Technical analysis by fibcos about Symbol METAX: Buy recommendation (10/30/2025)

fibcos

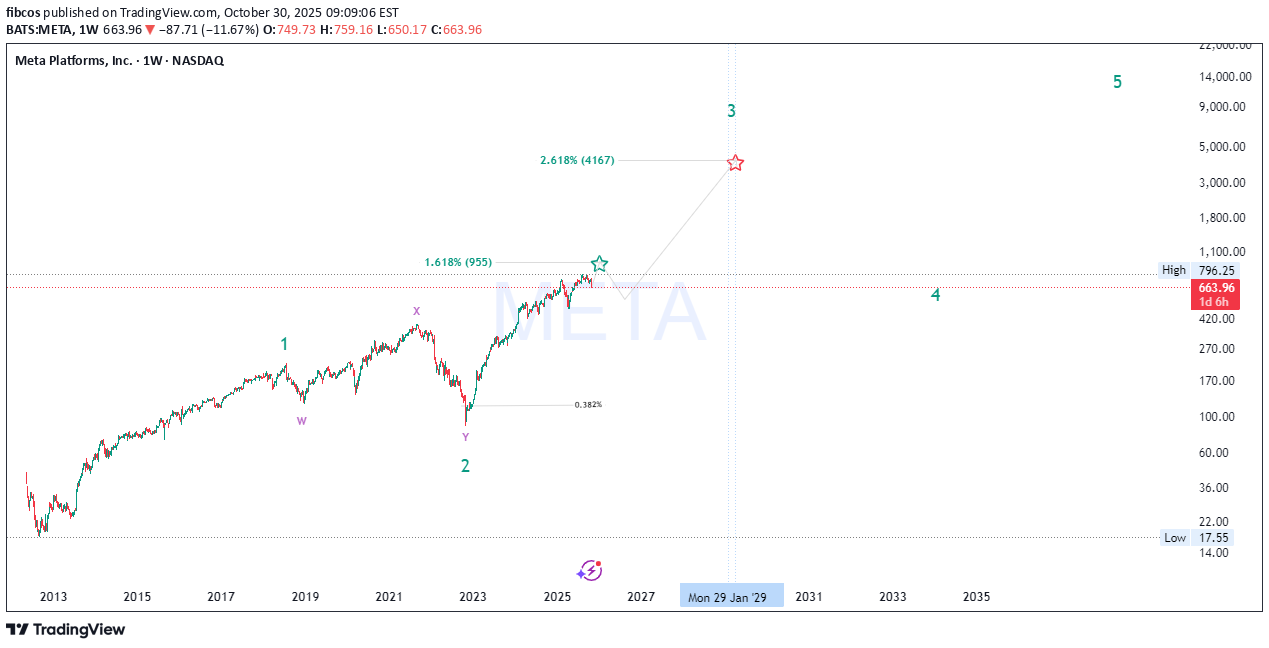

مسیر مخفی فیبوناچی متا: آیا آماده رسیدن به ۴۰۰۰ دلار هستید؟ (پیشبینی موج ۳)

🚀 META Long-Term Elliott Wave + Smart Money Macro Outlook 🌊 Elliott Wave Structure (662→955→4000+) META appears to be progressing through a major impulsive 5-wave supercycle on the weekly timeframe: Wave 1: The initial breakout from accumulation (2015–2021), fueled by growth in advertising dominance and metaverse expansion narratives. Wave 2: Deep corrective W–X–Y structure into the 2022 low around $90 — a classic multi-year liquidity sweep and re-accumulation phase. Wave 3 (in progress): This is typically the strongest and most extended wave , with Fibonacci projections aligning near the 2.618 extension ≈ $4,160 , targeting 2028–2029 based on current momentum. Wave 4: Expected to form a macro re-distribution or range between ~$900–$1,000 before the final parabolic Wave 5, likely extending toward $10K+ . 💡 Wave Confluence: 1.618 Fib extension of Wave 1 → Wave 3 aligns around $955 , acting as the first major resistance (and your current high zone). 2.618 Fib extension → next macro target $4,160 , confirming bullish impulsive momentum. 🧠 Smart Money Concepts (SMC) The 2022–2023 bottom represents a “Displacement + Re-accumulation” phase , with institutions absorbing liquidity beneath previous demand zones. Current price action (mid-2025) shows a premium range reaction , where smart money is likely taking partial profits before the next accumulation leg. Expect a retracement into the 0.382–0.5 Fib zone ($420–$500) to rebalance inefficiencies before continuation toward macro Wave 3 targets. Key Reaccumulation Zone: $420–$500 — watch for BOS (Break of Structure) confirmation and liquidity sweeps below equal lows. 🔍 Fibonacci Alignment 0.382 retrace marks ideal Wave 4 re-entry. 1.618 & 2.618 extensions align perfectly with the Wave 3 and 5 confluences — textbook impulsive expansion. Each extension zone has been confirmed with prior liquidity sweeps and displacement candles, increasing Fibonacci reliability 📈. 📊 Market Structure & Price Action META maintains a strong bullish market structure of Higher Highs (HH) and Higher Lows (HL) since 2023. The recent 9% correction (-$69) is likely a short-term liquidity grab — not structural weakness. As long as price holds above $420 , macro bullish market structure remains intact. Volume profile shows heavy accumulation between $300–$450 , suggesting smart money is still positioned long-term bullish. 💰 Fundamental Confluence META’s fundamentals are catching up with technicals: Massive AI CapEx and ad recovery boosting EPS growth 📊 Metaverse burn rate shrinking , improving profitability Share buybacks providing a floor for price corrections Macro environment supports tech leadership rotation , and META remains a key beneficiary of the AI + social data synergy cycle 🔄 🔮 Market Cycle View We’re entering the “Expansion Phase” of the broader innovation cycle. 2018–2022 = Accumulation/Disbelief 2023–2025 = Early Markup / Smart Money Entry 2025–2029 = Public Participation Phase (Wave 3) 💥 Post-2029 = Euphoria / Distribution (Wave 5) 😱 ⚙️ Key Levels to Watch Support Zones: $420 – $500 (Wave 4 re-entry) Resistance Levels: $955 → $4,160 (Wave 3 targets) Invalidation: Sustained break below $300 on weekly close 📈 Summary META remains one of the strongest macro bullish charts in big tech — with perfect alignment across Elliott Wave, SMC, Fibonacci , and fundamental cycle theory . We’re currently witnessing the mid-phase of Wave 3 , with institutional repositioning before the next vertical leg. Patience and precision around the reaccumulation zone ($420–$500) could provide the golden setup before the next expansion wave 🚀🌕 #META #ElliottWave #SmartMoneyConcepts #Fibonacci #Wave3 #BullMarket #AIStocks #TechnicalAnalysis #TradingView