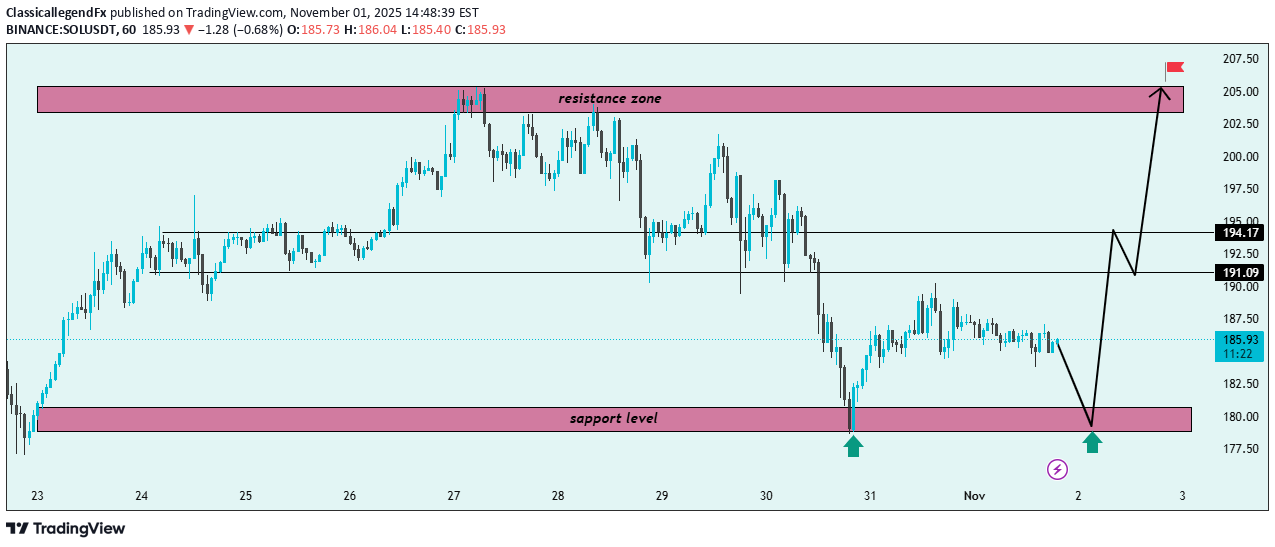

Technical analysis by ClassicallegendFx about Symbol SOL: Buy recommendation (11/1/2025)

ClassicallegendFx

سولانا (SOL) در آستانه انفجار؟ حمایت قوی و مسیر صعودی تا ۲۰۵ دلار!

1. Market Structure Overview The chart shows Solana (SOL/USDT) trading within a well-defined range between a support level (~$179–$182) and a resistance zone (~$203–$207). The price has recently tested the support zone multiple times (marked by green arrows), confirming its strength as a key demand area. 2. Key Technical Levels Support Level: $179–$182 → Major demand zone where price has bounced twice. Resistance Zone: $203–$207 → Supply area where previous rallies have reversed. Mid-level Zones: $191.09: Intermediate resistance (potential short-term reaction point). $194.17: Secondary resistance before the upper target zone. 3. Price Action Insight Price is currently consolidating around $185, showing indecision after a prior drop. The black projection arrows suggest a potential liquidity sweep of the support zone before a bullish reversal. Expected structure: A final dip toward $180 to retest support. A bullish reaction leading to a higher low formation. A break above $191–$194, confirming bullish continuation. A final push toward the resistance zone ($205) — the main target. 4. Trade Bias Bias: Bullish from support Confirmation Needed: Strong bullish candle or breakout from $191 resistance. Invalidation: Daily close below $178 support. 5. Target Projection Primary Target: $194 Final Target: $205 (resistance zone / flagged target) Summary: SOL/USDT is showing a potential bullish reversal setup from the $180 support zone. If price confirms strength with a bounce and breaks above $191–$194, the next rally could target the $205 resistance zone. A breakdown below $178 would invalidate the bullish scenario.