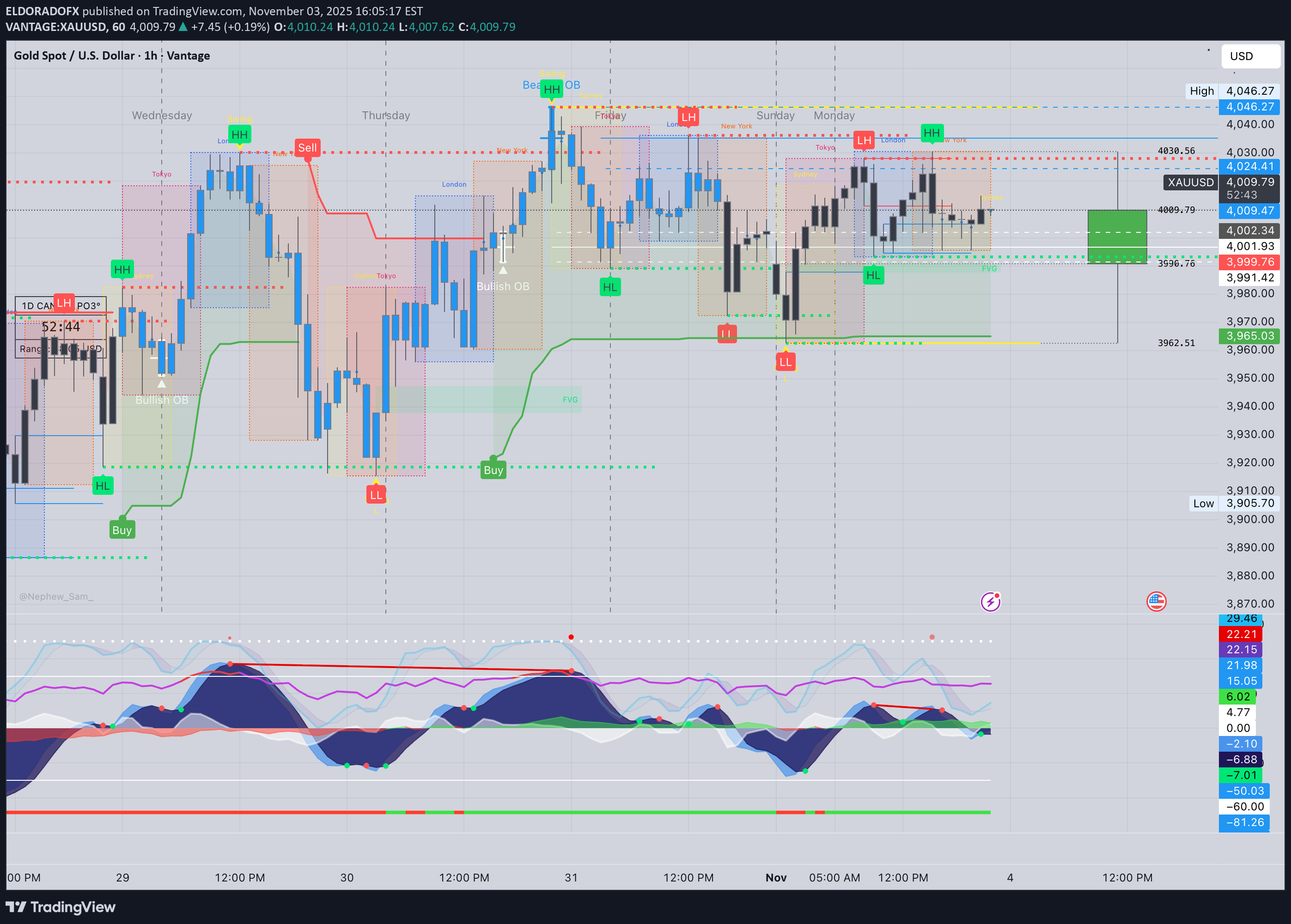

Technical analysis by ELDORADOFX about Symbol PAXG on 11/3/2025

تحلیل طلا: منطقه طلایی 4008-4016 و انتظار برای انفجار آسیا

Gold ends the NY session stabilizing near 4,009, after multiple rejections from 4,025–4,030, confirming that sellers are still defending the upper liquidity zone. Meanwhile, buyers continue holding 4,004–3,995, maintaining a short-term ascending structure. This compression phase between resistance and support signals an imminent breakout setup — with Asia likely to decide direction for the next leg. ⸻ 📊 Technical Outlook 🔹 D1: Gold remains bullish above the 100EMA, sustaining higher lows from 3,962 → 3,985 → 3,995. RSI ~52 — neutral but holding mid-range momentum. Daily breakout above 4,025 could reopen the path toward 4,060–4,082. 🔹 H1: Structure compressing between 4,025 resistance and 3,995 support. EMAs converging; MACD neutral with low volatility — ideal for a pre-breakout scenario. 🔹 15M–5M: Price forming equal highs at 4,011–4,012 and higher lows near 4,004. RSI 54–58, indicating gradual bullish accumulation before volatility expansion. ⸻ ✨ Fibonacci Golden Zone (Last Swing 3,995 → 4,030) 38.2% = 4,016 50.0% = 4,012 61.8% = 4,008 🎯 Golden Zone: 4,016 – 4,008 (acting as key liquidity zone and short-term pivot). ⸻ 🎯 High Probability Zones 📈 BUY SCENARIO (Primary Bias) ✅ Buy Zone: 4,016 – 4,008 (Golden Zone) 🎯 Targets: 4,025 → 4,036 → 4,046 → 4,060 🛑 Stop Loss: Below 3,995 ⚡ Confirmation: Bullish engulfing or CHoCH above 4,012–4,016 with MACD crossover upward. 📊 Bias Rationale: The market continues to respect higher lows and absorb liquidity dips — indicating smart money accumulation around the Golden Zone. 💥 Breakout BUY Setup Trigger: Break & close above 4,025 Retest: 4,022–4,024 🎯 Targets: 4,036 → 4,046 → 4,060 → 4,082 🛑 Stop Loss: Below 4,010 📉 SELL SCENARIO (Contingency Setup) ⚠️ Sell Zone: 4,025 – 4,036 (liquidity pocket + supply zone) 🎯 Targets: 4,012 → 4,004 → 3,985 → 3,965 🛑 Stop Loss: Above 4,046 ⚡ Confirmation: Sharp rejection or RSI divergence >65 from 4,025–4,030 area. 📉 Break & Retest SELL Setup Trigger: Break below 3,995 Retest: 4,000–3,997 🎯 Targets: 3,982 → 3,965 → 3,945 🛑 Stop Loss: Above 4,008 ⸻ 📰 Fundamental Watch • Asia session: Low-impact day; volatility expected from liquidity sweeps. • US Dollar Index (DXY) holding above 106 — mild pressure on gold short-term. • Global markets: Traders positioning ahead of Fed and NFP later this week, keeping gold in range mode for now. ⸻ 📌 Key Levels Resistance: 4,025 / 4,036 / 4,046 / 4,060 Support: 4,012 / 4,004 / 3,995 / 3,982 Golden Zone: 4,016 – 4,008 Break Buy Trigger: > 4,025 Break Sell Trigger: < 3,995 ⸻ ✅ Summary (Expert View) Gold remains bullish-to-neutral, consolidating between 4,004–4,025. The Fibonacci Golden Zone (4,016–4,008) continues to act as the core decision area — expect Asia to attempt a liquidity sweep before breakout. ⚡ Expert Bias: BUY setup favored above 4,008, targeting 4,036–4,046. Bearish bias only if 3,995 breaks cleanly.