slight bullish momentum; no bearish divergence visible. • H1: Structure is consolidative between $3,950 – $3,975 with resistance at 200 EMA and ascending trendline support beneath. Bulls are defending the trendline successfully so far. • 15M–5M: Short-term compression forming a potential bullish breakout setup. MACD shows a flattening histogram with early signs of momentum reactivation to the upside. ⸻ 3️⃣ Fibonacci Analysis Last Swing: 3,987 → 3,928 •38.2% → 3,950 •50.0% → 3,957 •61.8% → 3,965 🎯 Golden Zone: 3,950 – 3,965 (active reaction area aligning with trendline & 100 EMA on 15M). ⸻ 4️⃣ High-Probability Trade Scenarios 📈 Buy Scenario (Main Bias) •Entry Zone: 3,950 – 3,965 (within the Golden Zone). •Targets: 3,975 → 3,990 → 4,010 → 4,045 •Stop Loss: Below 3,940 •Confirmation: 15M bullish engulfing, RSI > 60, and MACD crossover to positive. 💥 Breakout Buy Setup •Trigger: Break and close above 3,975 •Retest Zone: 3,970 – 3,972 •Targets: 3,990 → 4,015 → 4,045 → 4,060 •Stop Loss: Below 3,960 ⸻ 📉 Sell Scenario (Countertrend) •Entry Zone: 3,975 – 3,990 (supply zone near 200 EMA). •Targets: 3,955 → 3,940 → 3,925 •Stop Loss: Above 3,995 •Confirmation: Bearish rejection candle or RSI divergence under 55. ⚡ Break & Retest Sell Setup •Trigger: Break below 3,940 •Retest Zone: 3,945 – 3,950 •Targets: 3,925 → 3,905 → 3,880 •Stop Loss: Above 3,960 ⸻ 5️⃣ Fundamental Watch •US ADP Non-Farm Employment Change – early indicator of Friday’s NFP. •ISM Services PMI – potential volatility driver for DXY and XAUUSD correlation. •Fed commentary and yield direction may influence session bias. ⚠️ High volatility expected during releases – avoid over-leveraging. ⸻ 6️⃣ Key Technical Levels TypeLevel (USD)Notes Resistance 13,975200 EMA + structure high Resistance 23,990Key supply & fib extension Support 13,955Intraday support Support 23,940Breakout validation point Trendline Support3,950Golden Zone confluence Breakout Triggers>3,975 / <3,940Defines session direction ⸻ 7️⃣ Analyst Summary Gold is currently compressing within the Golden Zone ahead of US data. Market bias remains bullish above 3,950, with the possibility of a breakout toward 4,000–4,015 if resistance breaks cleanly. A failure to hold above 3,950 will shift momentum short-term bearish toward 3,925 and below. ⸻ 8️⃣ Final Bias Summary 📊 BULLISH while above 3,950, targeting 3,990 – 4,015 🔻 BEARISH only if price breaks below 3,940, targeting 3,925 – 3,905 — ElDoradoFx PREMIUM 3.0 Team 🚀 ⸻