Technical analysis by ELDORADOFX about Symbol PAXG on 11/3/2025

تحلیل تکنیکال طلا: طلسم شکسته میشود؟ سناریوهای خرید و فروش در جلسه لندن

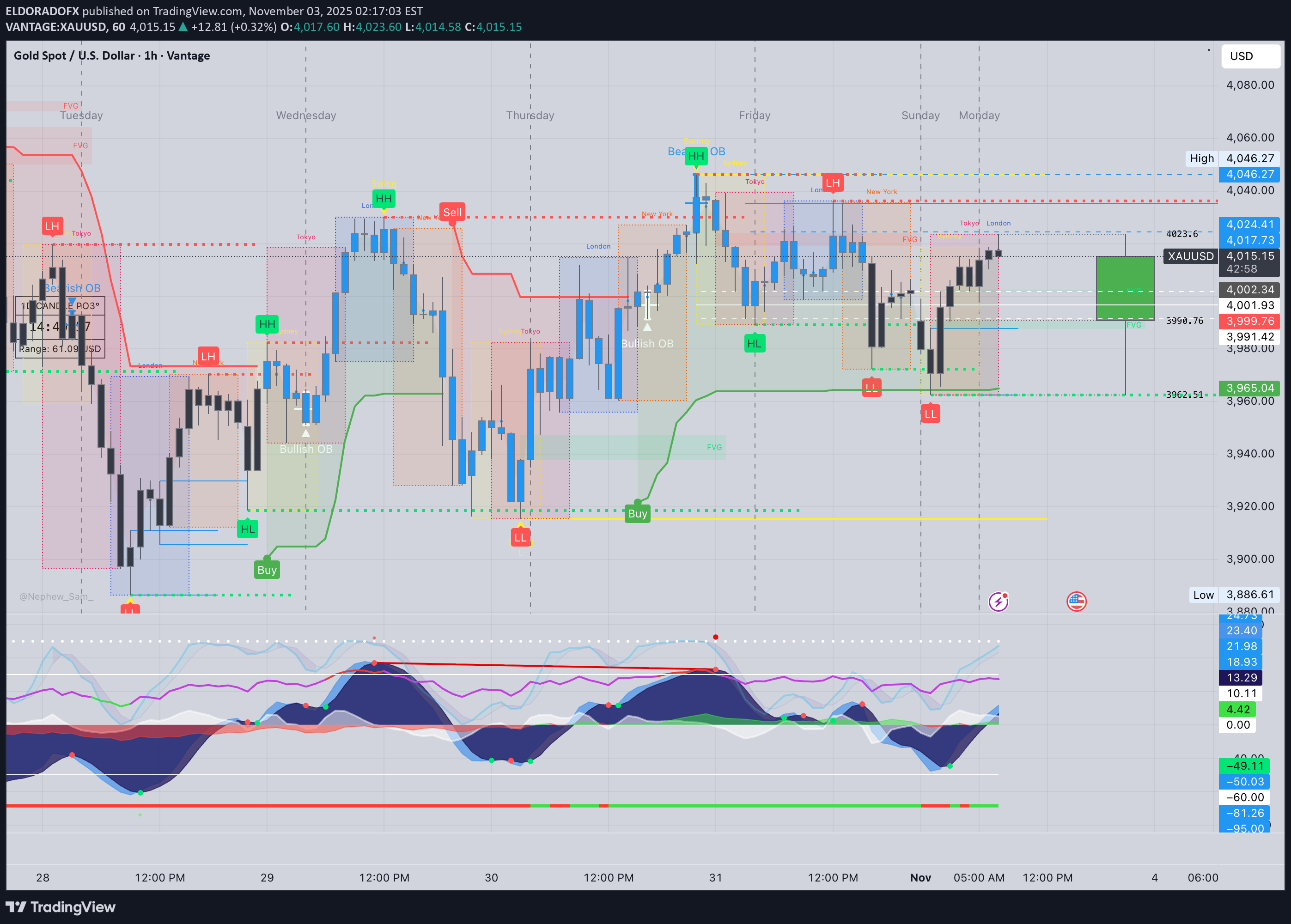

1️⃣ Market Overview Gold continues its bullish momentum from the 3,962 weekly low, now trading around 4,018–4,020, with clear signs of accumulation above the 200 EMA. The market remains in an upward correction phase, with intraday structure showing strong recovery and possible breakout above key resistance. London session focus: whether gold can sustain above 4,023 to confirm a continuation toward 4,036–4,046. ⸻ 2️⃣ Technical Breakdown 🟢 Daily (D1) •The daily candle remains bullish, holding above the 10EMA (≈4,010) and approaching resistance near 4,036. •RSI at 61, signaling sustained recovery momentum. •MACD histogram decreasing red volume, hinting at reversal continuation potential. 🟡 H1 (Hourly) •Price structure: higher lows from 3,962 → 3,985 → 4,000, forming a bullish channel. •Break of structure at 4,015 with RSI 56+, confirming bullish control. •Price testing the descending trendline and 200EMA (4,022–4,026 zone). •MACD momentum positive, suggesting strength for a potential London breakout. 🔵 15M–5M (Intraday) •Bullish BOS (Break of Structure) confirmed at 4,010; price consolidating below 4,023 liquidity zone. •RSI 65 → near breakout threshold. •EMAs aligned bullishly (50EMA > 100EMA > 200EMA). •MACD showing continued bullish histogram expansion. ⸻ 3️⃣ Fibonacci Analysis Last swing: 3,962 → 4,036 LevelPrice 38.2%4,017 50.0%3,999 61.8%3,982 🎯 Golden Zone: 3,999 – 3,982 → Ideal retracement zone for continuation buys if price corrects. ⸻ 4️⃣ High-Probability Trade Scenarios ✅ BUY SCENARIO (Main Bias) Buy Zone: 3,999 – 3,982 (Golden Zone) Confirmation: 5M–15M bullish CHoCH + RSI >55 🎯 Targets: •TP1 → 4,023 •TP2 → 4,036 •TP3 → 4,046 •TP4 → 4,060 🛑 SL: Below 3,975 Breakout Buy: Trigger: Break & retest above 4,023 🎯 Targets: 4,036 → 4,046 → 4,060 🛑 SL: Below 4,010 ⸻ ⚠️ SELL SCENARIO (Countertrend) Sell Zone: 4,023 – 4,036 (Liquidity trap + 200EMA rejection) Confirmation: RSI divergence + rejection candle on 15M 🎯 Targets: •TP1 → 4,008 •TP2 → 3,995 •TP3 → 3,982 🛑 SL: Above 4,046 Breakout Sell: Trigger: Break below 3,975 🎯 Targets: 3,962 → 3,945 🛑 SL: Above 3,990 ⸻ 5️⃣ Fundamental Watch •UK Manufacturing PMI early volatility may drive session movement. •US ISM Manufacturing PMI and Fed Williams speech later today could bring sharp USD reactions. •DXY hovering near 106.10, slightly weakening — bullish bias for gold if this continues. ⸻ 6️⃣ Key Technical Levels TypeLevels Resistance4,023 / 4,036 / 4,046 / 4,060 Support4,008 / 3,995 / 3,982 / 3,962 Golden Zone3,999 – 3,982 Break Buy Trigger> 4,023 Break Sell Trigger< 3,975 ⸻ 7️⃣ Analyst Summary Gold continues its bullish recovery from the 3,960 zone and is currently testing structural resistance at 4,023. A confirmed breakout and retest above 4,023 would open the path to 4,036–4,046, while a failure at this level could lead to short-term retracement toward 3,995–3,982 (Golden Zone) before continuation. ⸻ 8️⃣ Final Bias Summary •Primary Bias: 🟢 Bullish above 4,008 → Target 4,036–4,046 •Secondary Bias: 🔴 Bearish below 3,975 → Target 3,962–3,945 •Volatility: Moderate → may increase around PMI data. ⸻ — ElDoradoFx PREMIUM 3.0 Team 🚀