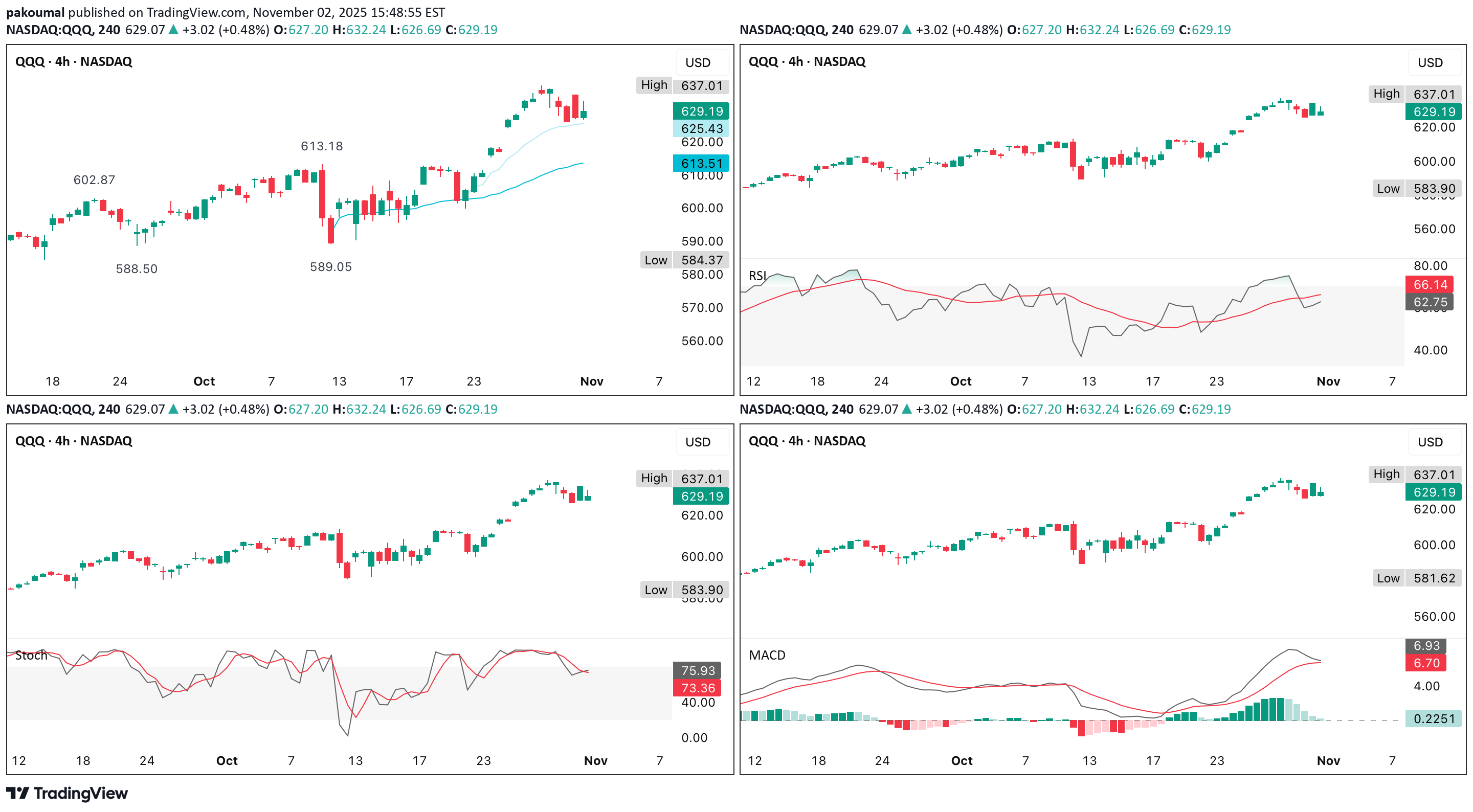

Technical analysis by pakoumal about Symbol QQQX on 11/2/2025

تحلیل تخصصی غولهای QQQ: رمزگشایی از سیگنالهای اپل، مایکروسافت و انویدیا برای حرکت بعدی بازار

Each stock is in a primary uptrend, but with slightly different phases of momentum - you’re seeing a bit of divergence among the “QQQ generals,' which is important AAPL Grinding higher, above 50d MA & within upper Bollinger band Still trending, but upper wicks = supply around $275-$277; likely digestion area MSFT Pullback from $555 to ~$520 after new highs Healthy retrace toward 50d MA so watch for higher low near $510-$515 NVDA Leading - broke out above prior $195 resistance, holding gains Most bullish of the 3; small-bodied candle near top = consolidation before next leg All 3 show small bodies with upper wicks, meaning buyers pushed early, but met resistance - a pause, not yet reversal No major bearish engulfing or heavy volume sell candle which suggests profit-taking, not panic RSI AAPL ~62 - mid-uptrend, not overbought MSFT ~56 - cooling, but healthy NVDA ~56 - steady strength RSI readings between 55-65 indicate trend continuation (no exhaustion yet) Stochastic AAPL/NVDA are curling up - supports continuation MSFT dipped, possibly a near-term bottom forming Watch for cross-ups below 20 for next entry cues MACD AAPL is still positive, slight flattening = momentum pause MSFT is bearish crossover forming (watch histogram near zero) NVDA is bullish crossover confirmed - strongest setup technically Volume Profile AAPL is slight uptick but not blow-off MSFT volume surge on red candle - likely earnings reaction fading NVDA high participation, but stable = institutions still active AAPL Above $270 = breakout continuation Bullish consolidation Watch for breakout >$277 or retest ~$258 support MSFT Needs hold >$515 to avoid deeper pullback Neutral–Bullish (short-term digestion) Accumulate on $510 retest if RSI holds >45 NVDA Above $200 breakout zone; $212 = extension target Bullish Buy-the-dip setup above $188-$190 (AVWAP support) Consolidation phase likely early next week, with NVDA likely to resume leading QQQ higher if $200-$202 holds QQQ remains in a strong uptrend, trading above the 50d MA & well above the 200d MA After an earnings rally (AAPL, AMZN, META) it pulled back slightly, but hasn’t broken support - meaning the trend is intact, but stretched The chart resembles a bullish pennant/flag forming just below the prior high (~$637-$640) Tight consolidation after a vertical rally = continuation potential Friday's small real body, upper wick - suggests sellers faded late-day strength, but not heavy distribution Strong breakout candles with solid volume confirm institutional accumulation So far, more of a rest bar than reversal bar Healthy momentum - RSI could cool near 60 without breaking trend MACD shows momentum slowing, not reversing Watch for histogram tick-up after 2-3 quiet days (potential signal for next leg higher) Stochastic curling down from overbought (80-90) Short-term pause likely, but still bullish mid-term unless it dips below 40 Volume was high during breakout (post-earnings), but tapered during the pullback - classic bullish pattern No sign of distribution selling yet Holding above $620 keeps the bull case fully intact & a breakout above $640 opens potential for $655-$665 targets (measured move from flag) AAPL neutral-bullish = confirming broad tech strength NVDA leading = risk-on sentiment still strong MSFT softening = brief digestion phase; not yet dragging the index VIX near cycle lows, TNX (yields) easing - macro tailwinds for growth stocks AAPL, AMZN, META, MSFT & TSLA have already reported strong earnings, so now semiconductors & AI names like AMD & PLTR become the next catalysts With NVDA earnings not until 19 November, AMD’s report Monday night effectively becomes a read-through for the AI/semiconductor complex, which heavily affects QQQ Best-case for bulls is a strong AMD report = renewed AI momentum - QQQ clears $640 resistance