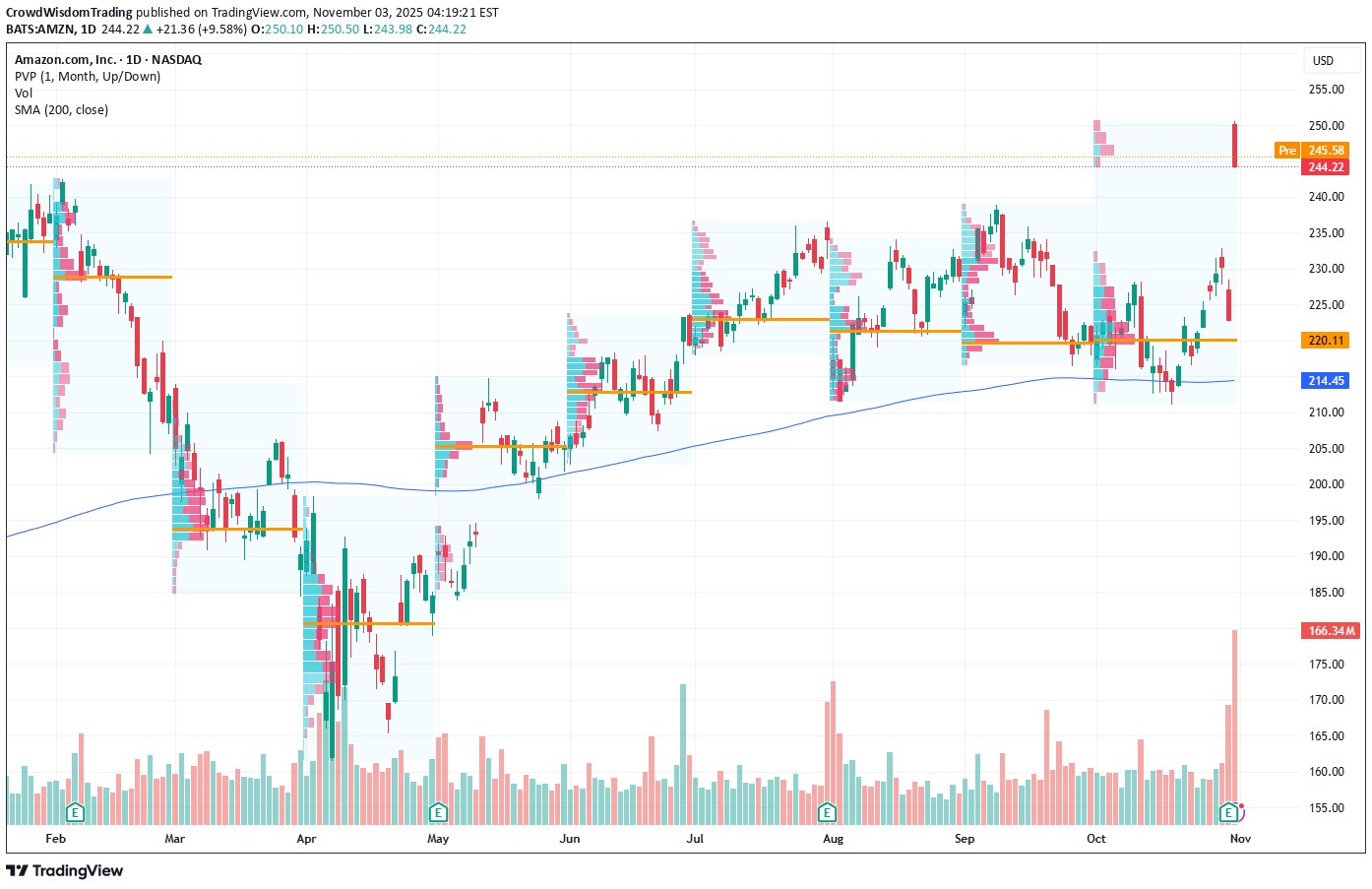

Technical analysis by CrowdWisdomTrading about Symbol AMZNX: Buy recommendation (11/3/2025)

CrowdWisdomTrading

خیز بزرگ آمازون (AMZN): سیگنالهای قوی برای صعود به ۲۶۲ دلار!

Current Price: $244.22 Direction: LONG Targets: - T1 = $255.50 - T2 = $262.00 Stop Levels: - S1 = $239.50 - S2 = $234.00 **Wisdom of Professional Traders:** This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market opinions often outperform individual forecasts, minimizing biases and offering a consensus view on AMZN’s current trajectory. **Key Insights:** Amazon remains at the forefront of innovation and market dominance across multiple sectors, including e-commerce, cloud computing, and digital advertising, with 2025 projections indicating sustained growth across its key business units. AWS, Amazon’s cloud platform, continues to outperform competitors by capitalizing on generative AI technologies, offering enterprise solutions that promote adoption and profit expansion in high-margin areas. Amazon's growing efficiency in supply chains and expanding advertising network further solidify its revenue streams. Furthermore, the stock’s technical structure exhibits bullish signs, with AMZN climbing past the critical $240 resistance level during early November. Accompanying this breakout were significant volume surges indicative of strong institutional buying interest. With holiday-season retail and AWS growth expected to peak during Q4, Amazon’s market positioning remains highly favorable, supported by attractive fundamentals. **Recent Performance:** AMZN has shown strong appreciation in recent weeks, gaining 6.8% over October thanks to better-than-expected Q3 2025 earnings. The stock previously oscillated within a range of $220-$238, consolidating before bursting through resistance at $240 in early November. This breakout was catalyzed by positive investor sentiment surrounding high-growth segments such as AWS and digital advertising revenue. While small pullbacks occurred on lighter volume, the price action remains predominantly upward, aligning with broader industry optimism. **Expert Analysis:** Leading financial analysts expect AMZN to outperform seasonal expectations during the end-of-year holiday quarter due to robust e-commerce sales and its world-class logistics network—an essential differentiator. Technical experts, meanwhile, highlight AMZN's “golden cross” pattern, where the 50-day moving average has crossed above the 200-day moving average, signaling prolonged bullish momentum. RSI levels at 62 indicate that the stock has upward room without approaching overbought territory, providing traders with confidence for further gains. **News Impact:** Recent announcements on Amazon’s large-scale collaborations to enhance generative AI capabilities within AWS have fueled investor expectations for continued innovation and financial performance. Amazon’s revised Q4 guidance anticipates record-breaking holiday sales driven by improving consumer demand alongside logistics efficiency. Additionally, commentary from company leadership has reinforced optimism regarding expanded market opportunities amidst persistent global demand for cloud computing services. **Trading Recommendation:** Taking a LONG position on AMZN at $244.22 is strongly supported by both fundamental performance and technical indicators. The stock's breakout above $240 confirms bullish momentum, with price targets set conservatively at $255.50 and $262.00. To safeguard against volatility, traders should establish stop-loss levels at $239.50 and $234.00, ensuring minimal risk exposure. With seasonal revenue acceleration, robust AWS growth, and sustained institutional interest, a well-timed entry could provide significant profit potential during Amazon’s strongest quarter in 2025. Do you want to save hours every week? Register for the free weekly update in your language!