Technical analysis by EconomicanalysAbdulRahman about Symbol PAXG: Buy recommendation (10/29/2025)

EconomicanalysAbdulRahman

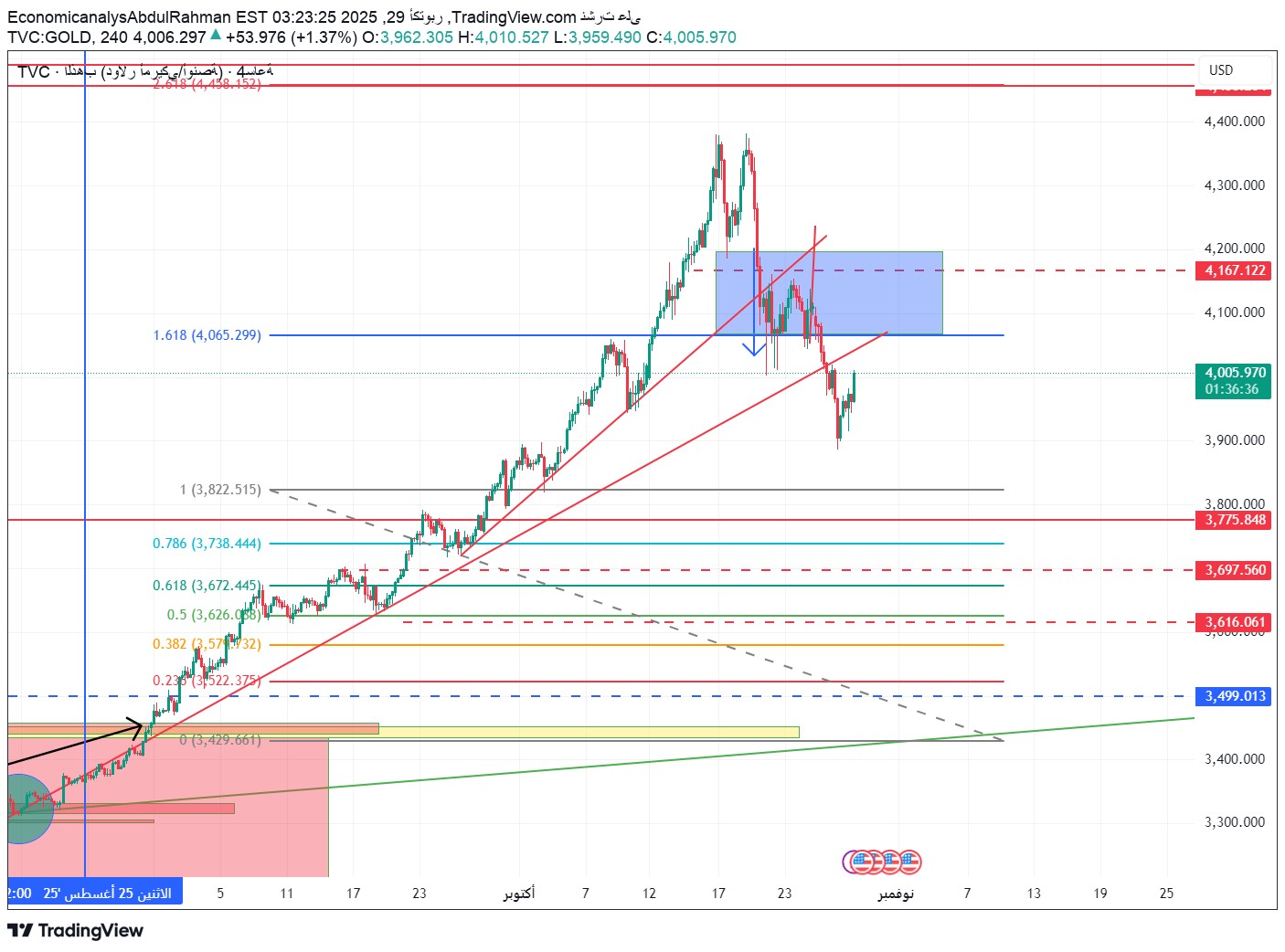

اجتماع الفيدرالي: هل يشعل الذهب نحو قمة 4,200؟ تحليل صادم لسيناريو خفض الفائدة

🔹 XAUUSD Gold Analysis – Tuesday, October 29, 2025 Author: EconomicanalysAbdulRahman Time frame: 4 hours The general trend: corrective bullish tending to a positive reversal 🧭 Overview Gold is regaining momentum above the 4,000 level after a strong correction wave that reached 3,900, as clear signs of reversal began to appear before the US Federal Reserve meeting. Markets are now pricing in a rate cut with a 98% probability, which strongly supports gold's upward trend and makes current levels a pivotal point for the start of a new wave. 🔸 Important resistance areas AreaDescription 4,065 – 4,100 pivotal resistance (Fibo 1.618) – breaching it confirms the bullish shift. 4,167 – 4,200 Strong supply area – short-term upside target. 4,456 – 4,488 Fibo Extension 2.618 – Possible target after stabilizing the cut. 🔹Main support areas Area approx 3,900 – 3,880 pivotal support and the bottom of the current retracement. 3,775 – 3,740 Fibo support 0.786 and previous demand area. 3,697 – 3,616 Strategic support in the medium term. 3,499Long-term support and a major structural bottom. 📈 Current artistic trend Short-term: corrective bullish tending to turn positive. Medium term: positive on condition of closing above 4,100. Long term: bullish as long as 3,616 is not broken. 📊 Expected scenarios for the American period 🔺 Basic scenario (weighted 70% - rate cut 98%) A rate cut of 25 basis points will strongly support gold. Before the decision: fluctuation between 3,980 – 4,050. After the decision: an accelerated upward push towards: 🎯 First goal: 4,100 🎯 Second goal: 4,167 🎯 Third goal: 4,200 – 4,300 Bullish confirmation: 4-hour candle closes above 4,100. 🔻 Alternative scenario (Powell’s cautious or tough tone) If Powell's tone is cautious, we may see a short correction towards 3,950-3,900. This decline will be considered a new buying opportunity as long as 3,880 is not broken. ⚙️ Technical indicators RSI: A rebound from the 40 area towards 55 – the beginning of positive momentum. MACD: A confirmed bullish crossover. Candles: Bullish Engulfing pattern at the bottom of 3,900. 💡 Tips for traders 🎯 For short-term (Intraday) speculators: Entry to buy from 3,980 – 4,000 Stop loss below 3,880 Objectives: 4,100 4,167 4,200 ⚠️ It is preferable to wait until the interest rate decision is issued or the start of the press conference to avoid high volatility. 🪙For traders of physical gold: Current prices represent an excellent gathering area ahead of the new monetary easing cycle. Gradually build positions from 3,900 and below with consolidation of positions after daily close above 4,100. Average target: 4,300 - 4,450 during the next quarter. 🏦 Fed meeting and Jerome Powell’s speech Markets are almost 98% sure of a cut, so the key will be Powell's tone. Dovish tone (hint of further downgrade) → immediate rise for gold towards 4,200+. Cautious or balanced tone → limited correction and then resuming the rise. 📌 General recommendation 🔹 Short trend: corrective bullish 🔸 Intermediate trend: positive provided it closes above 4,100 🔹 Long trend: Strongly bullish as interest rates continue to be cut 🎯 Strategy: Buy from corrections and hold long positions 🏷️ Tags #XAUUSD #Gold #TechnicalAnalysis #Fed #JeromePowell #Rate_Cut #Trading #Economy #TradingView #GoldAnalysis