Technical analysis by ProjectSyndicate about Symbol PAXG: Sell recommendation (11/2/2025)

ProjectSyndicate

تحلیل طلا هفته آینده: سطوح حیاتی حمایت و مقاومت و پیشبینی معاملهگران

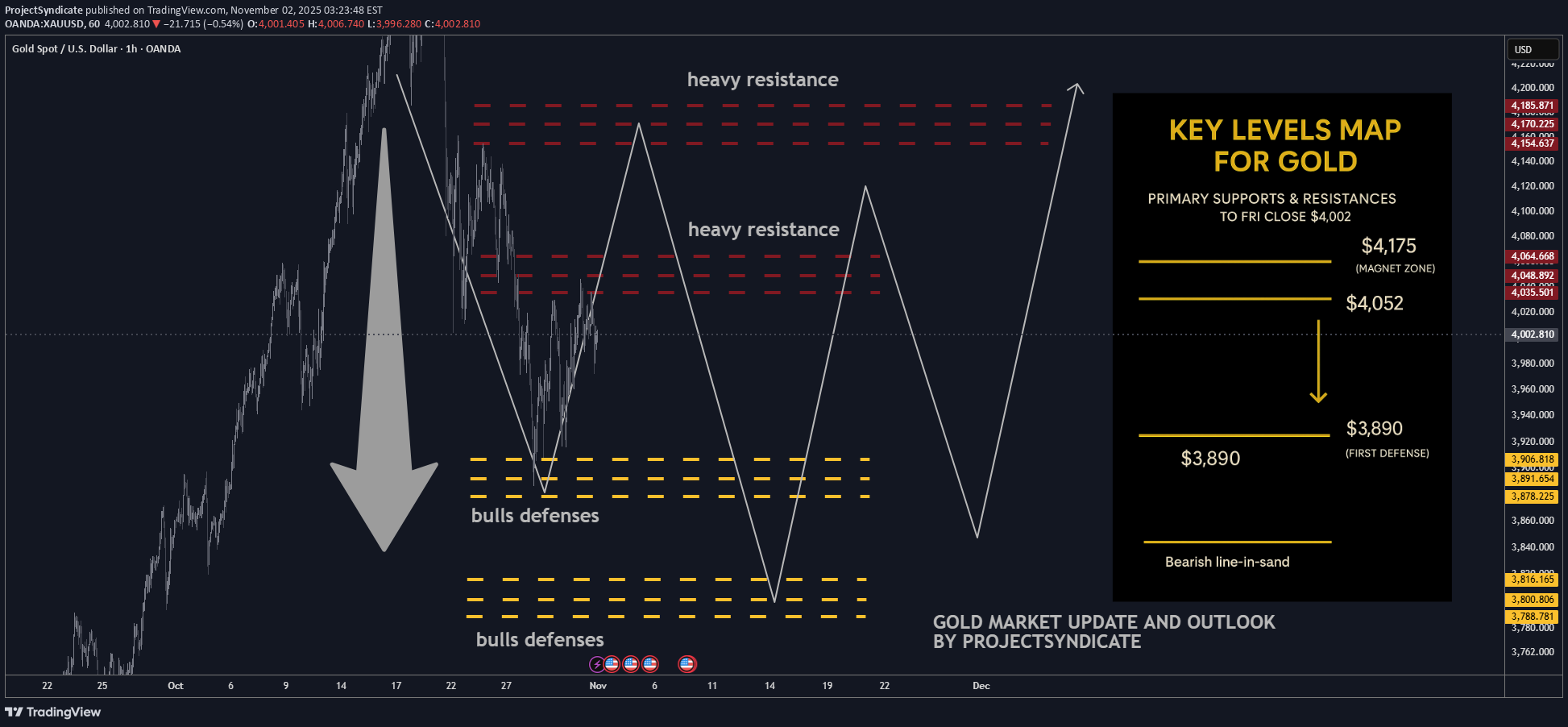

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: $4,108 → ~$4,002 — sellers defended overhead; weekly close soft within range. 📈 Trend: Neutral / correction mode still ON; not expecting new highs near term. 🛡 Supports: $3,890 → $3,800 — pivotal shelves for downside containment. 🚧 Resistances: $4,052 / $4,175 — magnet zones for supply / fade attempts. 🧭 Bias next week: Prefer short sells into $4,052–$4,175 with take-profit toward $3,890 → $3,800. Invalidation on sustained reclaim > $4,175; failure of $3,800 risks extension lower. 🌍 Macro tailwinds/headwinds : • Rates: Real yields stable-to-firm keep upside contained; any dovish surprise could spark squeezes into resistance. • FX: DXY mixed—lack of broad USD weakness limits impulse follow-through. • Flows: CB/ETF demand supportive on deep dips but tepid near highs. • Geopolitics: Event risk provides intermittent bids; not a trend driver this week. 🎯 Street view: Medium-term bullish narratives reserve diversification, policy easing into 2026 remain, but near-term tape favors mean-reversion lower under resistance. ________________________________________ 🔝 Key Resistance Zones • $4,052 — immediate ceiling; prior supply pivot likely to cap first tests • $4,175 — upper resistance; acceptance above flips tone from corrective to constructive 🛡 Support Zones • $3,890 — first defense; loss invites momentum probes • $3,800 — critical structural base; break risks downside acceleration ________________________________________ ⚖️ Base Case Scenario Range-to-soft trade within $3,800–$4,175. Rallies into $4,052–$4,175 are sellable; expect rotations back toward $3,890 with scope to $3,800 if sellers press. 🚀 Breakout Trigger Only a sustained acceptance > ~$4,175 negates the correction and opens $4,200+ pathing; conversely, firm rejection at $4,052 with a daily close < $3,890 increases odds of a $3,800 test. 💡 Market Drivers • Fed path & real-yield drift • USD index swings • ETF/CB flow tone on dips vs. rips • Risk sentiment headlines (geopolitics/trade) 🔓 Bull / Bear Trigger Lines • Bullish above: $4,175 correction phase likely over if held • Bearish below: $3,890 → risk expands under $3,800 🧭 Strategy Short-sell from overhead resistances ($4,052 → $4,175). Scale profits into $3,890 then $3,800; keep stops tight above trigger levels. Stand aside on fresh longs until sustained reclaim above $4,175 reasserts momentum.🔥 GOLD WEEKLY SNAPSHOT — PROJECTSYNDICATE 🏆 High/Close: $4,108 → $4,002 — soft finish; sellers capped upside. 📈 Trend: Neutral / correction mode still ON — no new highs expected. 🛡 Supports: $3,890 → $3,800 — key downside floors. 🚧 Resistances: $4,052 / $4,175 — strong overhead supply zones. 🧭 Bias: Short-sell into $4,052–$4,175 → targets $3,890–$3,800. 💣 Invalidation: Reclaim > $4,175 flips tone bullish; below $3,800 = deeper risk. 🌍 Macro: Stable yields & firm USD cap upside; dips supported by CB/ETF flows. ⚖️ Range View: Trade remains $3,800–$4,175 — rallies likely to fade. 🚀 Trigger: Sustained > $4,175 = breakout; < $3,890 = renewed weakness. 🎯 Strategy: Sell resistance, take profit near supports; avoid longs for now.let me know your thoughts on the above in the comments section 🔥🏧🚀🎁Please hit the like button and 🎁Leave a comment to support our team!